Projecting Mail Volume: Future Trends and Implications for The Postal Service

- Research and Insights Solution Center -

United States Postal Service Office of Inspector General

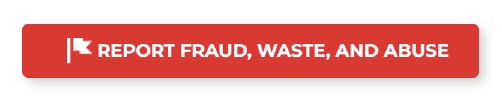

Mail accounts for nearly half of the Postal Service's revenue, but volume has been declining.

Market Dominant mail primarily consists of products like letters, postcards, advertising mail, bills, magazines, and newspapers. Even in the age of e-commerce and online shopping these products remain critical to the American public and the Postal Service’s bottom line.

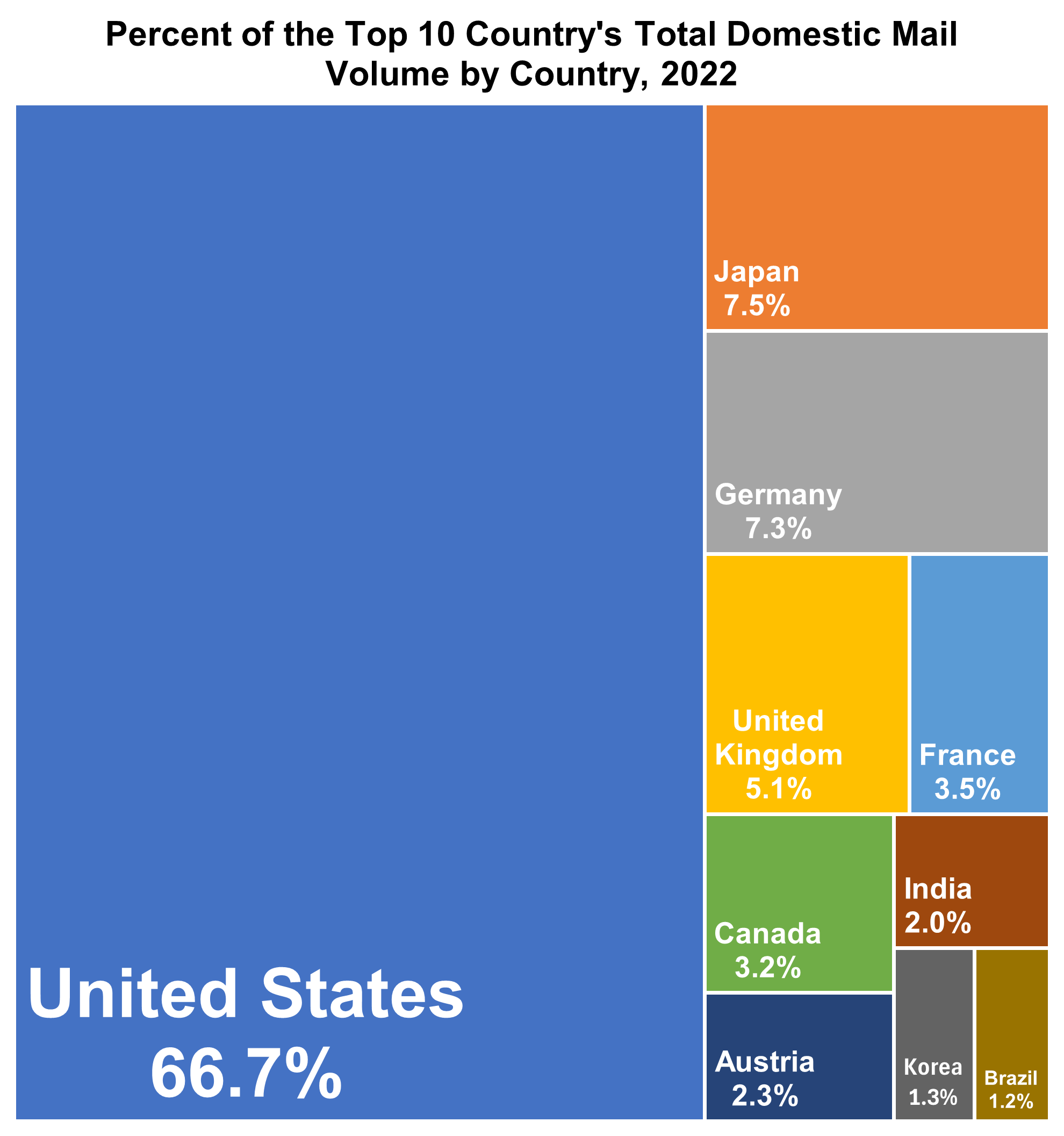

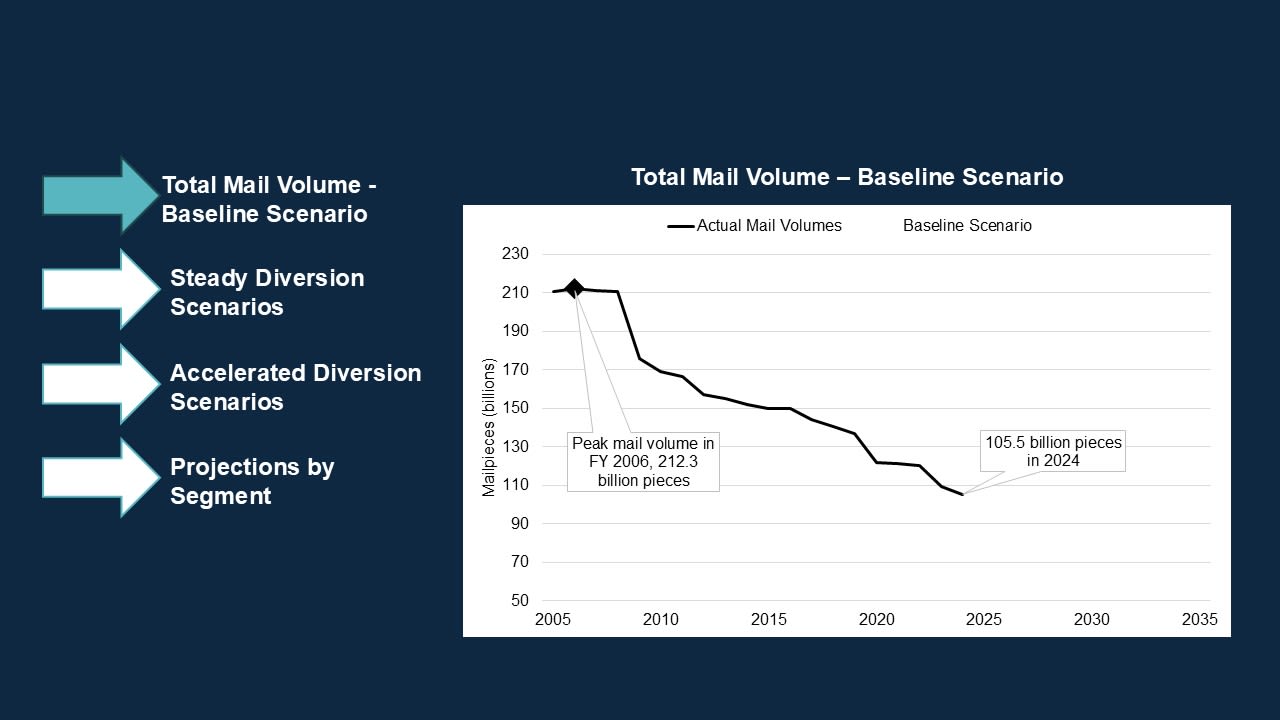

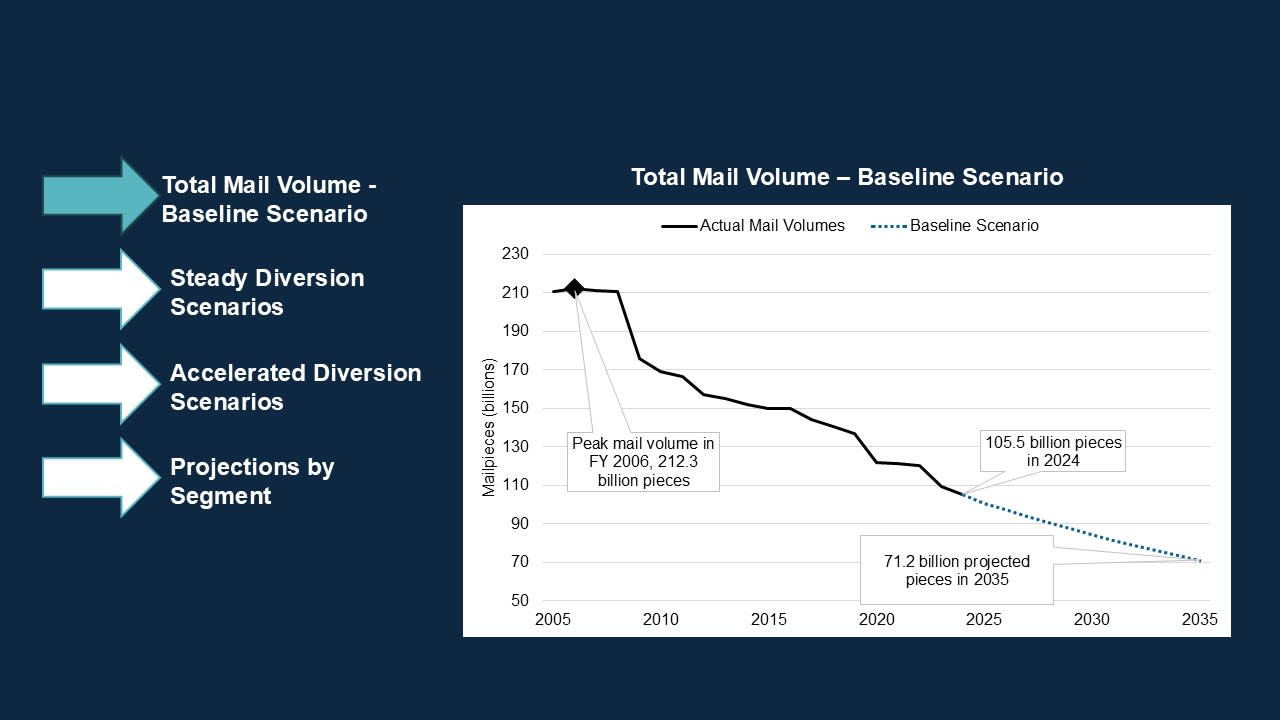

While mail volume peaked in 2006 and has continued to decline over the past decade, it still accounts for roughly half of the Postal Service’s revenue. Annual revenue from traditional mail has actually increased in recent years.

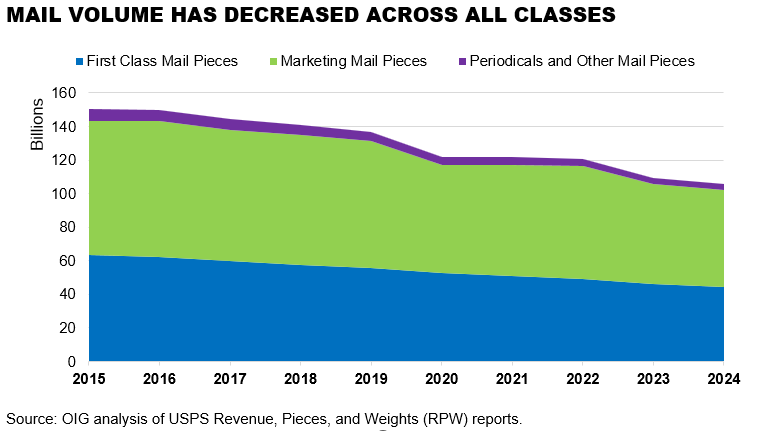

Despite declining volume, the United States remains the world’s largest market for mail.

The Postal Service plays a key role in ensuring that all Americans receive essential communications and products regardless of their location. In 2023 the Postal Service offered the world's most affordable domestic letter prices when adjusted for purchasing power. Even the worst-case scenario in our volume projections below see the Postal Service handling about four times as much mail in 2035 as the world’s next second busiest post did in 2022.

Nevertheless, further declines in mail volume are expected over the next decade. The extent of future volume losses depends on multiple factors, including overall economic trends, electronic diversion, pricing, and service quality.

The USPS OIG worked with WIK Consult to project future mail volumes from 2025 to 2035.

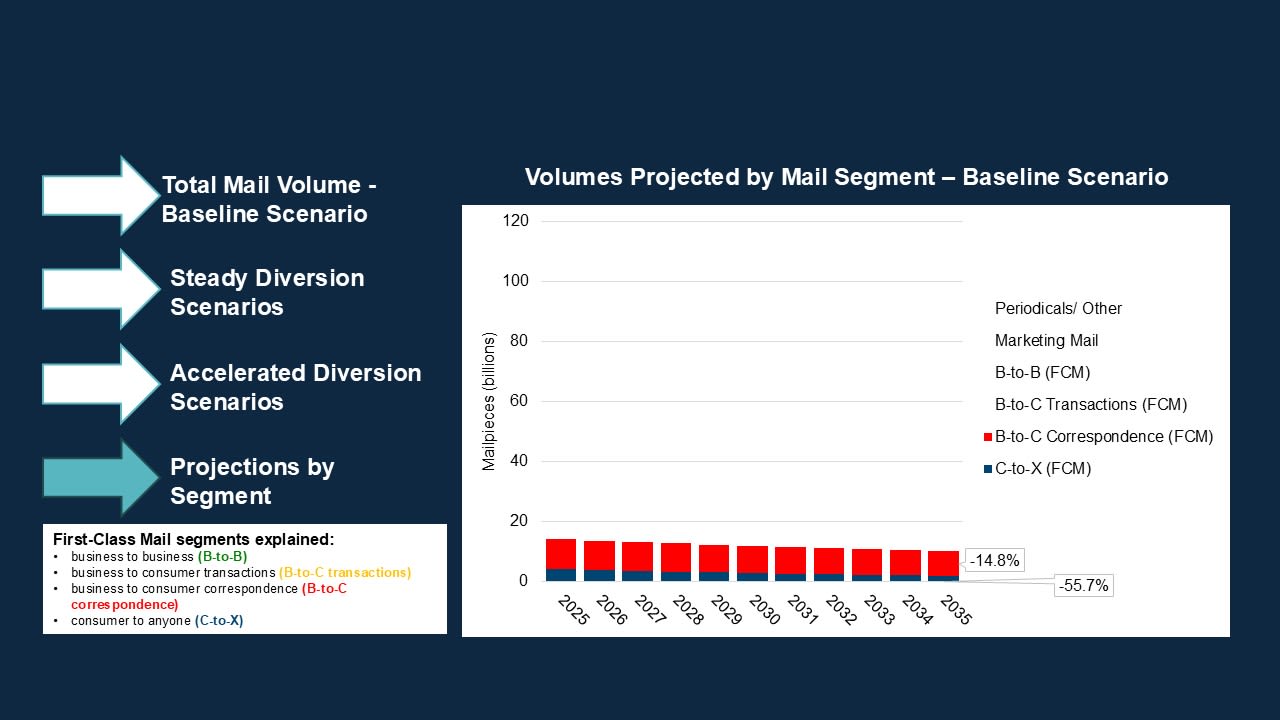

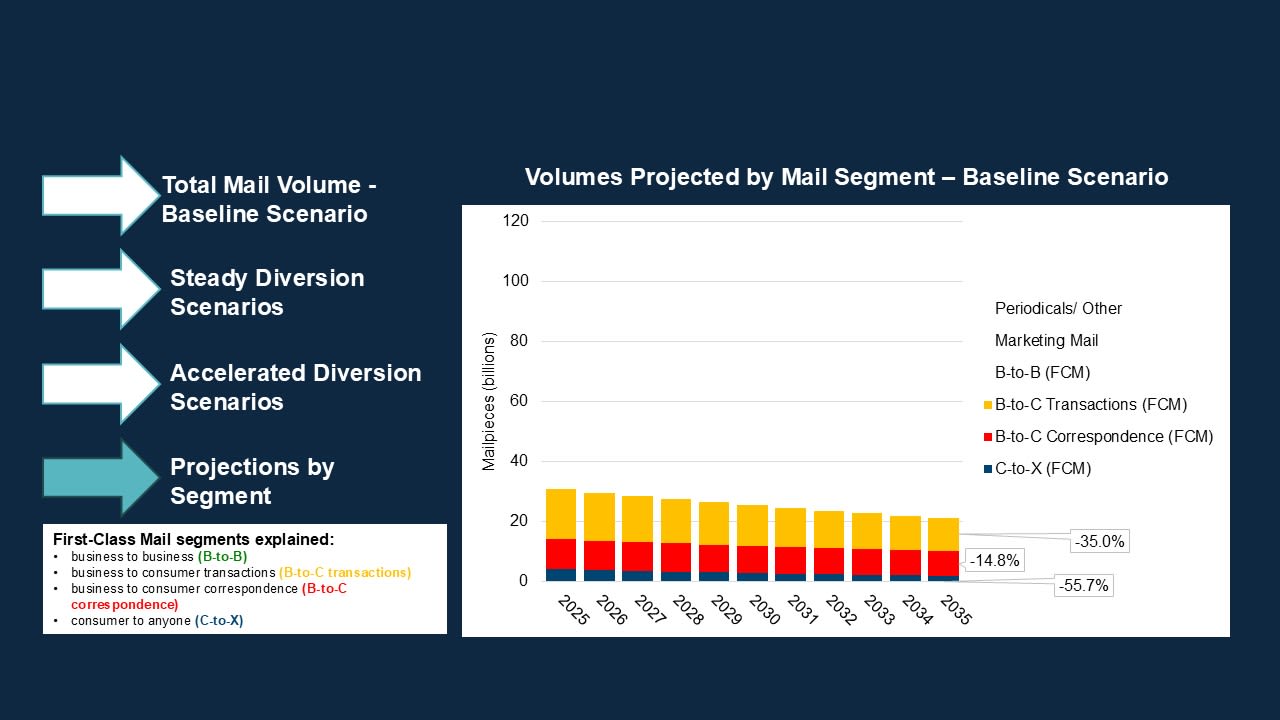

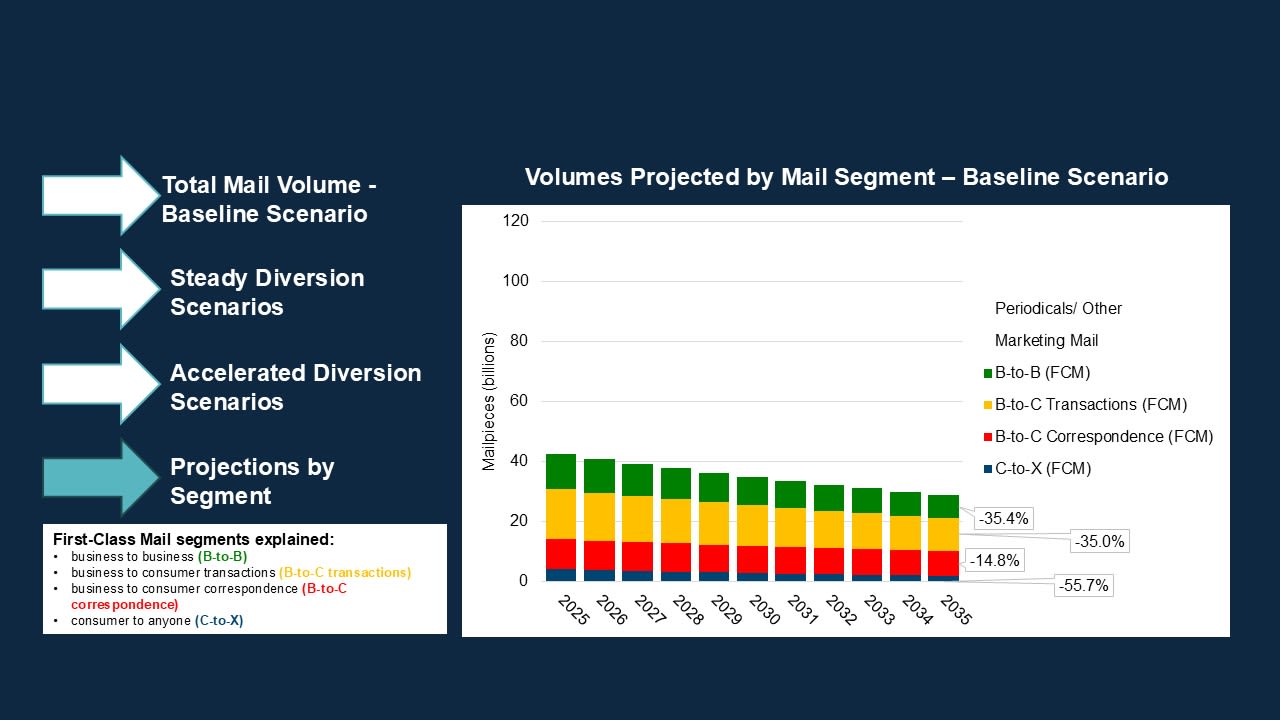

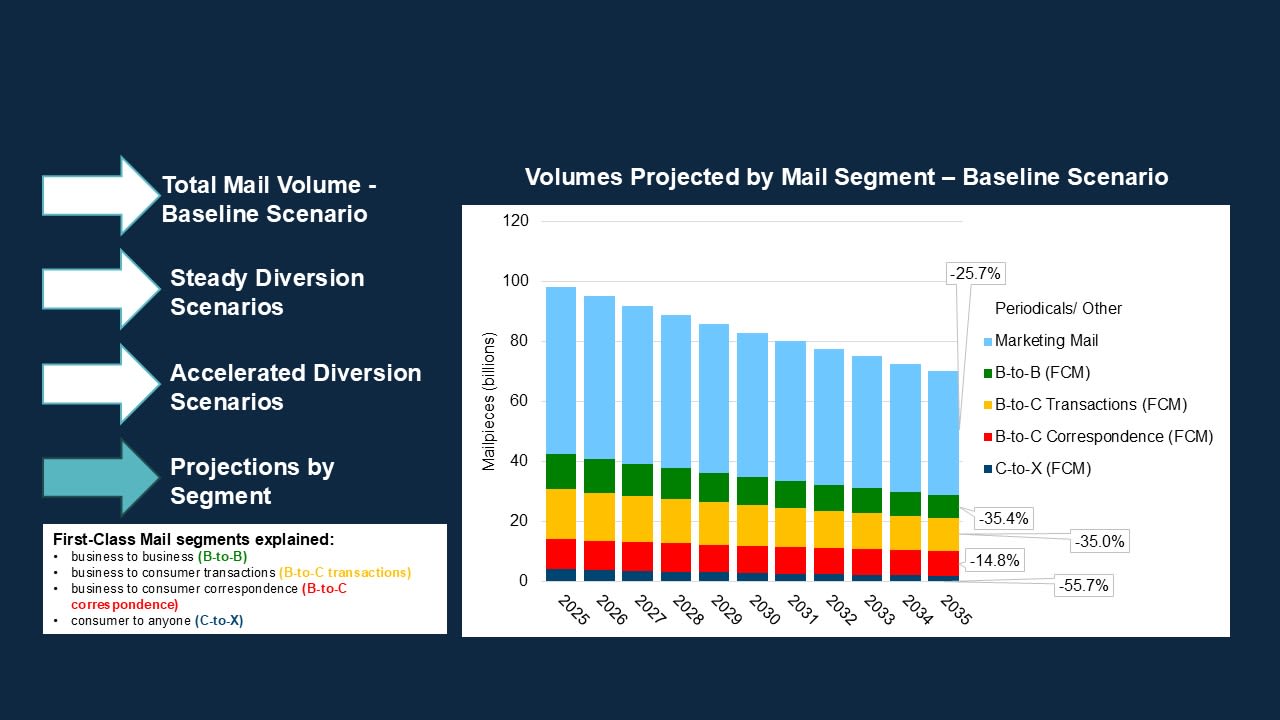

The model projects mail volumes in six scenarios, focusing on First-Class Mail and Marketing Mail.

Scenarios differ based on the rate of projected economic growth and the rate that physical mail is replaced by electronic alternatives, or electronic diversion.

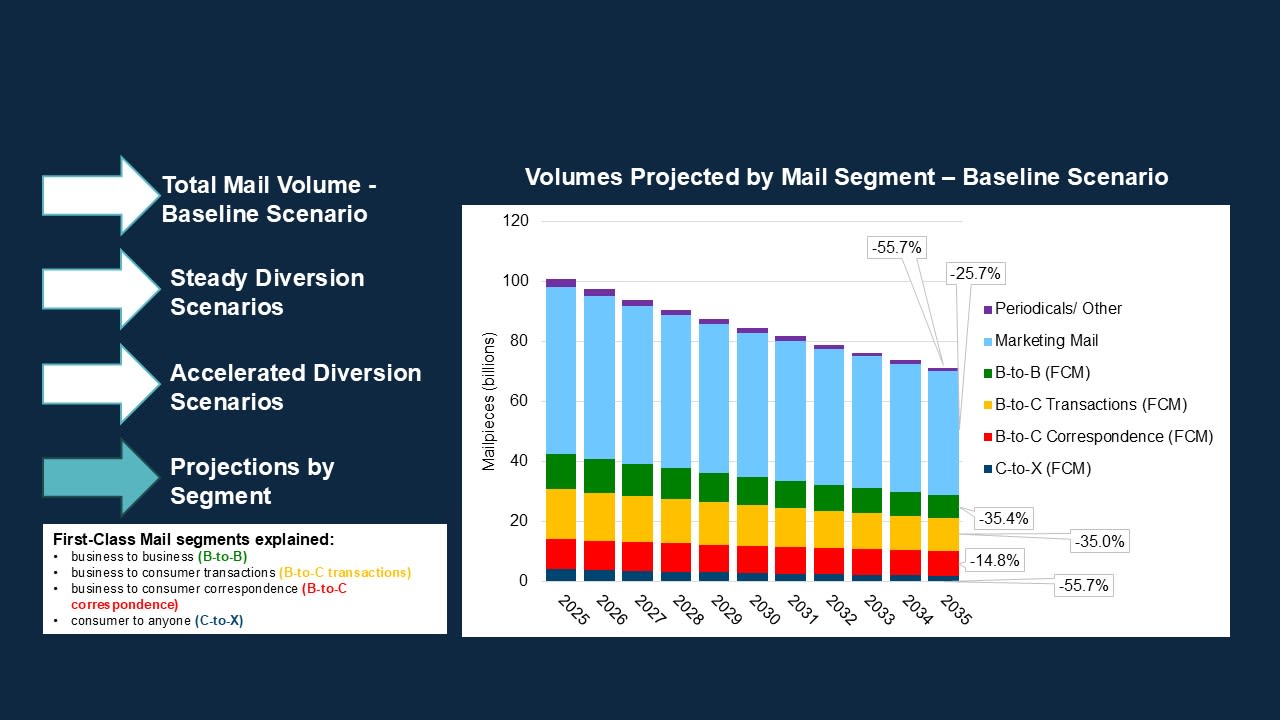

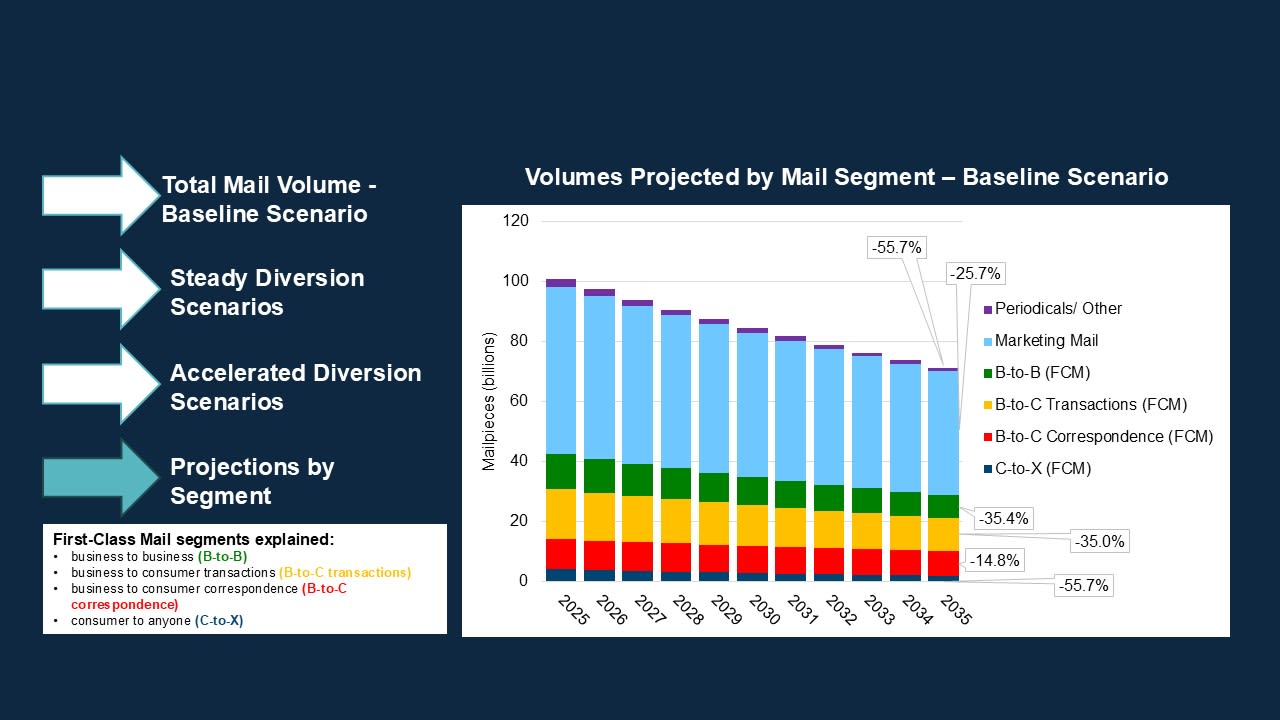

In a baseline scenario where current trends continue with steady economic growth and unaccelerated adoption of digital alternatives, total mail volume is projected to decline 33% over the next ten years, from 104.6 billion pieces in 2025 to 71.2 billion mailpieces in 2035.

While the baseline scenario sees a 29% decline in combined First-Class Mail and Marketing Mail volumes, most other scenarios project a greater decline. The best- and worst-case scenarios range from a relatively modest 14% decline to a much larger 41 % decline in combined First-Class Mail and Marketing Mail volume.

Note: this baseline scenario differs methodologically from the simulation model used to create the rest of the scenarios. It is included primarily for illustrative purposes and is not directly comparable to the simulation-based projections.

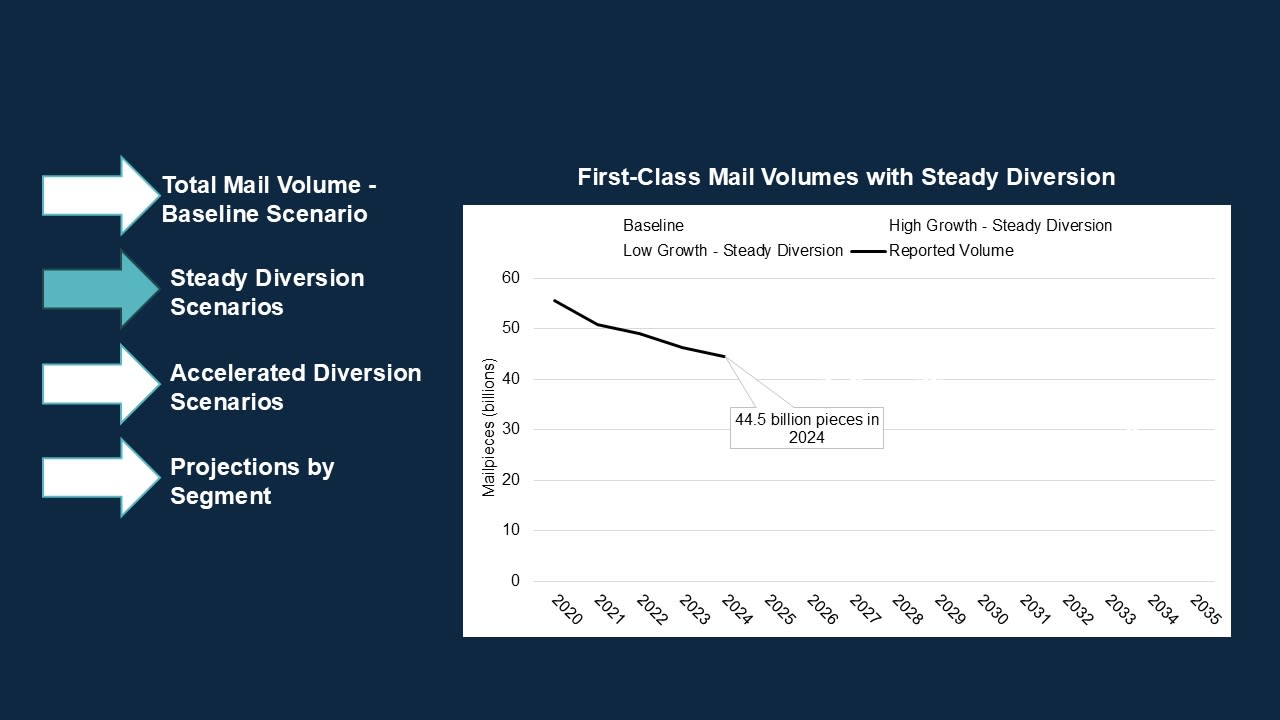

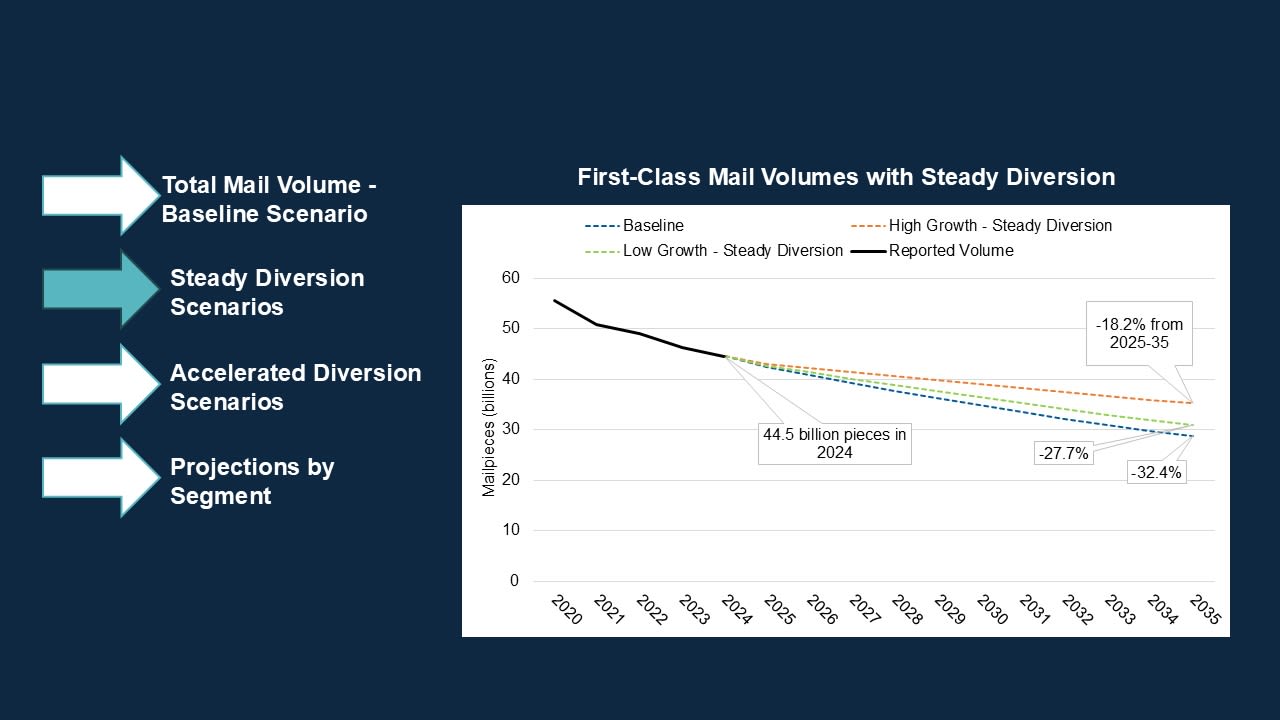

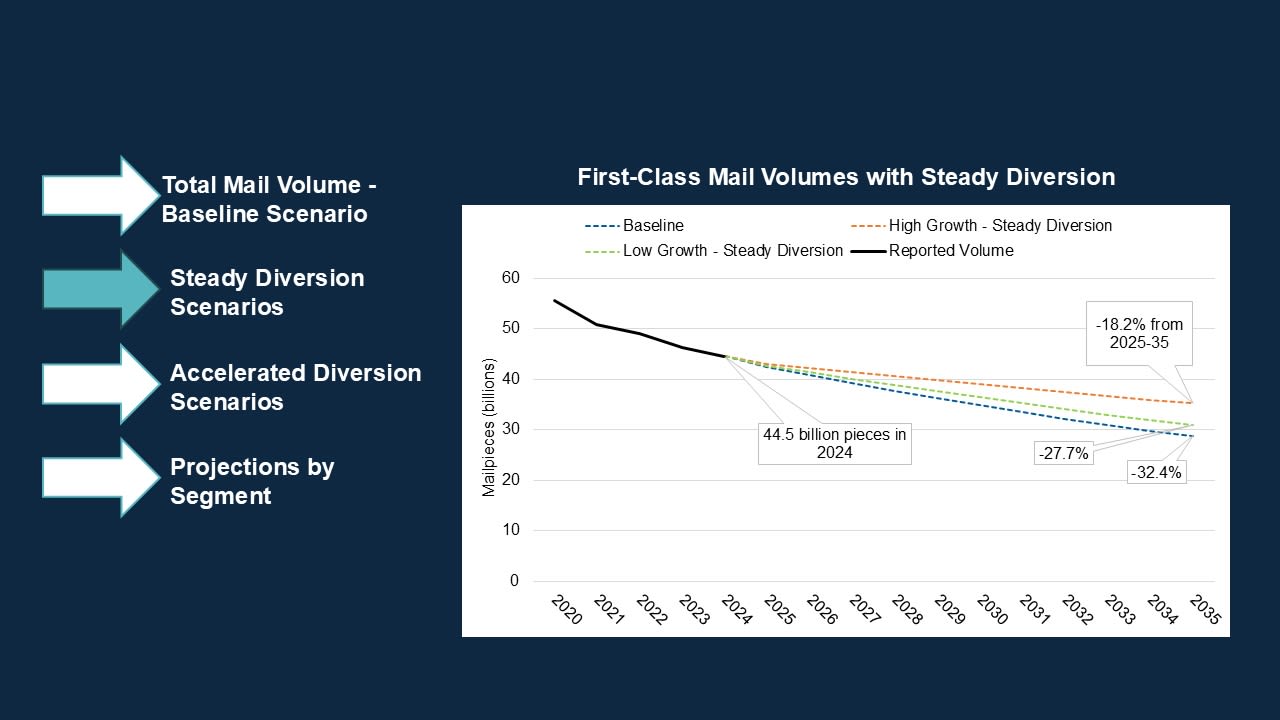

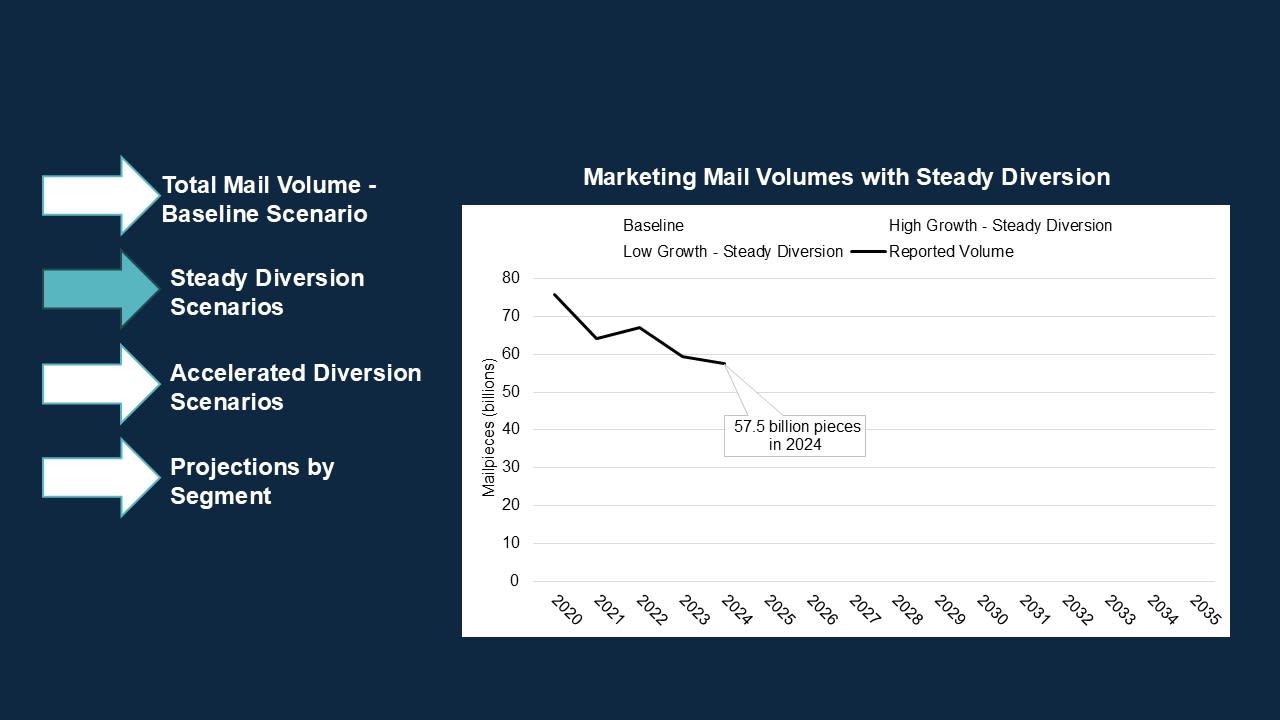

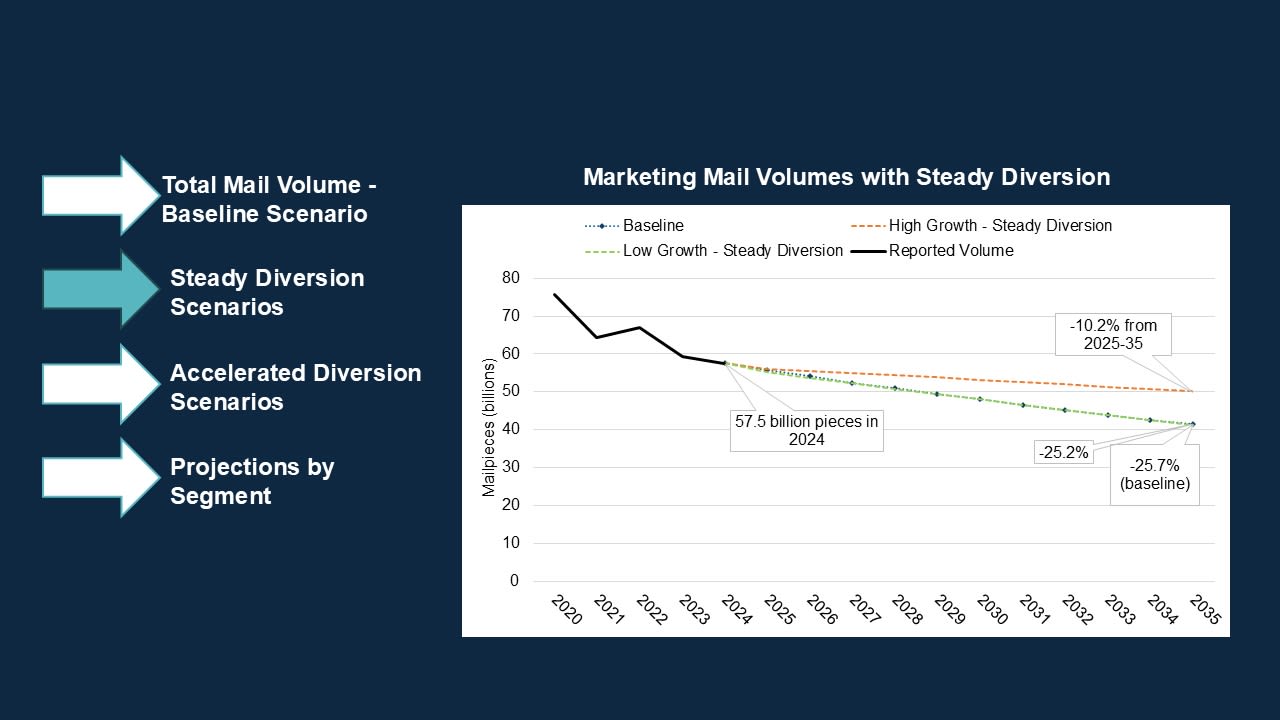

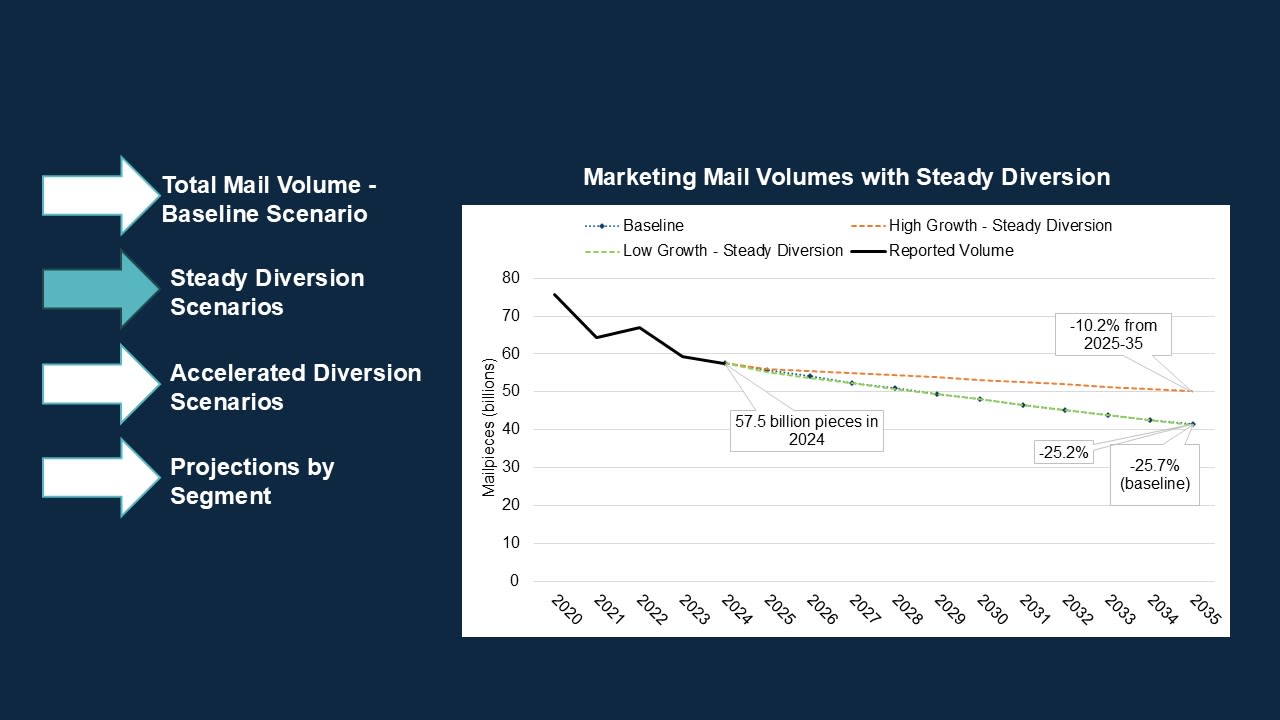

Scenarios with steady electronic diversion assume consumers remain incentivized to adopt digital communications, but with relatively little pressure to adopt e-government initiatives or online services. These scenarios could result from slower implementation of AI-driven digital customer communications.

A low economic growth and steady diversion scenario projects a 28% decline in First-Class Mail volumes and a 25% decline in Marketing Mail volumes by 2035.

A high economic growth and steady diversion scenario is the best-case scenario, seeing only 18% and 10% declines in First-Class and Marketing Mail volumes, respectively.

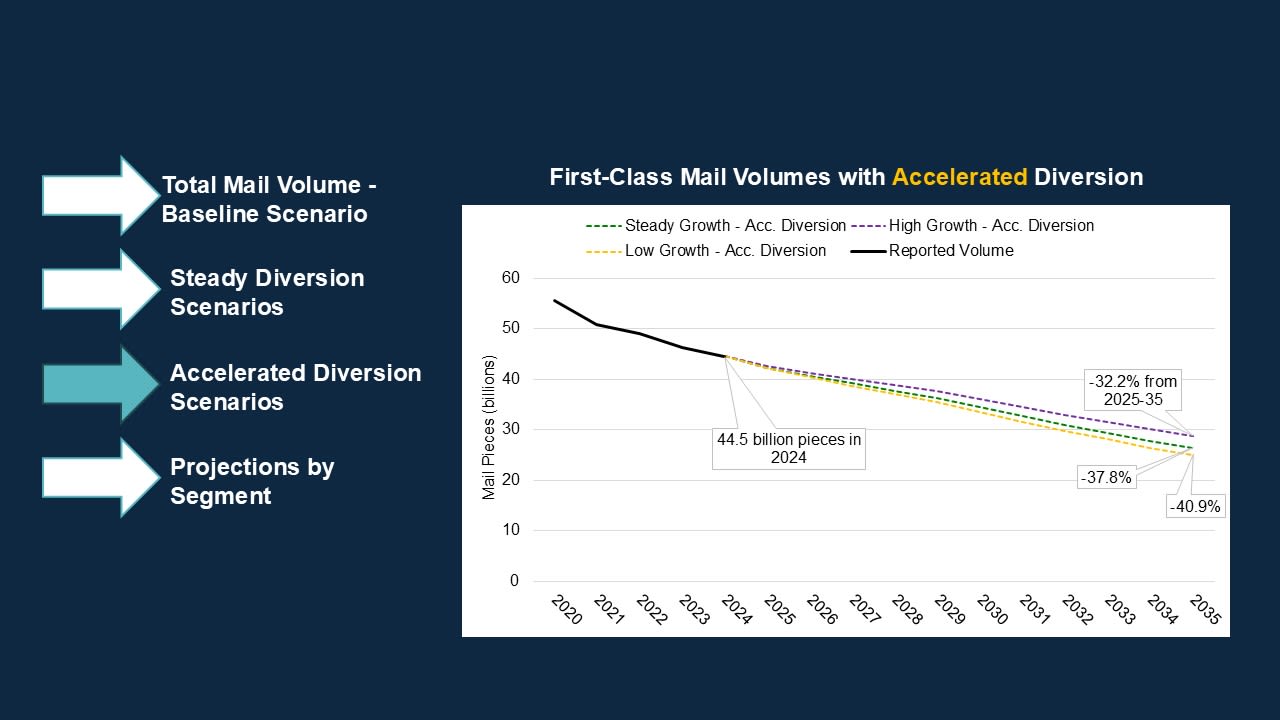

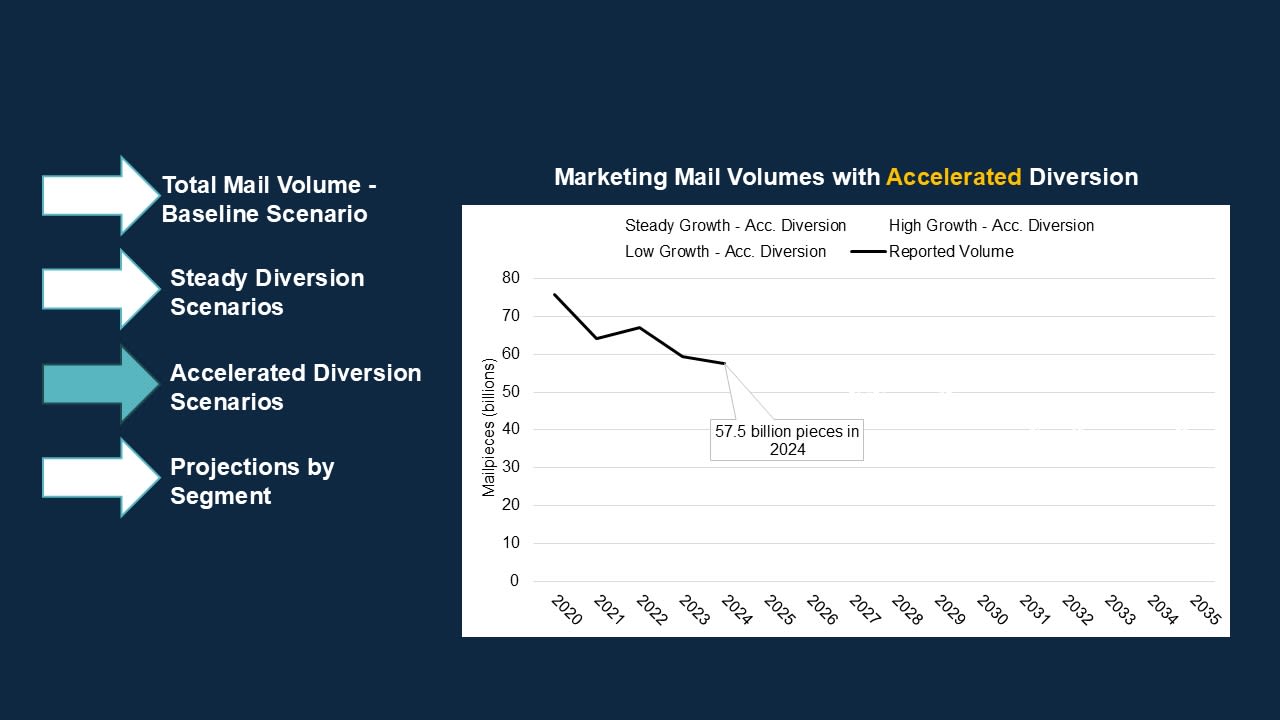

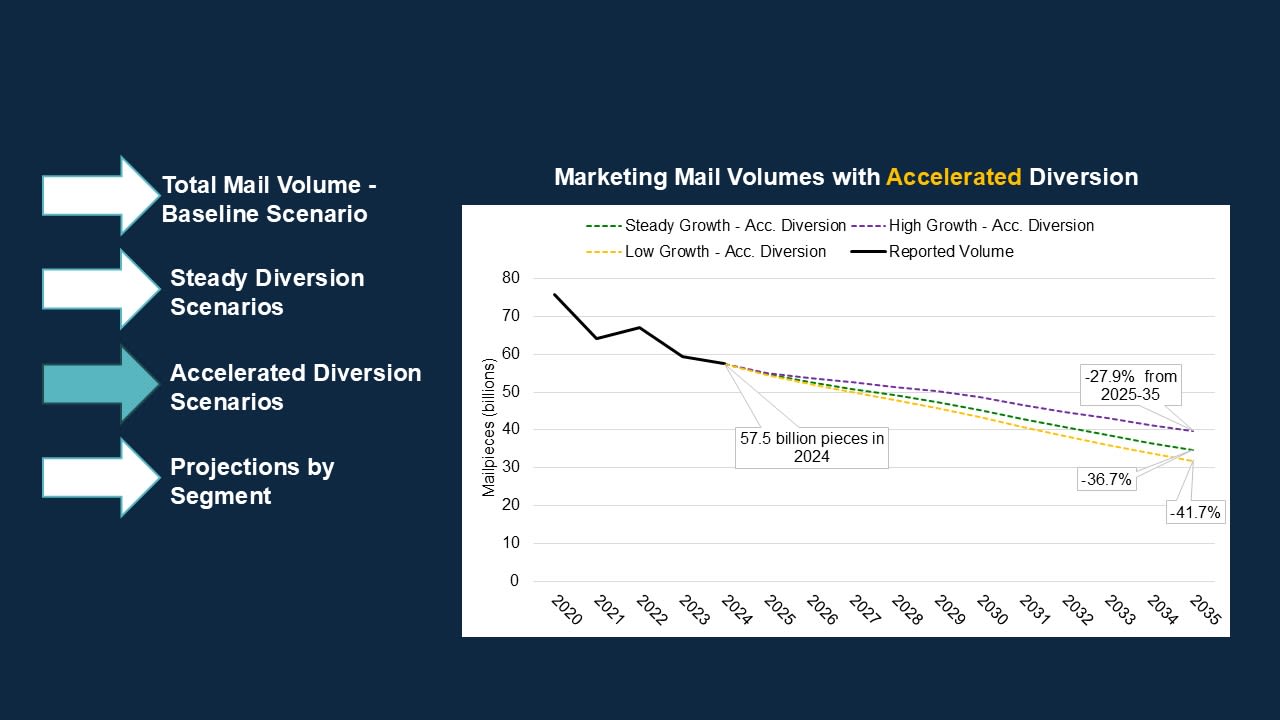

Scenarios where electronic diversion accelerates assume a faster development and user adoption of new technologies. These scenarios assume an increased reliance on digital communications in everyday life.

High economic growth somewhat mitigates the effects of increased diversion, with a 32% decline in First-Class Mail and 28% decline in Marketing Mail.

Low economic growth and accelerated electronic diversion is the worst case for mail volume, with a 41% decline in First-Class Mail and a 42% decline in Marketing Mail.

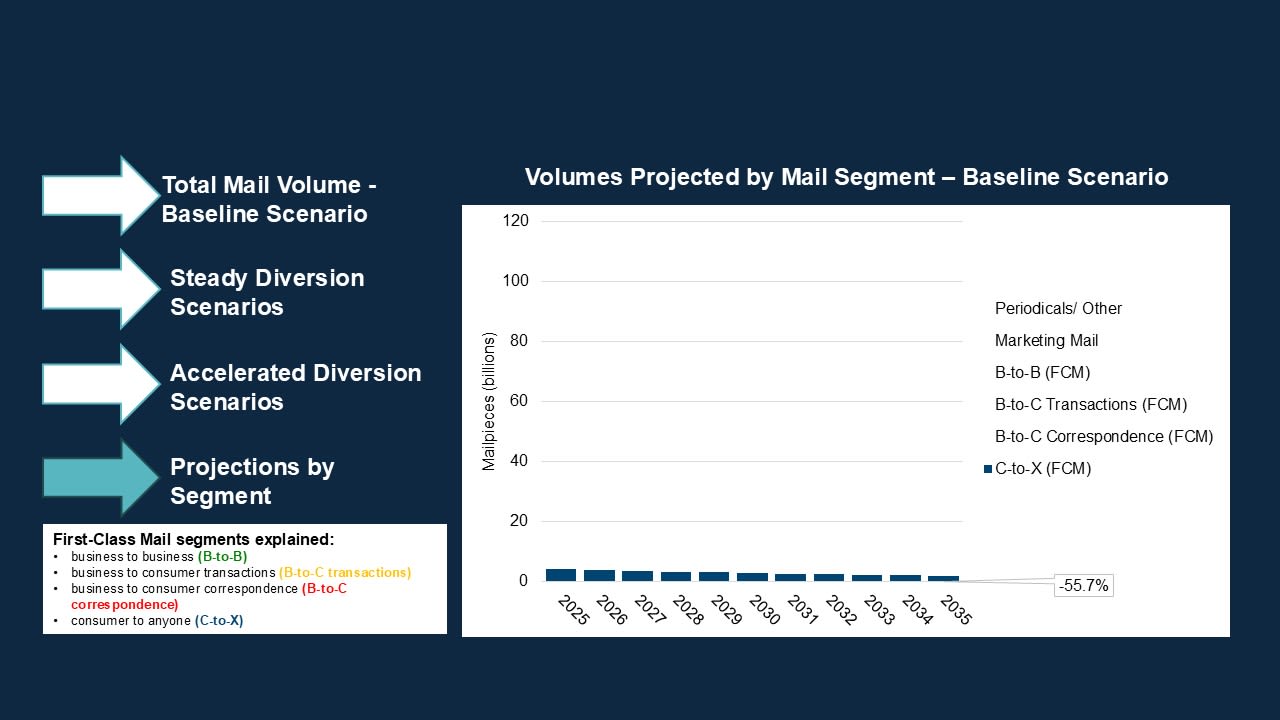

The model also forecasts that First-Class Mail sent by individual customers will be harder hit by declines than First-Class Mail sent by businesses, and that Marketing Mail will continue to be more resilient in terms of volume than First-Class Mail in most scenarios.

Summary of Future Mail Volume Scenarios

|

Electronic Diversion |

Economic Growth |

Scenario |

Projected |

Projected Mail Volume Growth |

Marketing & First-Class Mail Volume in FY 2035 (billions) |

|---|---|---|---|---|---|

|

Steady |

Accelerated |

Best-case |

4 FCM, 1 MM |

-13.7% |

85.4 |

|

Steady |

Steady |

Baseline |

4 FCM, 1 MM |

-28.2% |

70.1 |

|

Steady |

Slow |

Steady diversion and slow growth |

4 FCM, 1 MM |

-26.3% |

72.1 |

|

Accelerated |

Accelerated |

Accelerated diversion and accelerated growth |

4 FCM, 1 MM |

-29.8% |

68.5 |

|

Accelerated |

Steady |

Accelerated diversion and steady growth |

4 FCM, 1 MM |

-37.2% |

60.9 |

|

Accelerated |

Slow |

Worst-case |

4 FCM, 1 MM |

-41.3% |

56.6 |

Implications of Future Declines

Even with the declines in traditional mail, Americans will continue to depend on the critical services provided by the Postal Service. However, planning operations to efficiently respond to volume shifts, and preserving affordable and reliable mail service as volume losses continue will become an increasing challenge. The Postal Service has requested various legislative and administrative actions and is implementing network-wide operational changes in pursuit of financial sustainability.

Amidst these changes, ensuring the affordability and reliability of mail service will be important to maintaining mail’s value proposition and preventing an acceleration in the decline of traditional mail volume

Projecting Mail Volume: Future Trends and Implications for The Postal Service