International Package Market:

Trends and Opportunities

— Research and Insights Solution Center —

United States Postal Service Office of Inspector General

November 2023

International ecommerce grew substantially over the past five years. As customers around the world began to order more products online, the number of packages crossing international borders surged. Cross-border ecommerce is expected to continue rising in the future.

Despite international ecommerce growth, postal operators' share of the international package market has actually been declining for years.

The USPS Office of Inspector General (USPS OIG) explored challenges and opportunities facing postal operators in this evolving environment. On May 15, 2023, we released a white paper titled, "The International Package Market – Trends and Opportunities for the Postal Service". The paper used market research and interviews to analyze market trends and their impacts on volume, revenue, and channels. The following day, we also hosted an in-person event to discuss these trends with subject matter experts from the international package industry. This interactive story distills key findings from both sources.

The International Package Market – Trends and Opportunities for the Postal Service

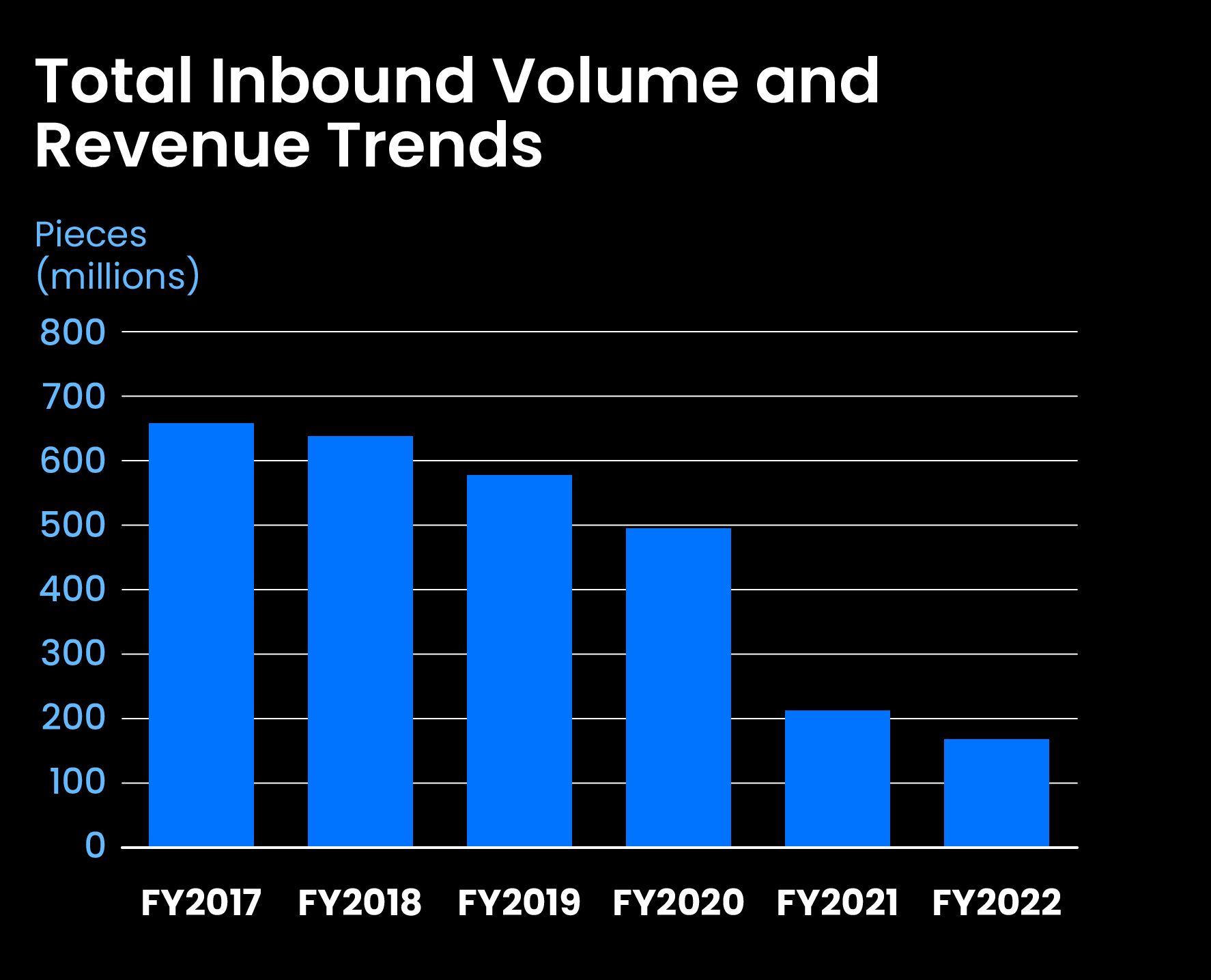

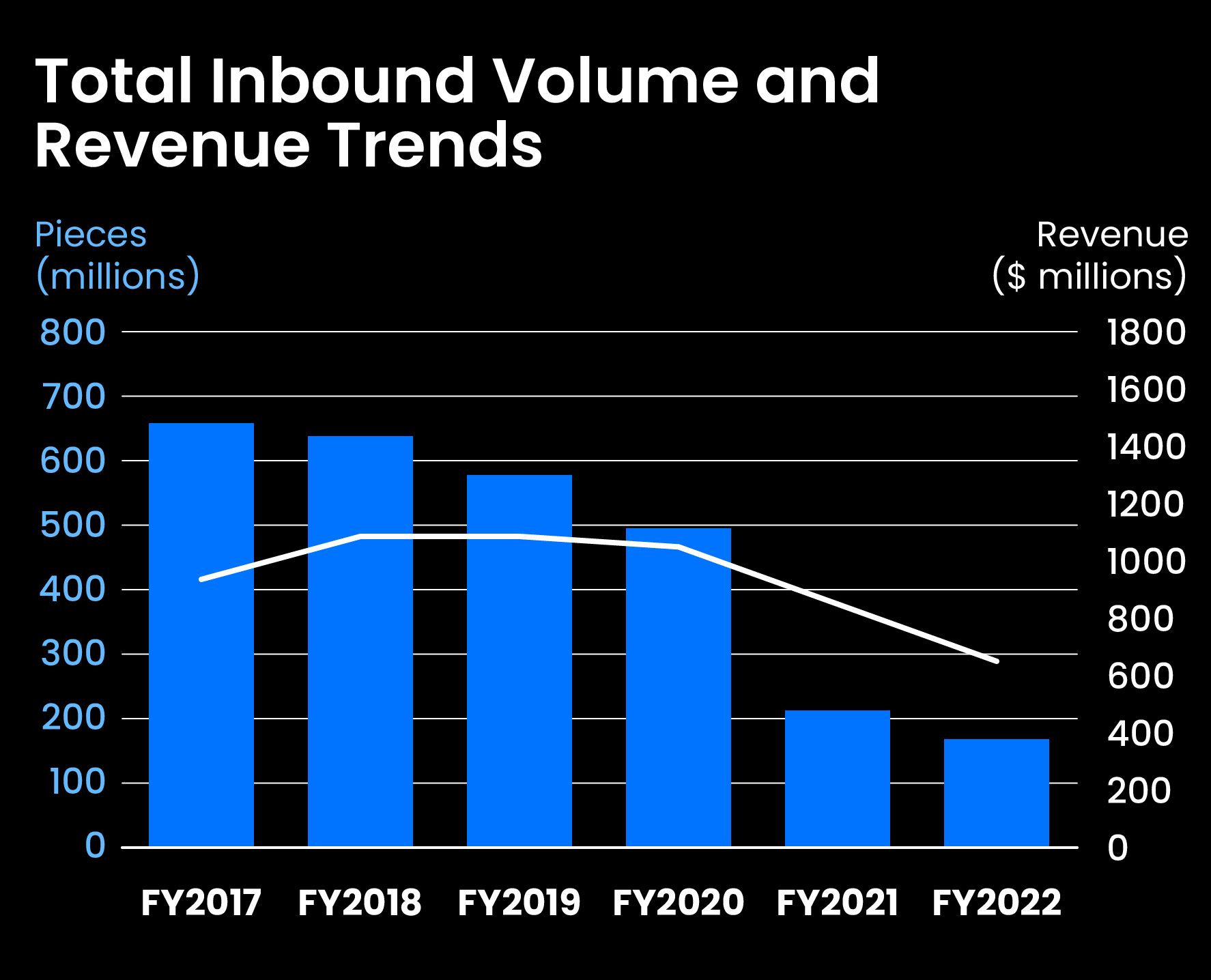

The Postal Service's inbound and outbound package volumes have been declining for years. Its total inbound volume, most of which were packages, declined by 74% between fiscal years (FYs) 2017 and 2022. Meanwhile, pandemic-related supply chain disruptions aggravated a structural decline in total outbound volume. The decline in volume corresponds to a decline in revenue: USPS's international revenue hit an 18-year low in FY 2022.

Inbound

Inbound international volumes: The Postal Service’s inbound international volumes are down from 659 million pieces in FY 2017 to 169 million in FY 2022 – an average total decline of 74%.

Inbound international revenues: Revenue, like volume, declined over the past six years. However, revenue fell at a slower rate than volume: total inbound international revenues fell from approximately $900 million in FY 2017 to nearly $700 million in FY 2022.

Outbound

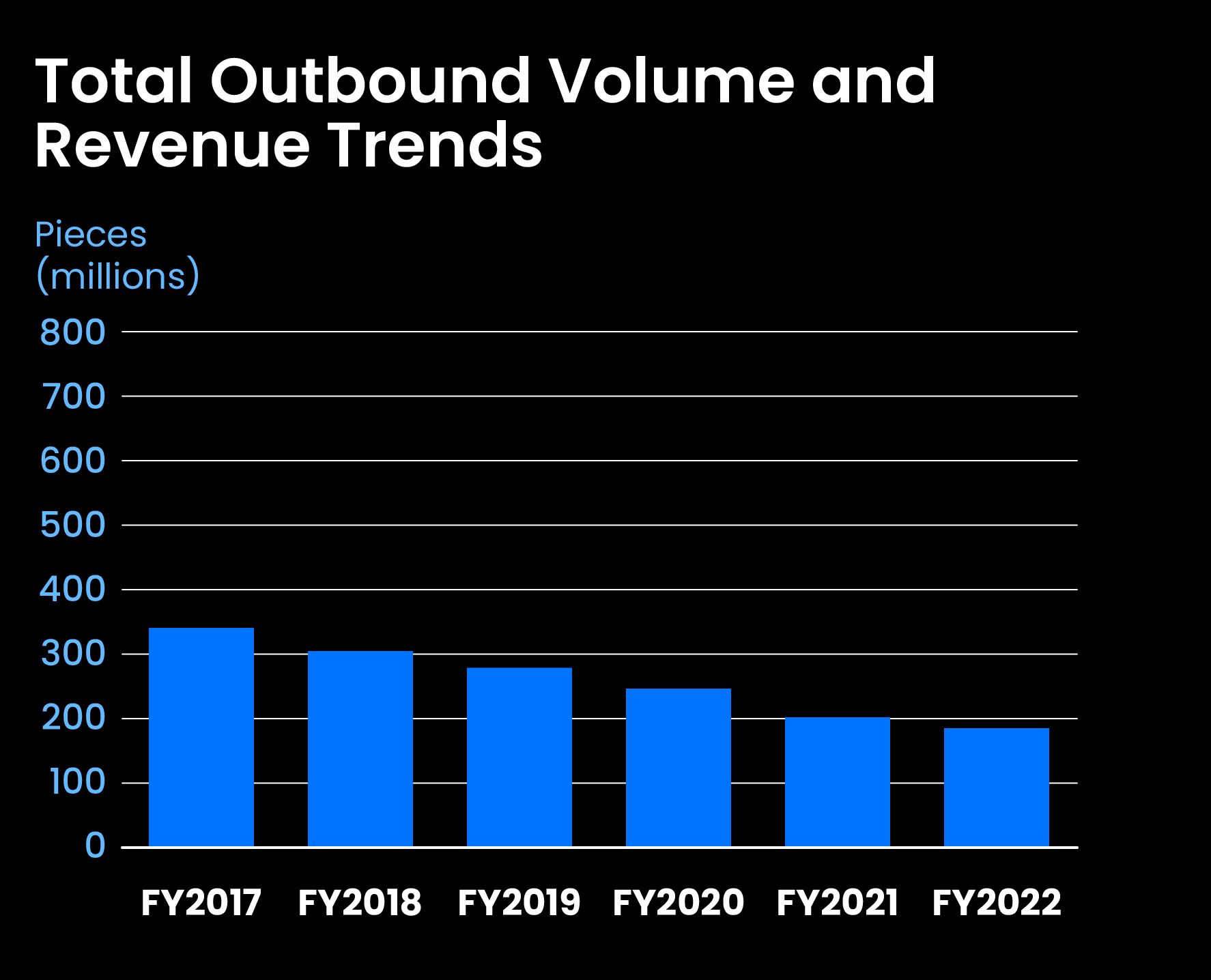

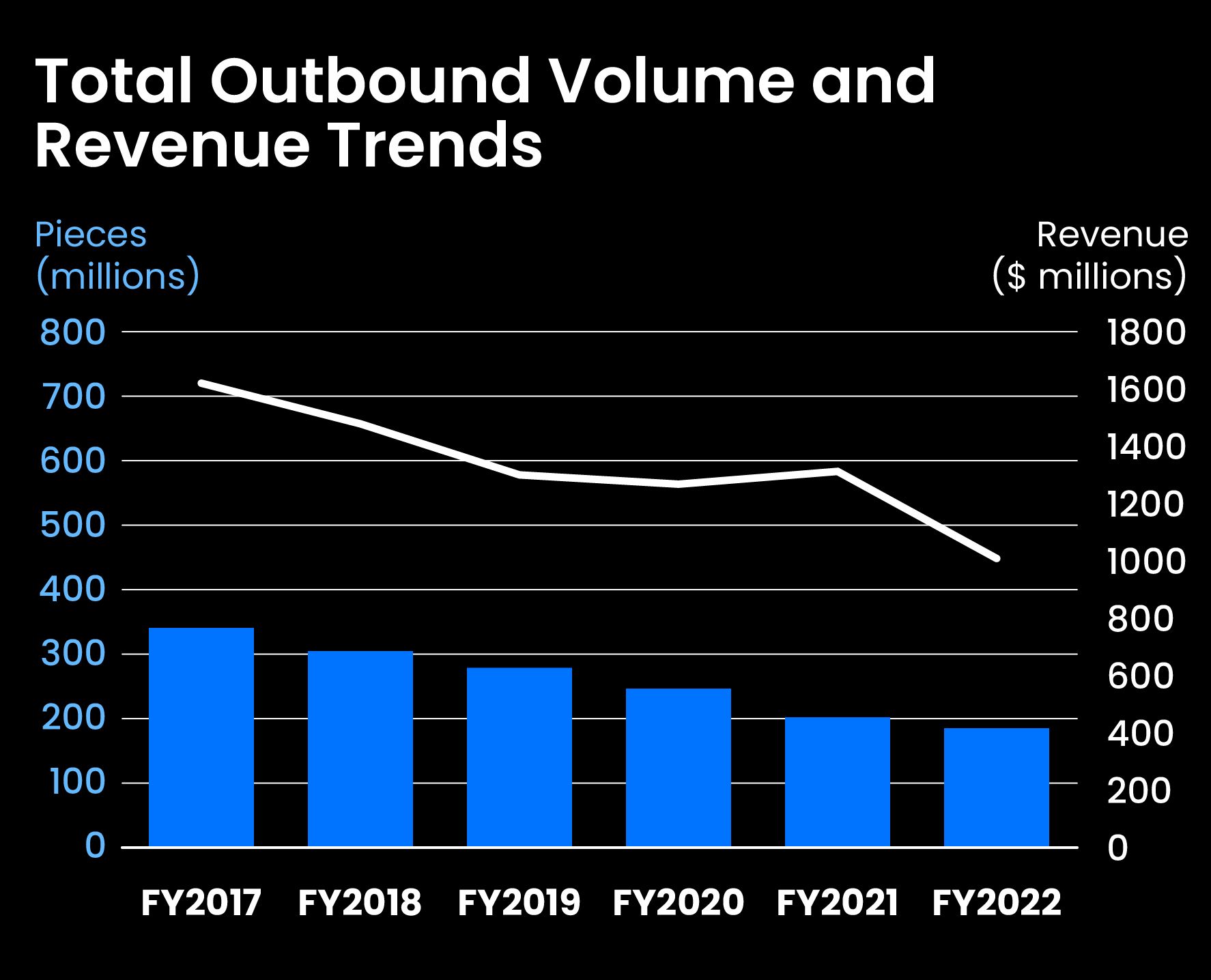

Outbound international volumes: A drop in outbound volumes was mostly driven by the volume decline of USPS’s major outbound package products, such as small packets, International Expedited Services, Priority Mail International, and First-Class International Package Service. Between FYs 2017 and 2022, the Postal Service’s total outbound volume declined by 38% to 185 million pieces.

Outbound international revenues: Outbound revenue decreased at a slower pace, falling an average of 8.3% per year between FYs 2017 to 2022. USPS’s total international revenue fell from $2.6 billion to $1.7 billion during the past six years — its lowest revenue level since FY 2004.

Upon further inspection, USPS's package volume decline is not as dramatic as it may at first appear.

A significant part of USPS's international inbound package volume is diverted to its Global Direct Entry (GDE) program and delivered as domestic volume. Therefore, although GDE packages are international, they are recorded as domestic package products.

International packages can also enter the Postal Service’s domestic delivery network another way: consolidators can bring bulk shipments into the U.S. through the commercial customs channel and take them directly to USPS destination delivery units for discounted prices.

Unlike GDE, this additional direct injection volume cannot be identified as originating outside of the United States. Consequently, total numbers for domestically-delivered international packages likely exceed GDE volume.

Overall, the Postal Service has observed package declines for years — and it's not alone. Other international postal operators also saw package declines despite an overall growth in cross-border ecommerce shipments.

Four factors contributed to the shift in package volume from postal to commercial channels:

- Increased costs,

- Increased complexity,

- Increased competition, and

- New international supply chain models.

Increased costs

Some members of the Universal Postal Union (UPU) raised their rates after the UPU terminal dues system was partly reformed in 2019. The terminal dues system governs how postal operators compensate one another for domestic delivery of international mail.

Previously, rates were set by majority agreement among UPU members rather than reflecting the true delivery cost of inbound international mail. The revised system allows postal operators to set their own delivery charges as long as charges are aligned with their corresponding domestic rates.

As a result, postal operators — including USPS — have significantly raised their terminal dues rates.

Increased complexity

New data requirements reduced the convenience of postal channels and added complexity to the shipping process.

Until recently, shippers needed to provide very basic information about their low-value packages when shipping through the postal channel. However, new tax regulations and increased security concerns have led to the imposition of new data requirements on both postal operators and their customers.

Efforts to comply are causing operational challenges to posts while making the postal channel less convenient for customers — especially for smaller merchants. These new requirements are estimated to account for roughly 30% of post-to-post volume decline.

Increased competition

Competitors for postal operators include private sector carriers, mail and package consolidators, and other postal operators.

In the past five years, a new generation of online shipping platforms intensified competitive pressures on postal operators. These platforms help shippers identify the most cost-effective providers for every cross-border supply chain segment (collection, transportation, customs clearance, or delivery). They also create “one-stop-shop” solutions such as tracking and compliance (i.e., compliance with new data requirements mentioned above) within one platform.

New international supply chain models

Over the past few years, new international shipping models limited or even eliminated the role of postal operators from the international supply chain.

Three new models emerged...

- Direct Injection: Packages from a country of origin are collected by different logistics players, grouped into bulk shipments, shipped overseas, cleared through customs, separated into individual packages, and then passed to domestic carriers for last-mile delivery.

- Commercial Customs Clearance Systems: Customs data and documentation are provided to customs authorities in advance. Compliance issues can then be identified and rectified before arrival, thus speeding up the commercial clearance process for most inbound shipments.

- Nearshoring: Large ecommerce merchants and online order fulfillment platforms set up warehouses in or near major destination countries. International online orders can then be fulfilled from warehouses that are nearby, limiting the risks of air capacity shortages and bottlenecks at customs.

Despite these challenges, the Postal Service’s post-to-post channel remains a vital avenue — especially for smaller (retail) international package customers and for individual customers.

While USPS has undertaken measures to protect its share of the international market, expanding its share may require a more comprehensive portfolio of initiatives and strategies. There are several opportunities it could pursue, including:

- Enhancing Global Direct Entry,

- Addressing the issue of counterfeit postage,

- Establishing a commercial channel,

- Developing support services for outbound shippers, and

- Improving communications with customers and partners.

Given the fast-paced changes in the international package market environment, time is of the essence.

Event: The U.S. Postal Service and the Future of the International Package Market

May 16, 2023 | USPS OIG Headquarters

Arlington, Virginia

We hosted an event focused on future trends in international package supply chains. Our panel featured industry experts who discussed the current state of international ecommerce, expounded on the shift to private channels, and offered strategic responses for key postal operators. They highlighted opportunities for the Postal Service to enhance the value of its international postal network while successfully positioning itself in the commercial shipping channel.

The panel discussion was moderated by Kate Muth (top right), Executive Director of the International Mailers Advisory Group (IMAG). Panelists included (above, left to right):

- Robert Raines, Jr., Vice President of Business Solutions, United States Postal Service;

- Jane Collison, Strategic Partner Manager, Zonos;

- Wendy Eitan, Director of E-commerce and Physical Services Integration, Universal Postal Union (UPU); and

- Levent Gencoglu, Senior Director, International Strategy and Product Management, DHL.

Panelists agreed the current movement from postal channels to private carriers could be reversed. They noted keys to future success in the international package market including: developing flexibility to meet ever-changing customer demands, embracing and incorporating technological innovations, and remaining mindful of evolving environmental concerns. Here are some of their takeaways.

Disruptions

There have been a number of disruptions over the last couple of years: the pandemic, self-declared rates, AED compliance, ICS2 release 1, and EU customs changes. Today, we are taking a look at all the ways we do business with international posts. We’re leveraging our KPG and IPC memberships and seeking to evolve the postal channel to be much more in sync with the commercial. A lot of postal operators we’re dealing with have commercial channels — we’re looking at how does some of that volume get shifted into the postal channel.

Technology

UPU is dealing with 192 member countries, with different levels of experience. We seek to provide interoperable tools in a standardized way so that even the smallest countries can implement them at a reasonable price. I think technology has a huge role in enabling this relationship between commerce and the post. It will all be about data and interoperability and networks and API.

Senders need to deal with all the regulations and thresholds for payment of duty and taxes. These companies have to be aware of these complexities and plan for the most stringent requirements rather than the least to satisfy the complexities of customs — and that is something technology can help them manage.

Returns

Based on my experience in the returns area, merchants and consumers are very interested in international returns, but cost is the biggest concern for all stakeholders involved. One of the strengths of the postal operators that we can leverage is utilizing their vast network and ability to consolidate returns shipments all around the world. The only way we can come to a reasonable price point is if we can find ways to leverage postal operators' reverse logistics capabilities.

The posts at different stages can potentially serve as consolidation points. The posts can pick up the item to be returned from the recipient and then it would trigger a return merchandise authorization so that the sender could issue a credit. I think it's the technology and the data about the shipment that is the most critical and posts need to unite in that data.

Sustainability

The UPU has really upped our game over the last few years regarding sustainability. We have a project to reduce our carbon footprint that many of our member countries are already participating in. We’re also looking at packaging. Sustainability is definitely a big part of our strategy for the next few years.

One of the difficulties is how do you measure [sustainability]. There is some uncertainty as to what the U.S. law will be, what the requirements will be from the SEC. And maybe people don’t want to pay for that, but maybe want the companies to pay.

Tracking

We’ve come a long way in visibility and tracking. I think the biggest challenge is, as we work with foreign operators from a destinating perspective, sometimes it’s challenging as they develop their technology because they’re not all at the same level.

International deliveries naturally take longer than domestic deliveries. We can use our data and algorithms to calculate the delivery dates for key markets to set a precedent and create a unique customer experience. When a merchant can provide a clear estimated delivery date to a consumer at time of purchase (e.g., package will arrive in 8 days), it creates an enhanced experience for the customer. I see a trend toward creating that experience for customers on the international stage.

Artificial Intelligence

Artificial Intelligence for harmonized codes has been a game-changer. We have humans who can oversee that as needed, but if we can quickly look through the AI for the harmonized codes it’s a really quick application that can serve a lot of needs. It’s been wonderful.

What do our panelists foresee for the international package market in the near future?

Quality of service is an issue along the whole network. You’re only as strong as your weakest partner.

Moving forward, we're certainly working with our foreign postal operators on how we approach our agreements in the future, how we get more packages into the postal stream.

Five years ago, the primary goal was to find the optimal balance between speed and cost for the merchants. For the most part, merchants were satisfied when they were given the right balance. Over the past five years, the new challenge became to inform merchants about the regulatory changes. Today, it’s not enough to just inform them. We need to partner with merchants to ensure they are prepared for the changes. We now have the opportunity to help merchants navigate through the changes and develop the right solutions for them.

Shift to cost-inclusive pricing. The customer needs to understand that paying duties and taxes up front is actually a savings to them. It’s time-savings, frustration-savings, and a way to turn browsers into buyers.

In conclusion, USPS is addressing these challenges:

Everything we do in the domestic network benefits the international network. As we redesign the network, as we improve our logistics, as we increase our processing capacity, all of those things will come together to, in the end, benefit international.

– Robert Raines, Jr., USPS

Additional Resources:

White Paper: The International Package Market

OIG Audit: U.S. Postal Service International Mail Operations and Performance Data

Management Alert: International Export Package Advanced Electronic Data

Contact us

For media inquiries, please email press@uspsoig.gov