State of the U.S. Postal Service Financial Condition

- Office of Audit -

United States Postal Service Office of Inspector General

The OIG presents the results of our self-initiated audit: State of the U.S. Postal Service Financial Condition.

Our objective was to evaluate the financial performance of the Postal Service in relation to its 10-year Delivering for America (DFA) plan financial projections.

The Postal Service continues to play a vital role in the U.S. economy. Consistently viewed by the American people as one of the most trusted government organizations, USPS visits every home and business six days a week.

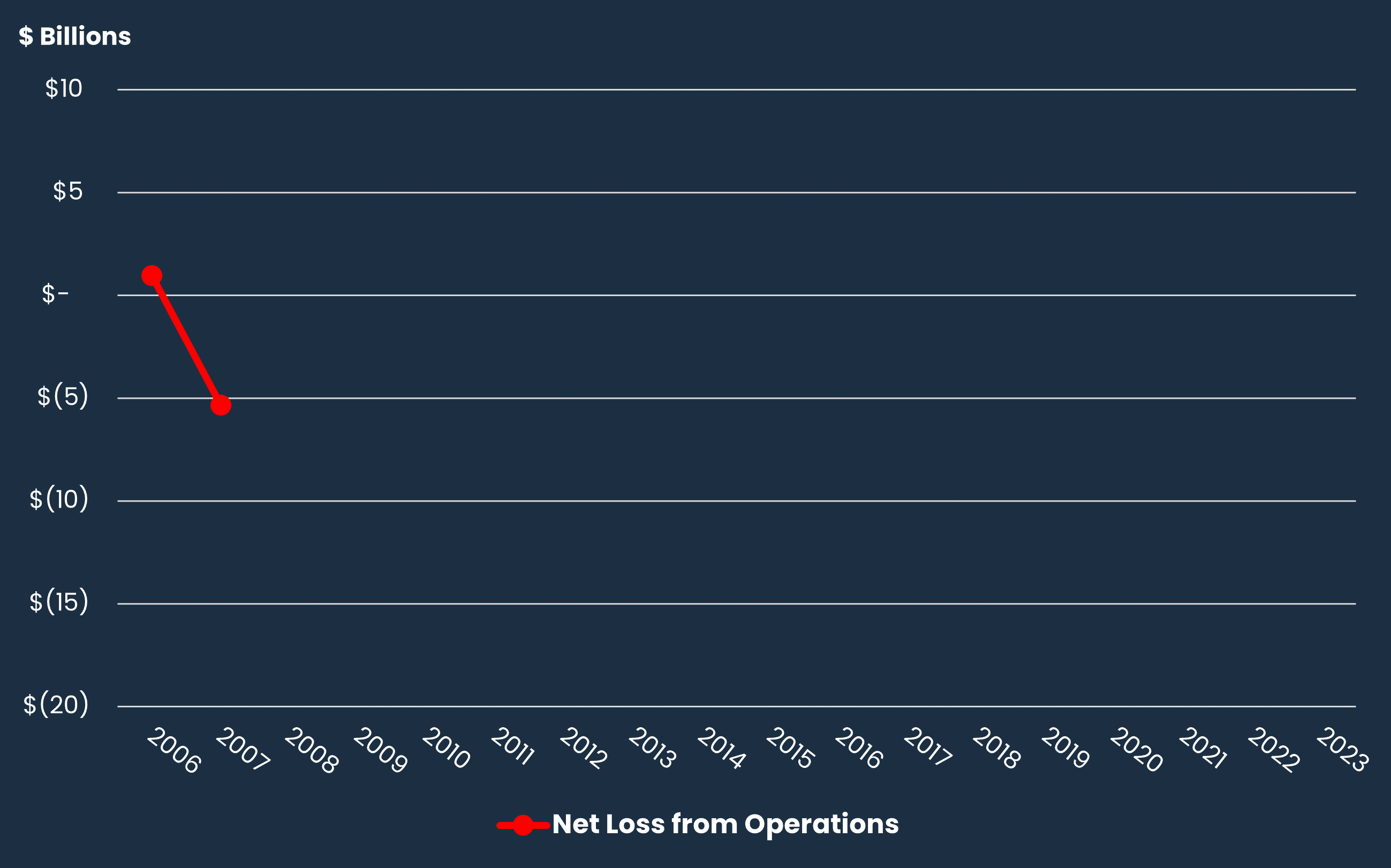

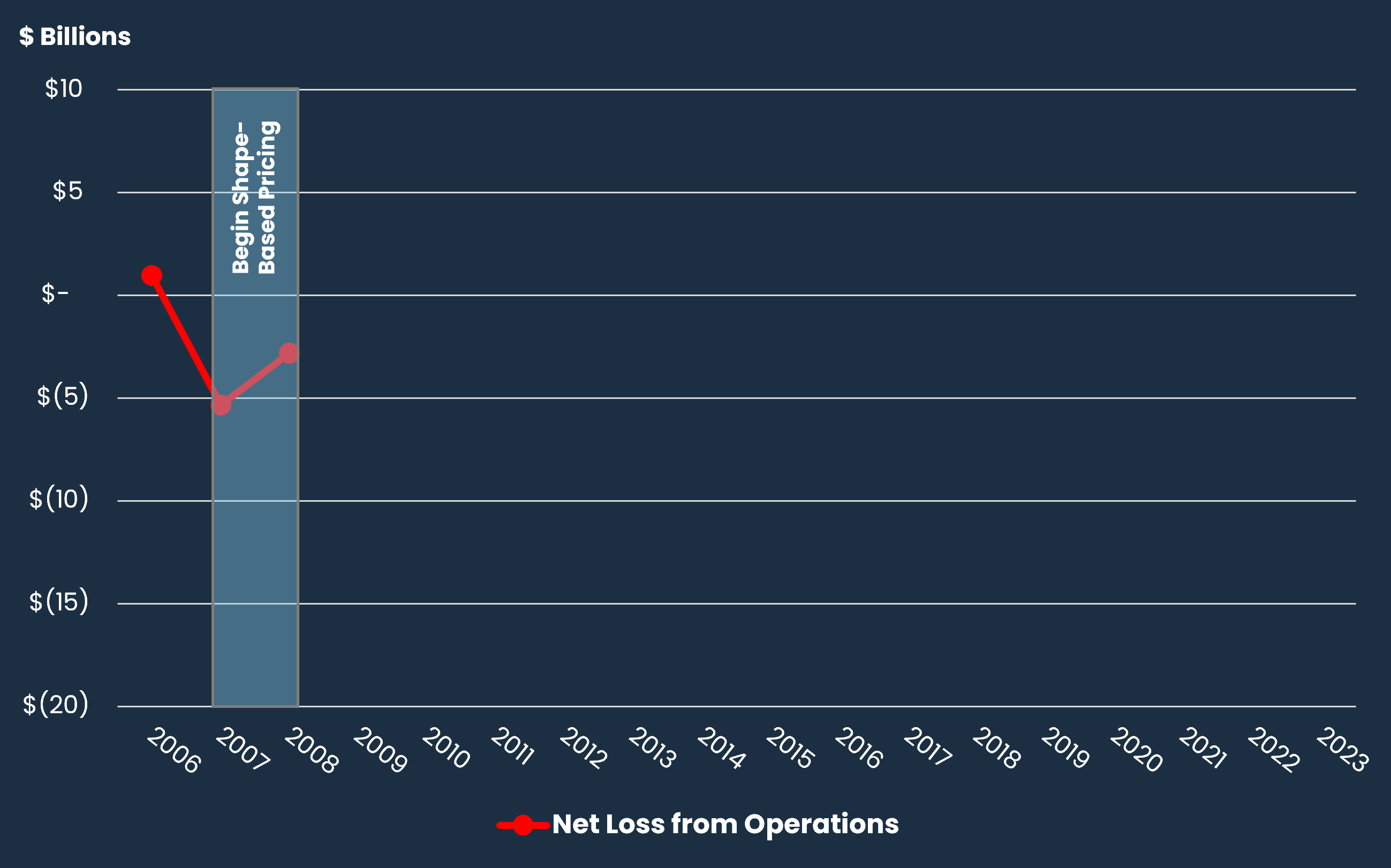

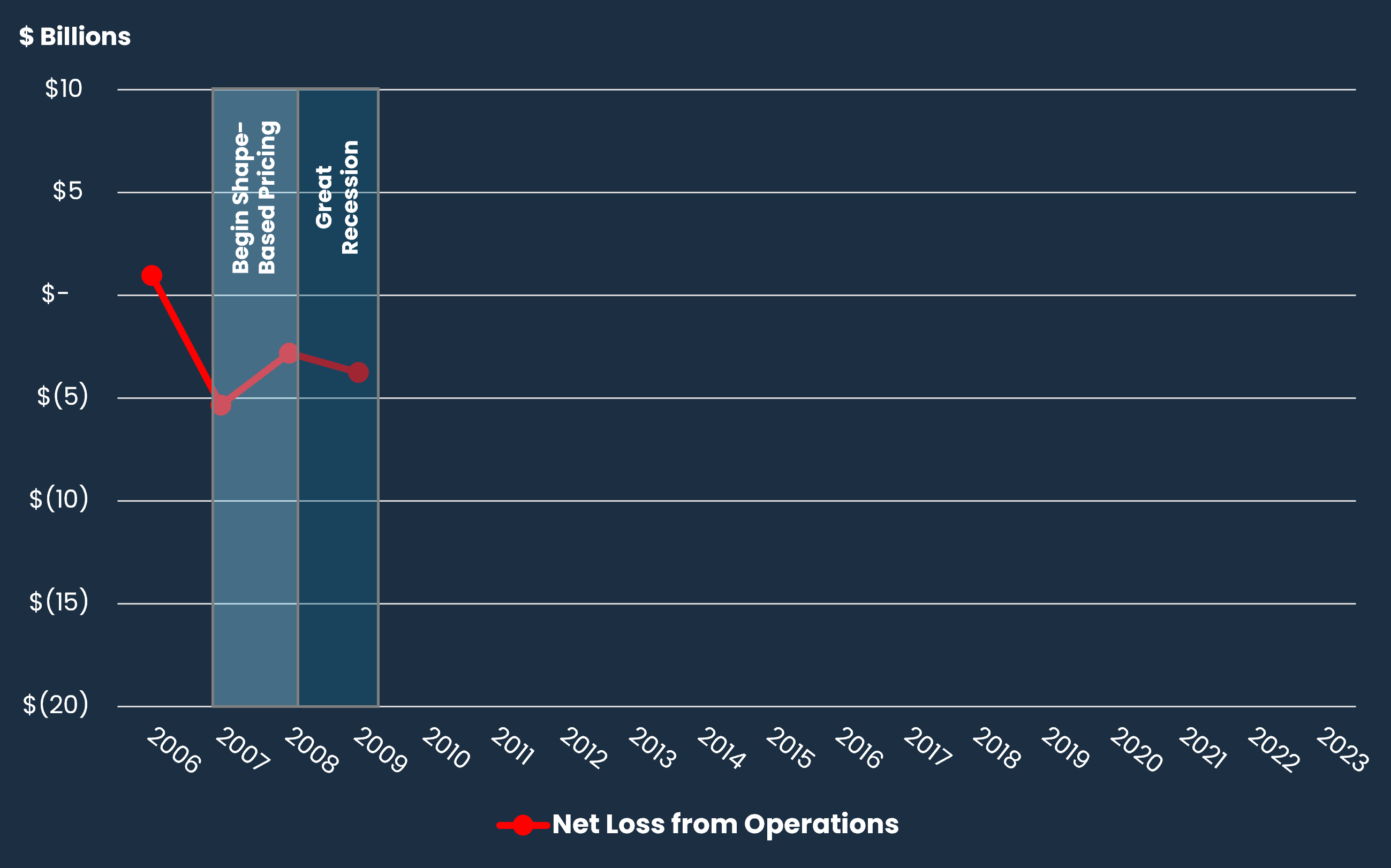

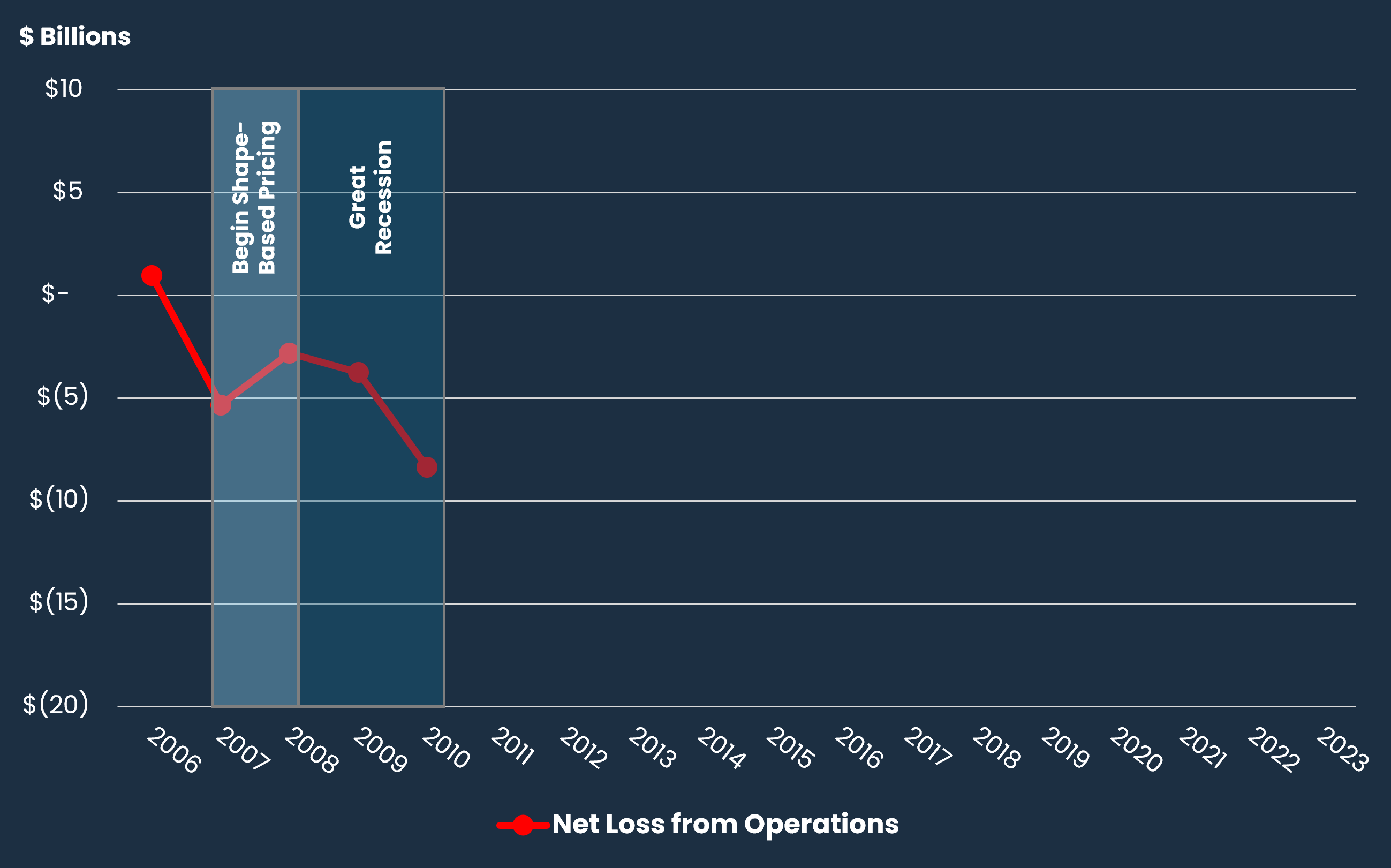

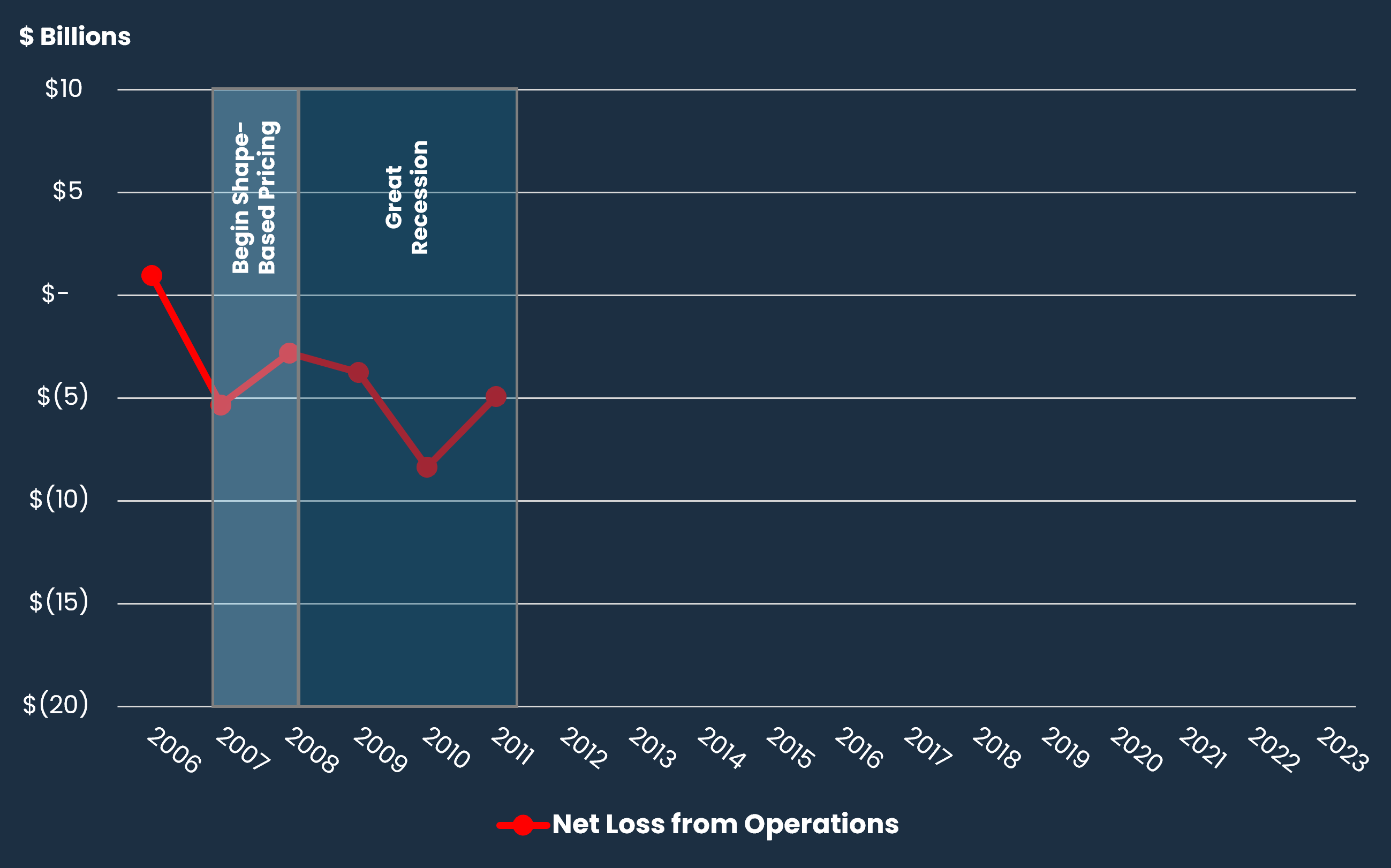

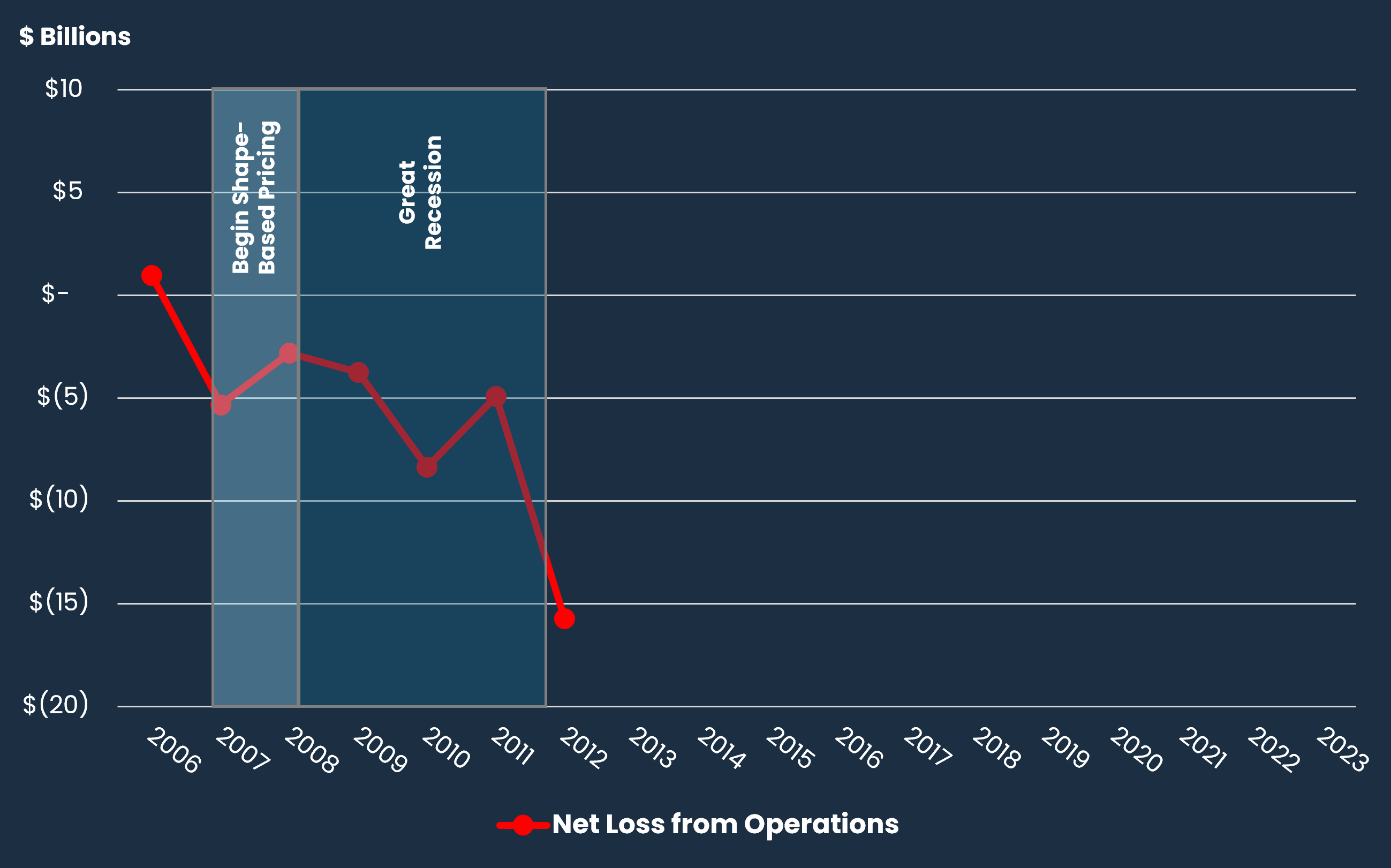

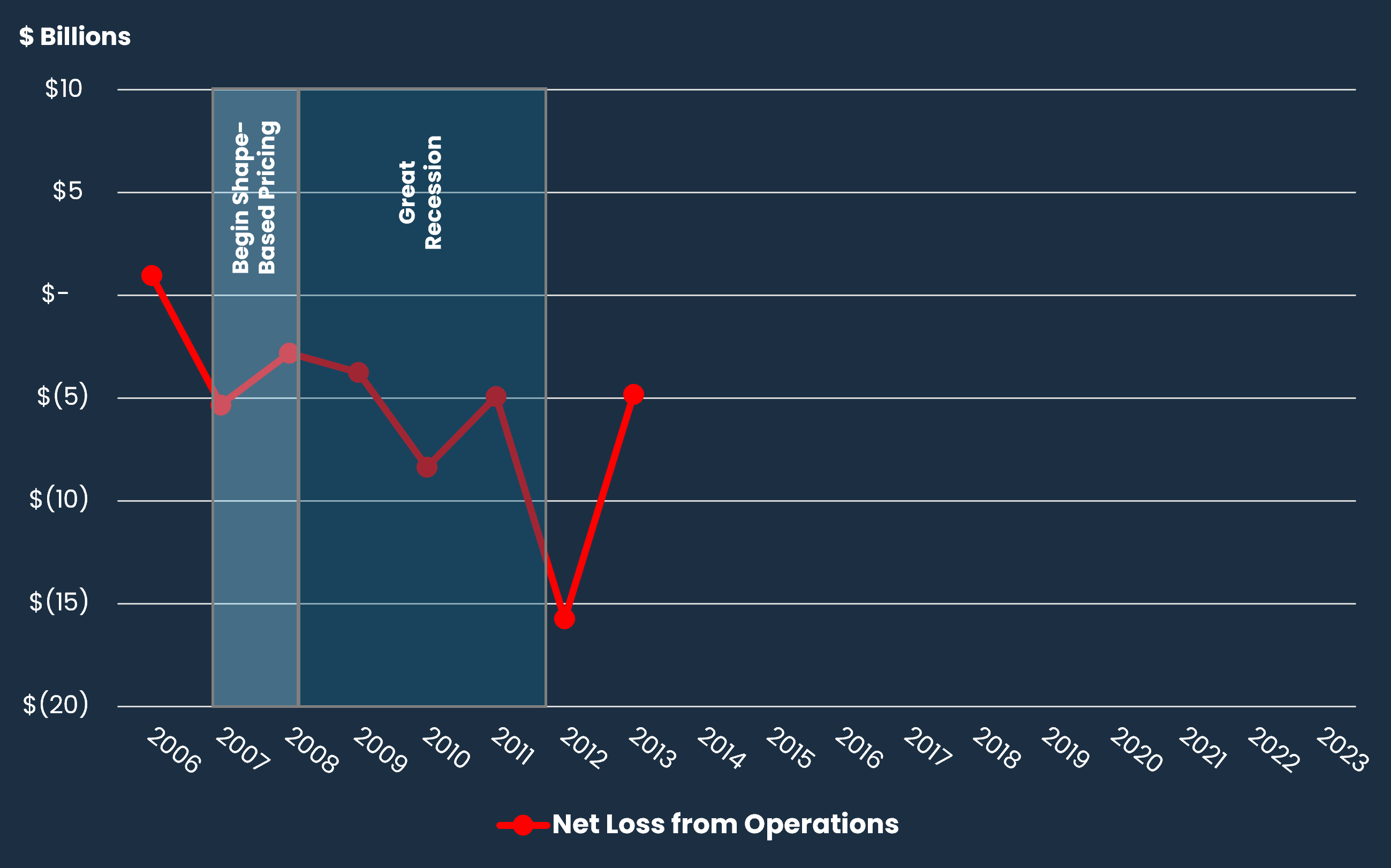

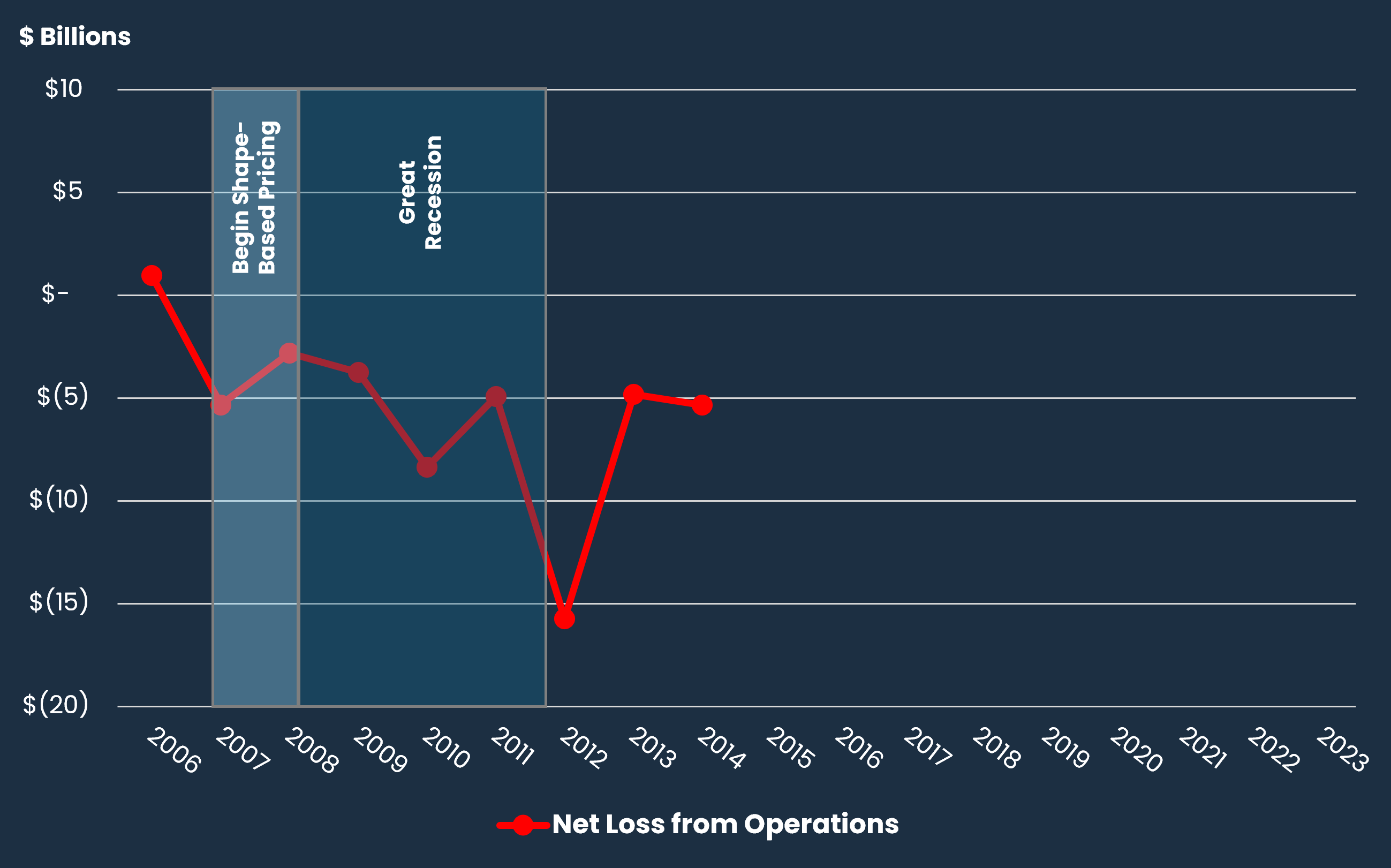

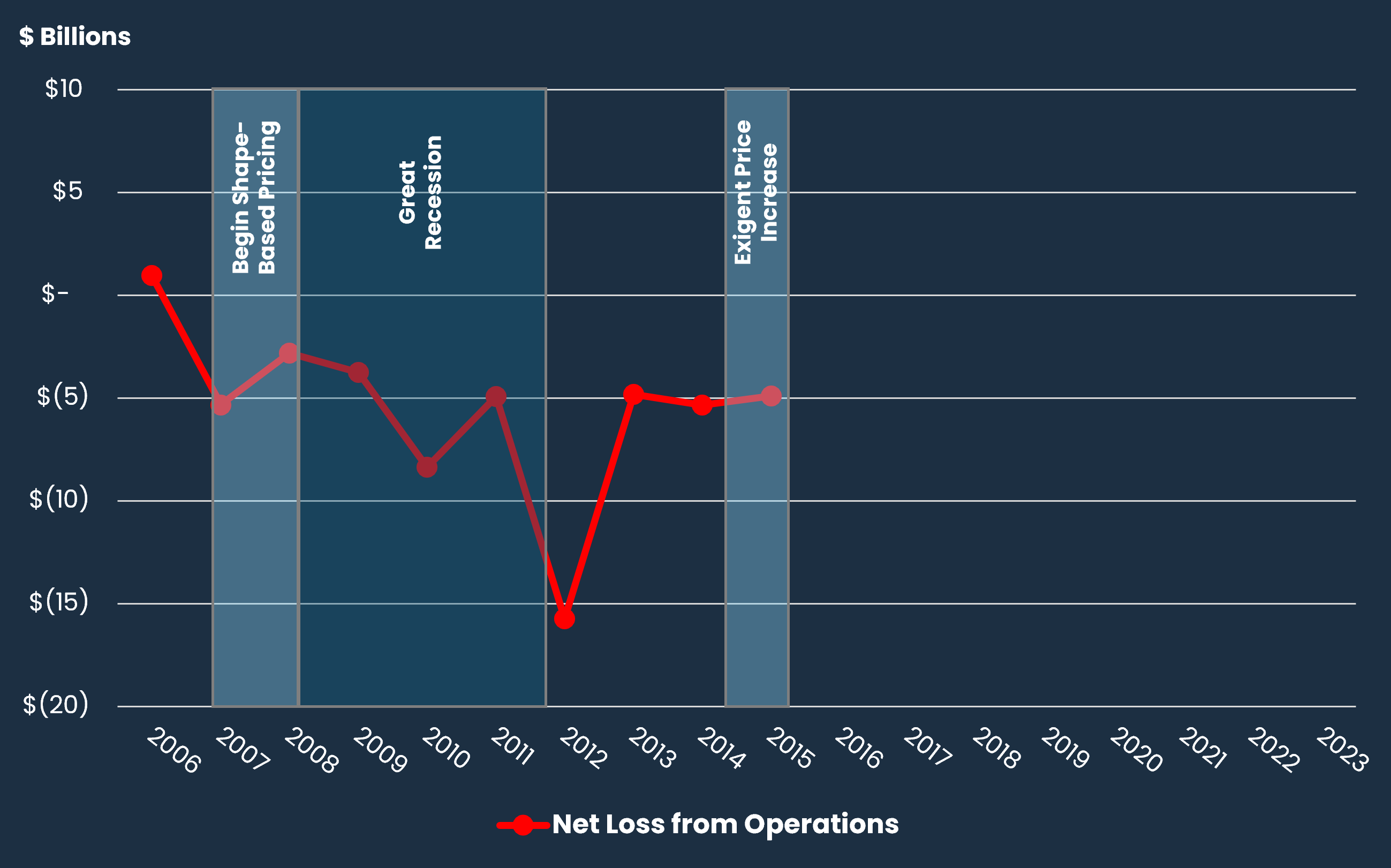

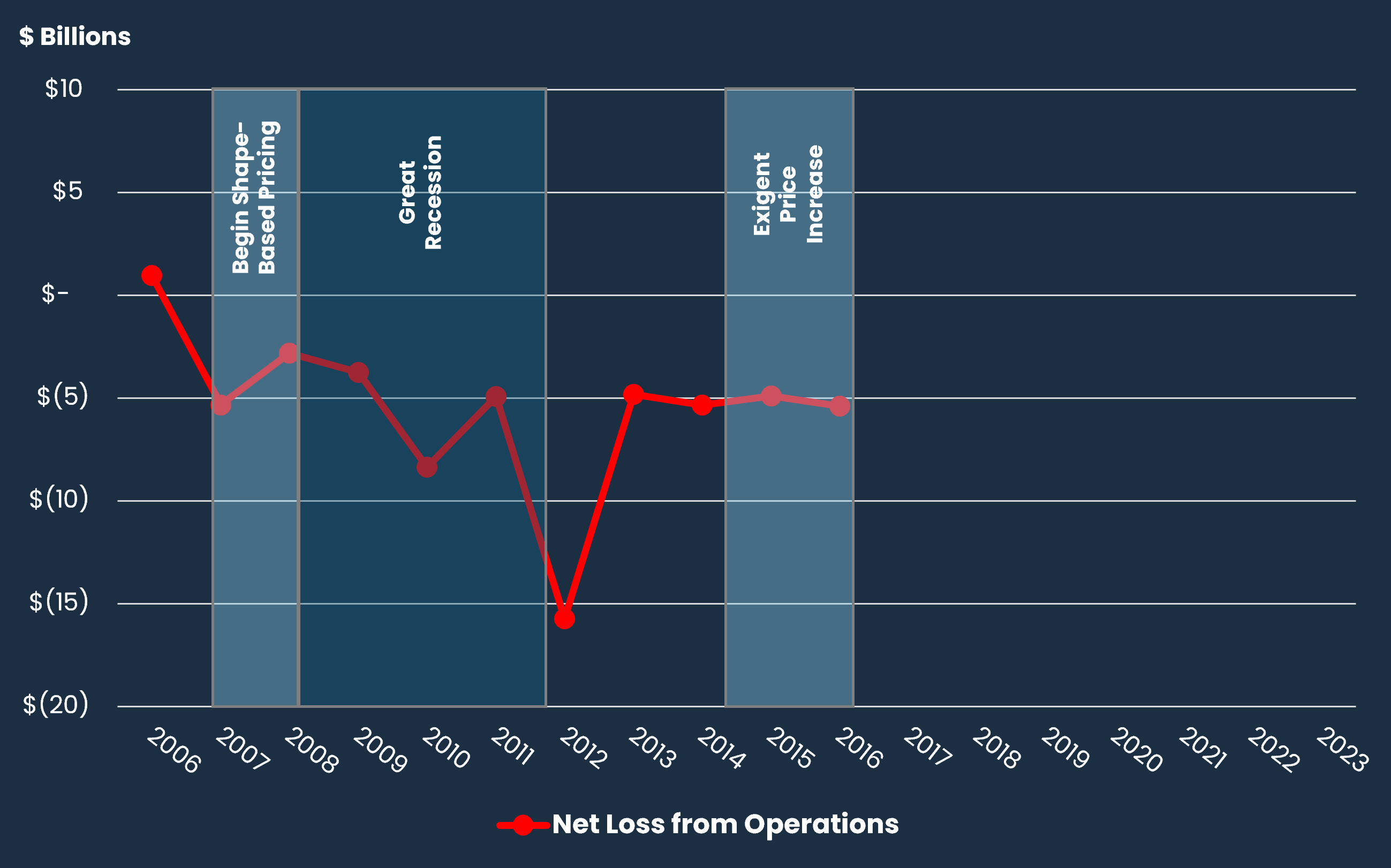

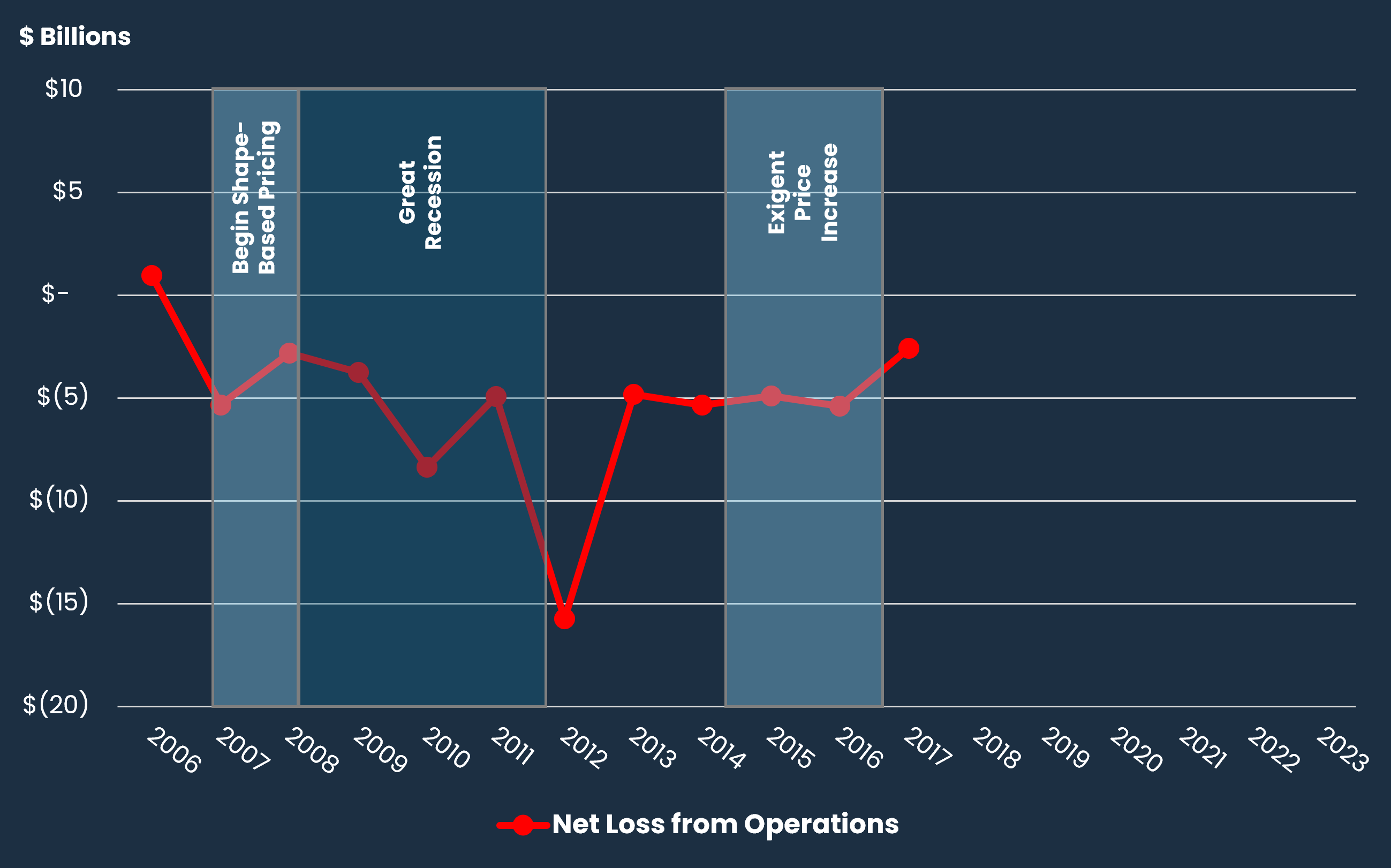

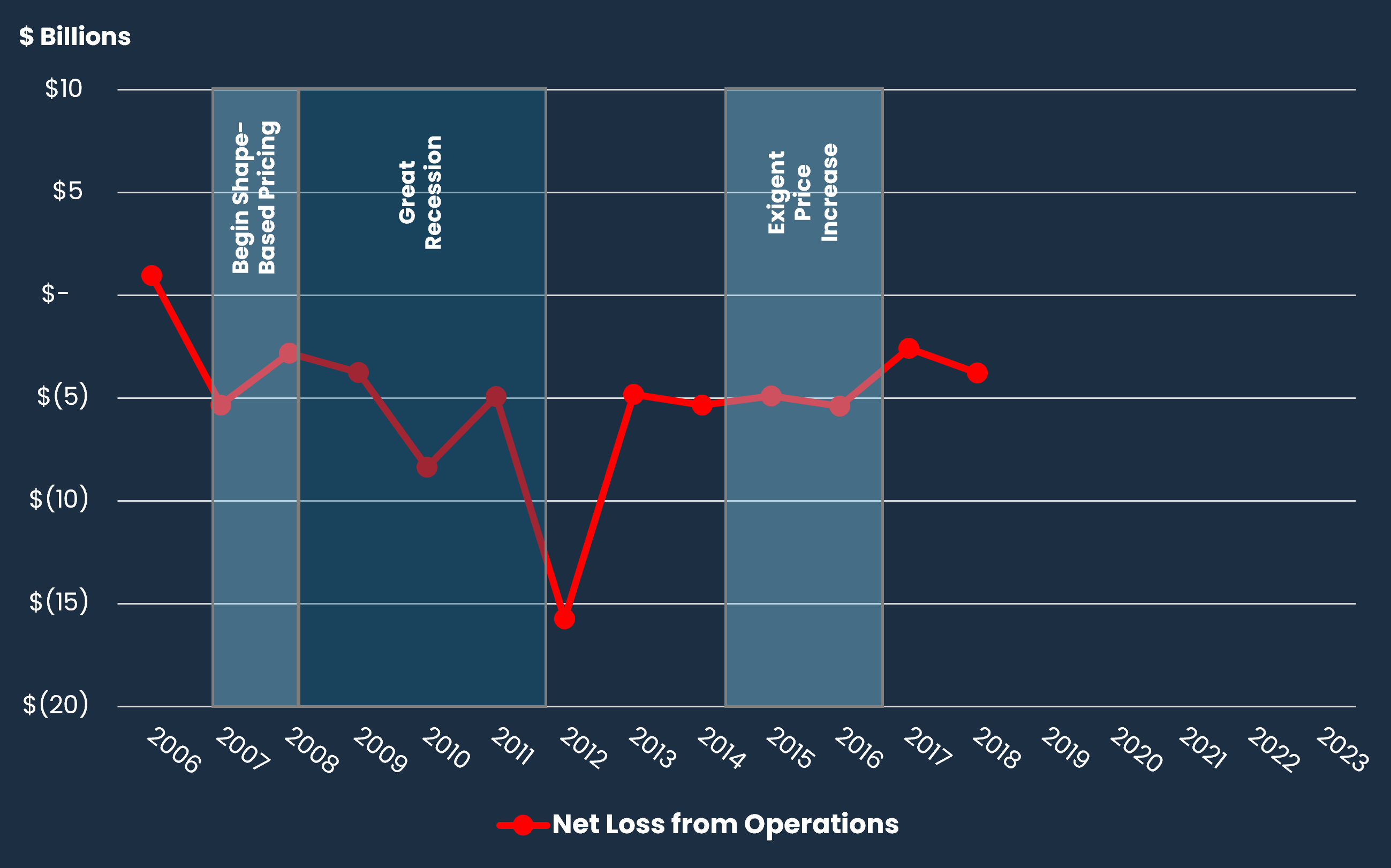

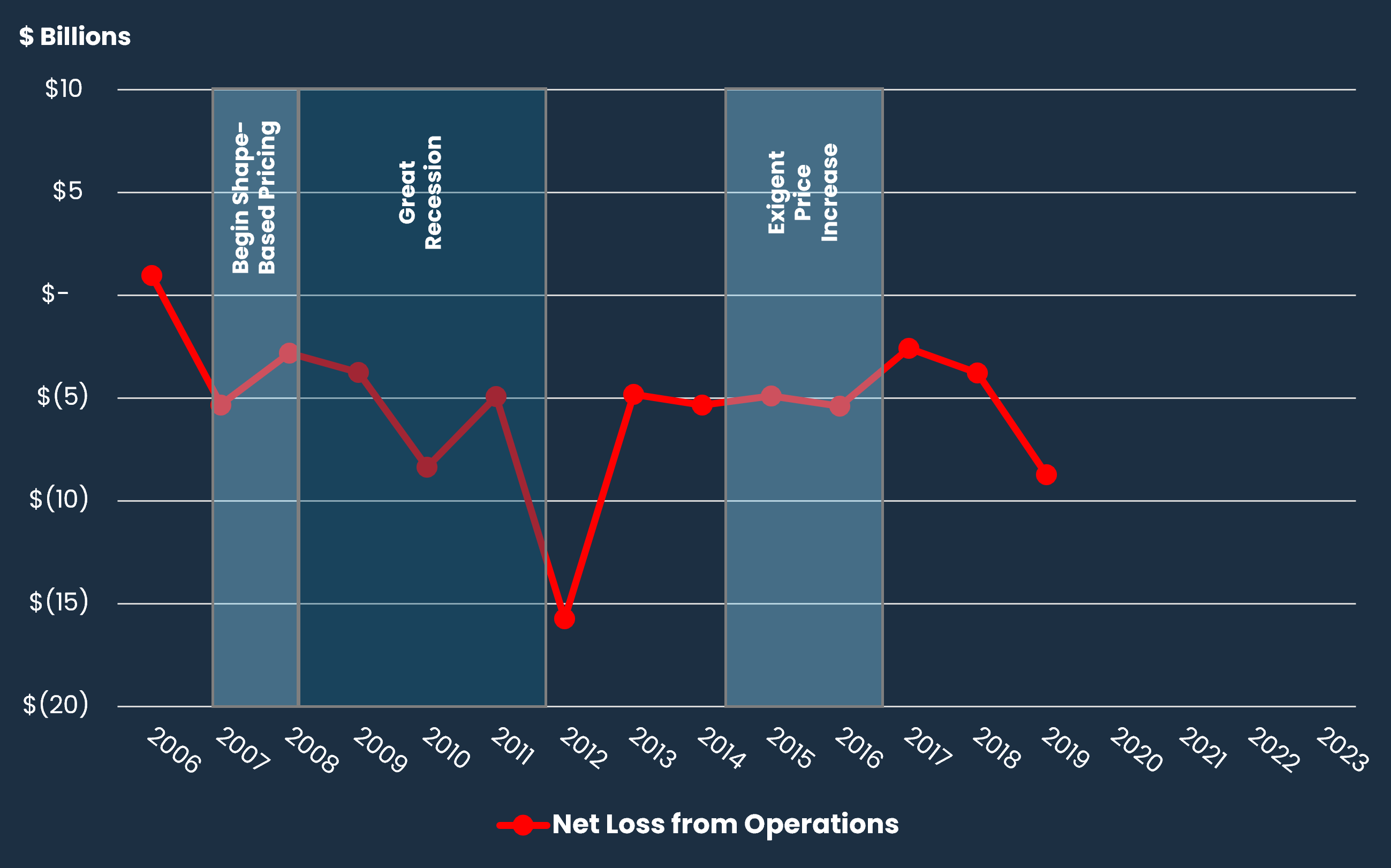

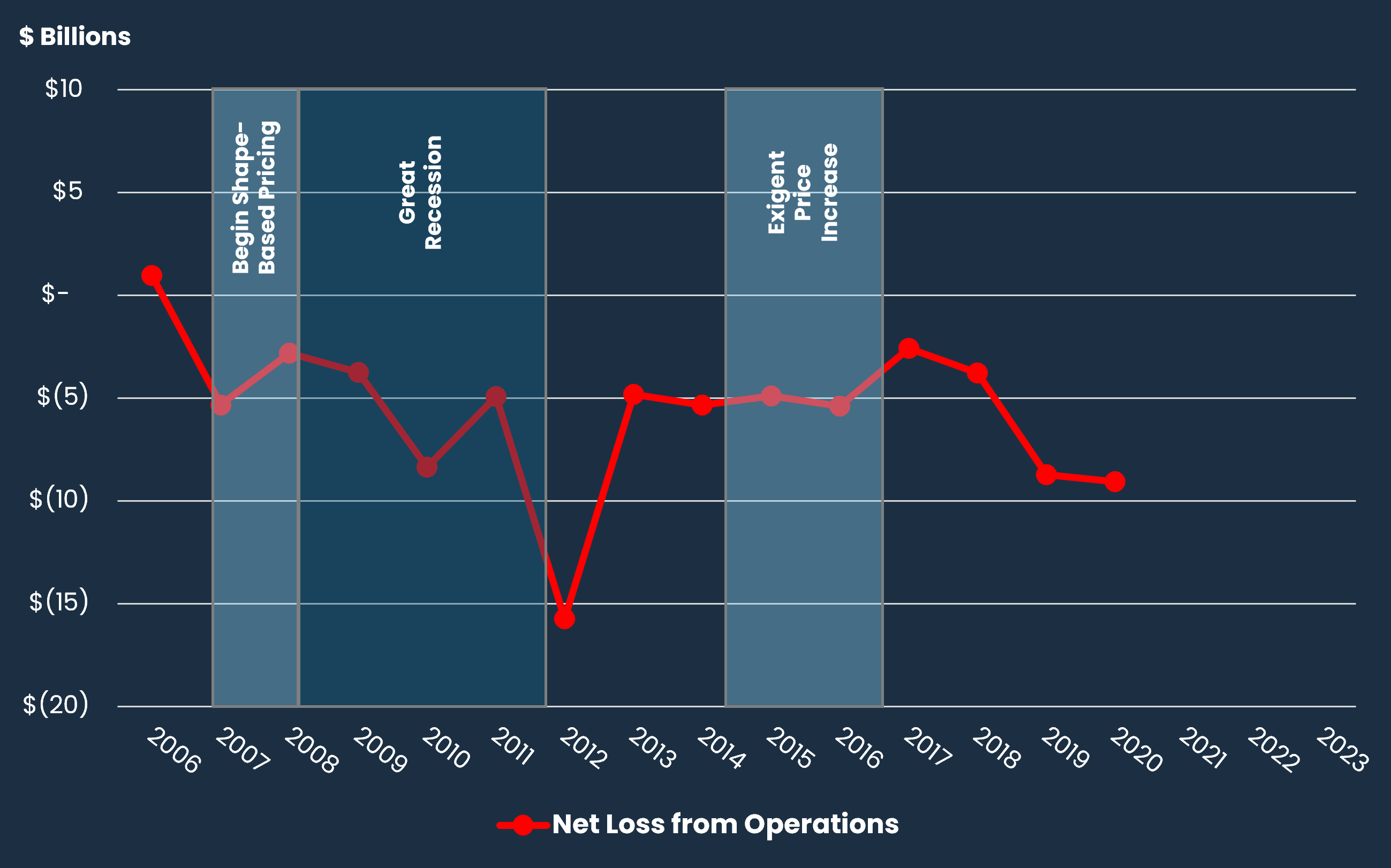

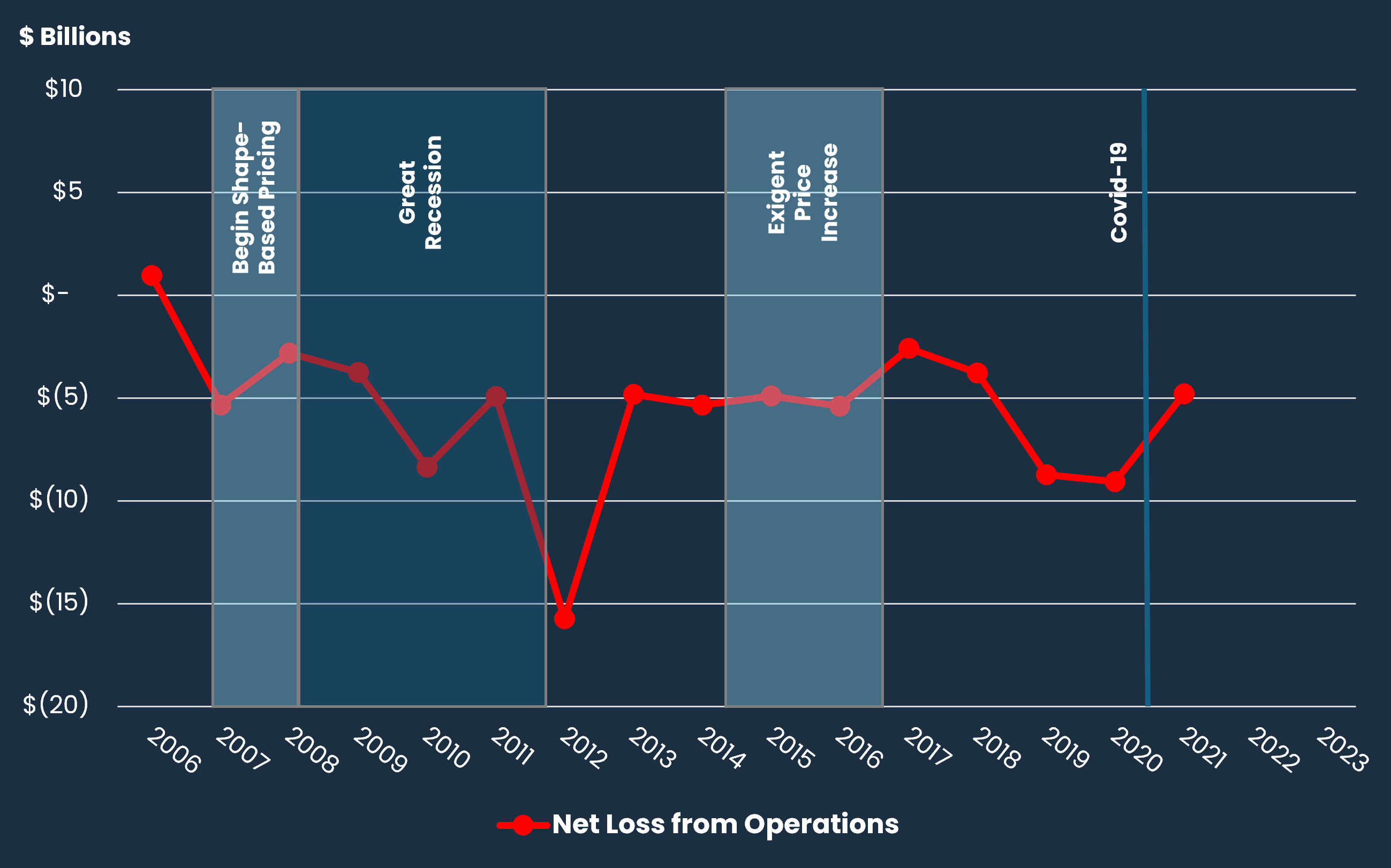

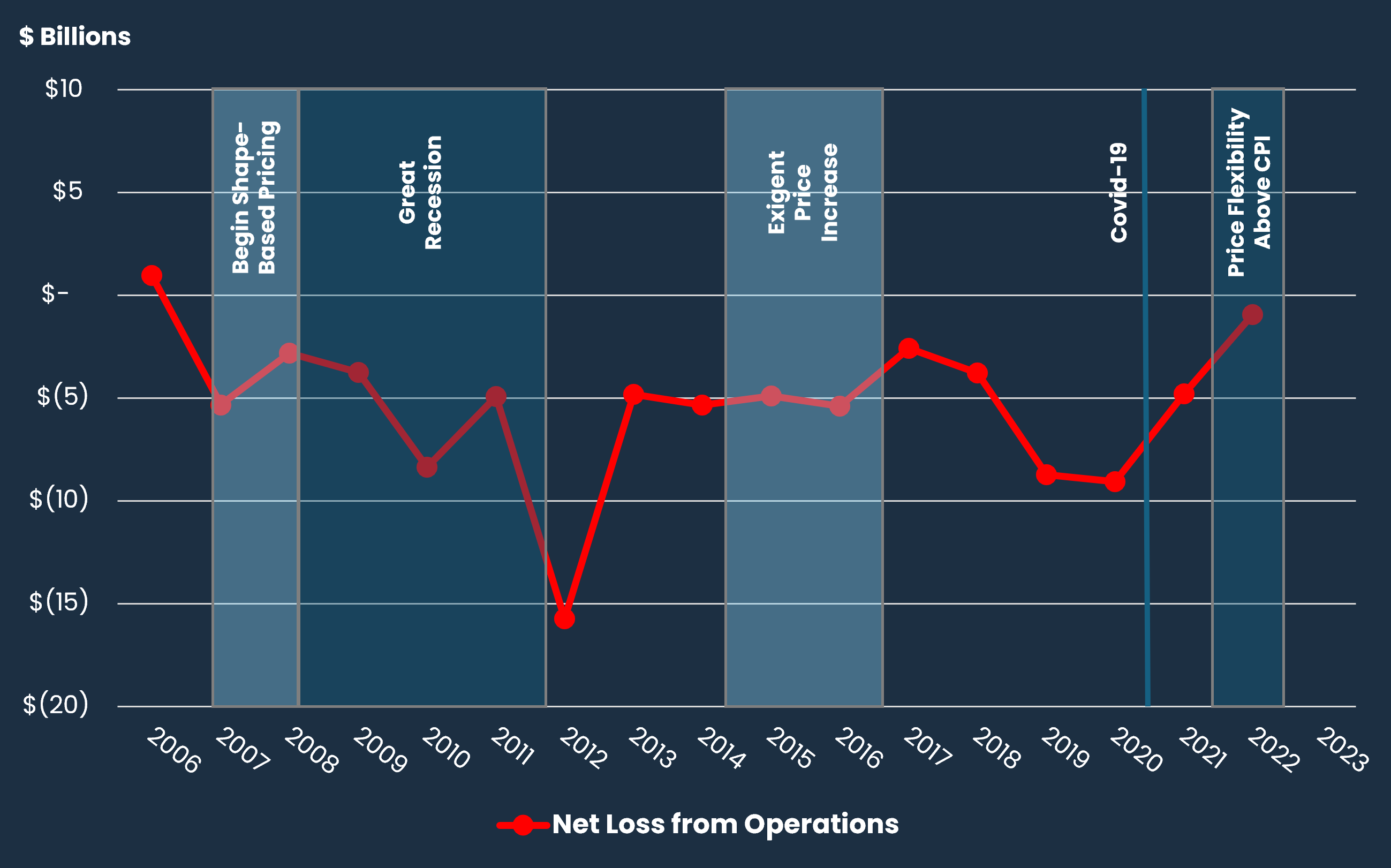

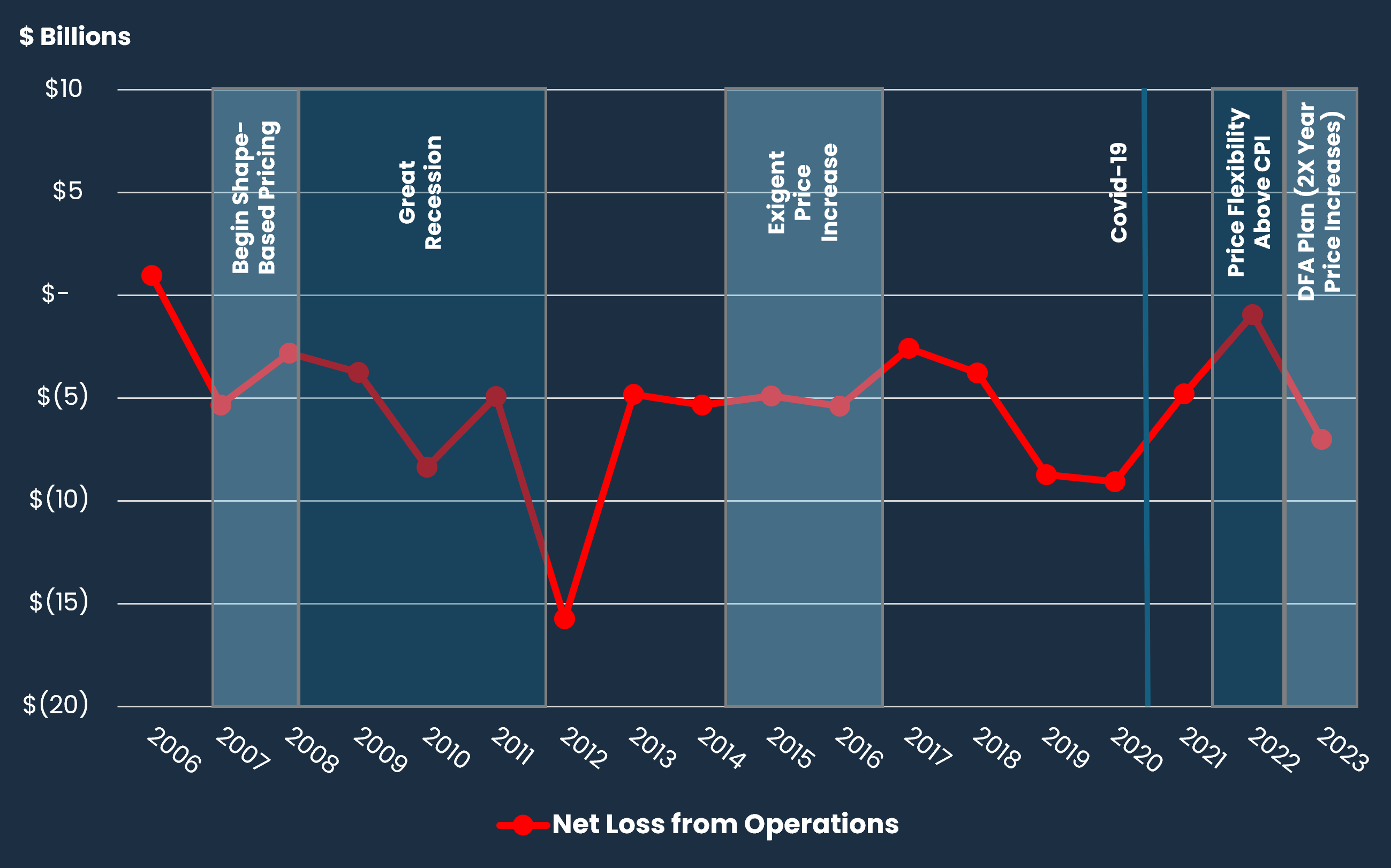

Yet, USPS has suffered a history of financial net losses dating back to FY 2007, when the Postal Accountability and Enforcement Act came into effect, which was then followed by the Great Recession.

Consumer preferences driven by the arrival and acceptance of electronic correspondence and bill payment exacerbated the decline of mail volume.

To maintain liquidity, USPS has not made certain annual amortization payments to the Office of Personnel Management for its retirement funds, Federal Employees Retirement System (FERS) since 2014 or Civil Service Retirement System (CSRS) since 2017.

Additionally, it owed $57 billion to its Postal Service Retiree Health Benefit Fund before the passage of the Postal Service Reform Act of 2022.

The losses from FYs 2007 through 2023 totaled $98 billion.

To address these financial and operational challenges, the Postal Service developed Delivering for America, a 10-year strategic plan published in March 2021.

"Our business and operating models were unsustainable and out of step with the changing needs of the nation and its customers.” - the U.S. Postal Service via its Delivering for America plan.

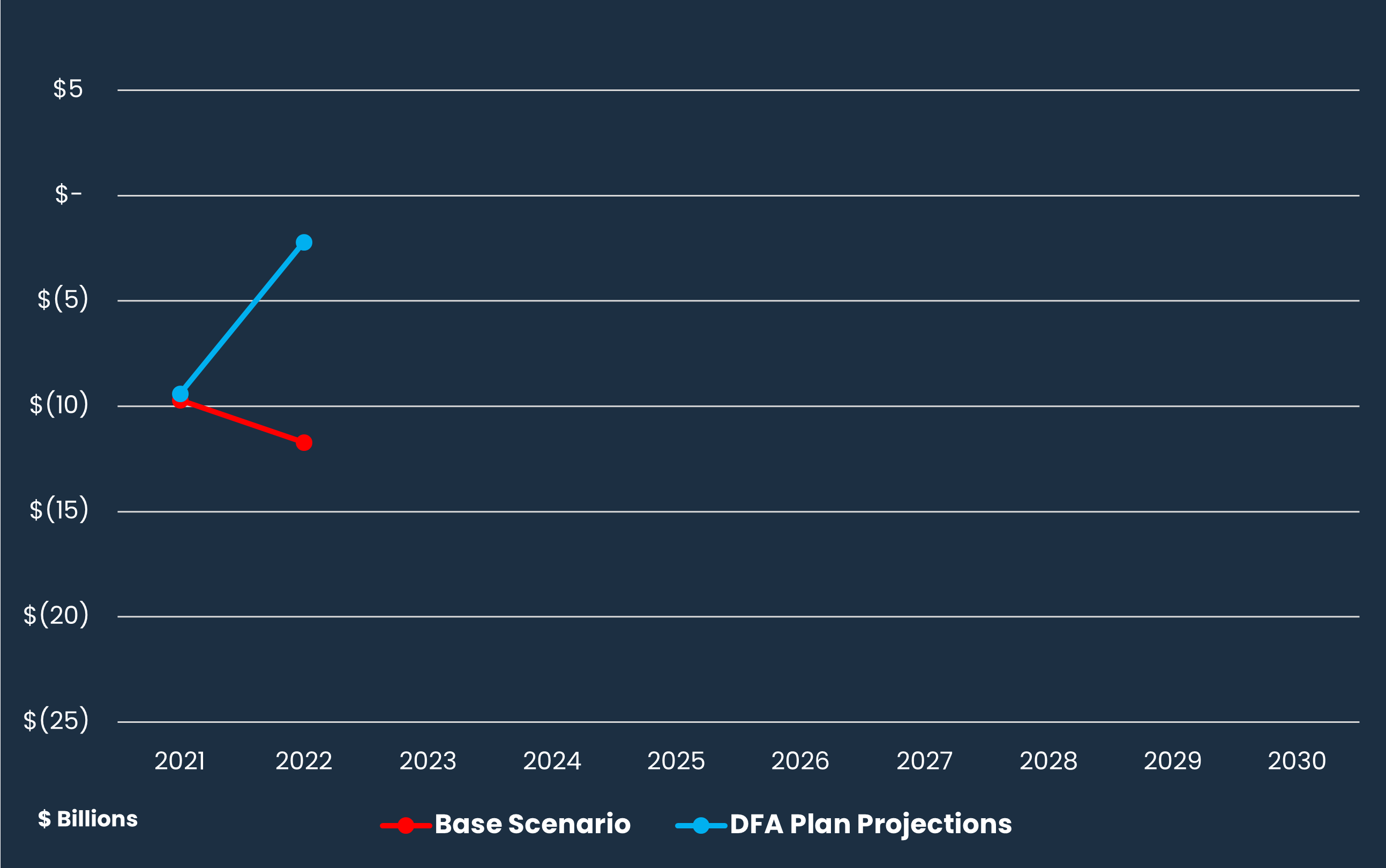

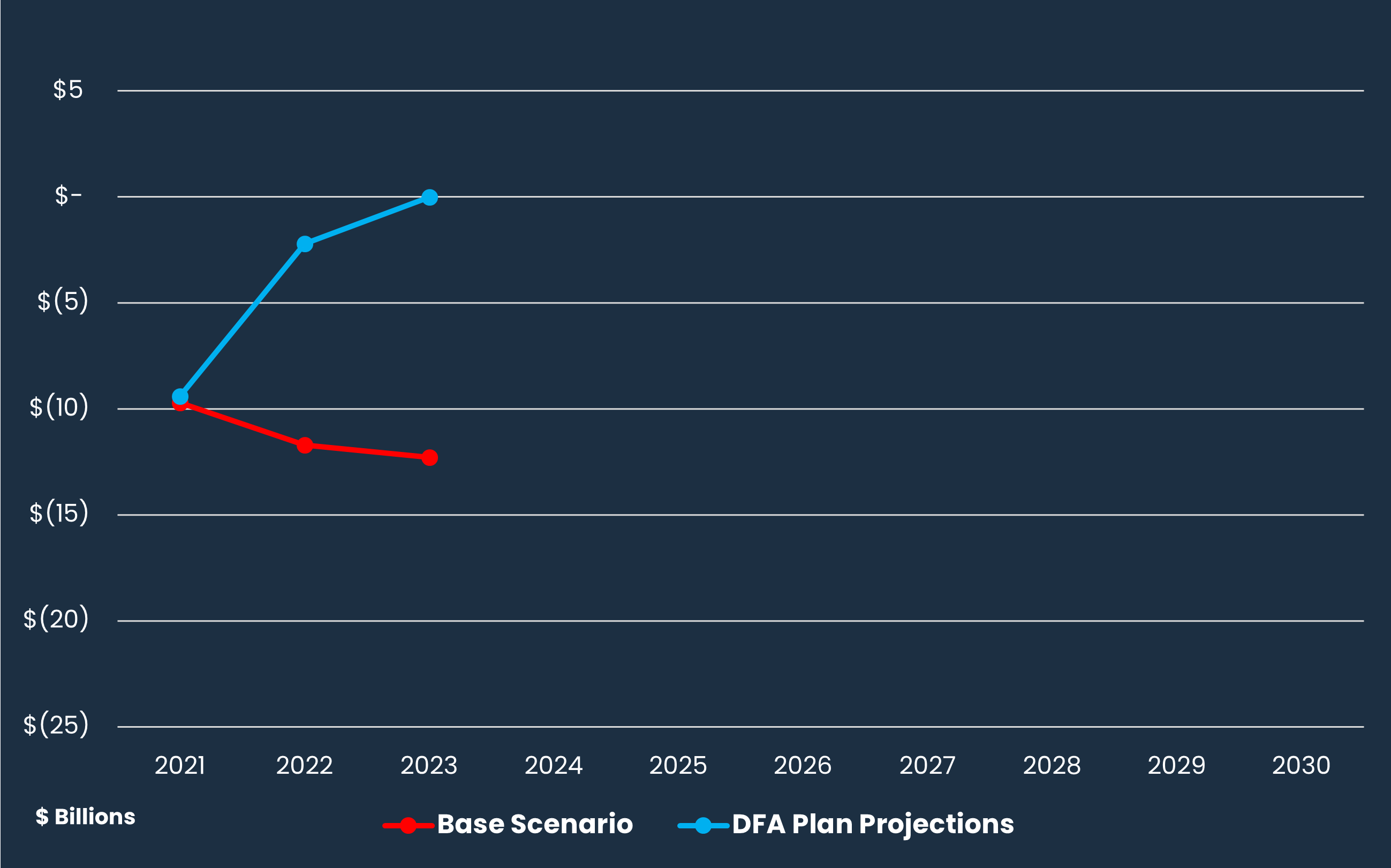

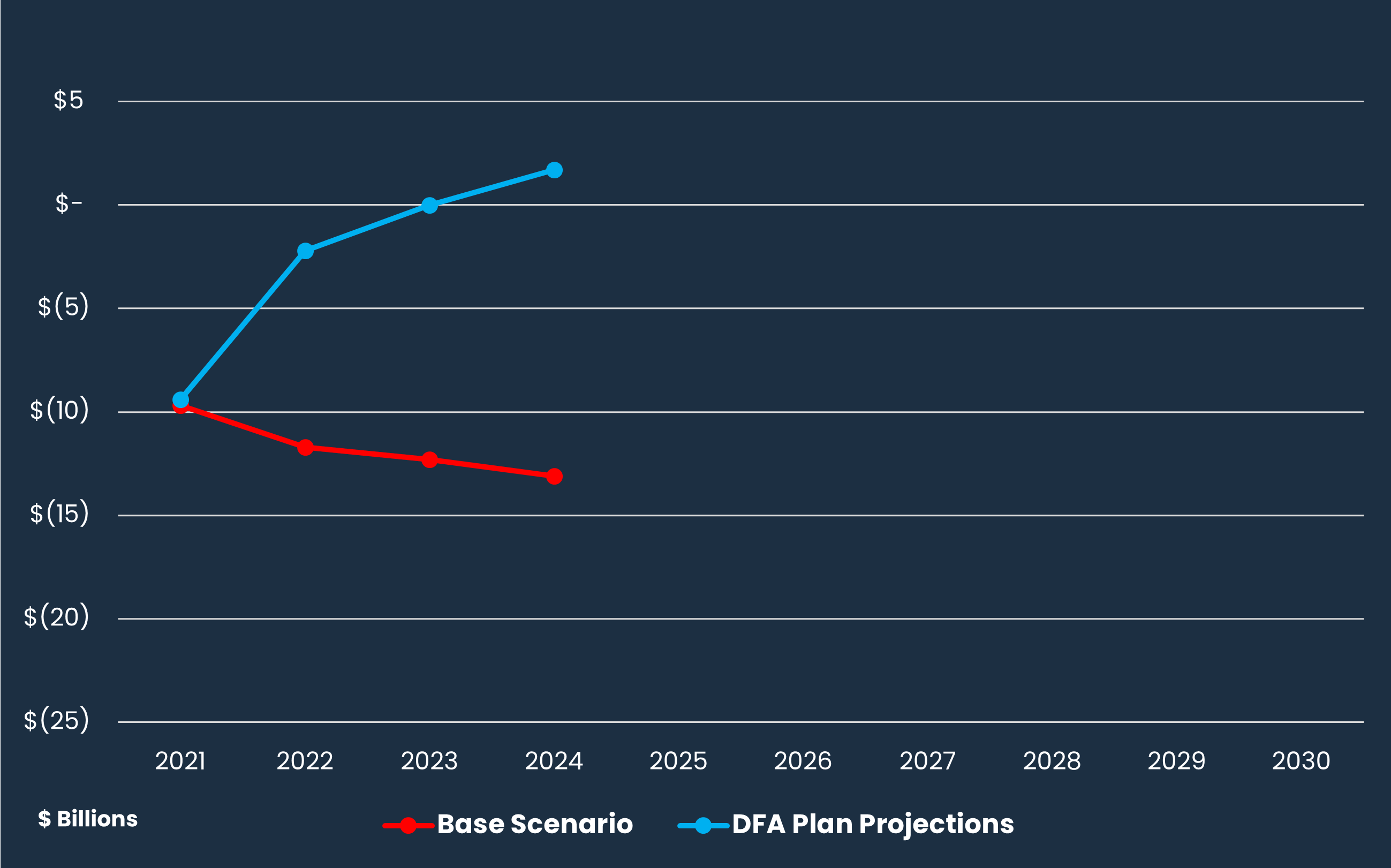

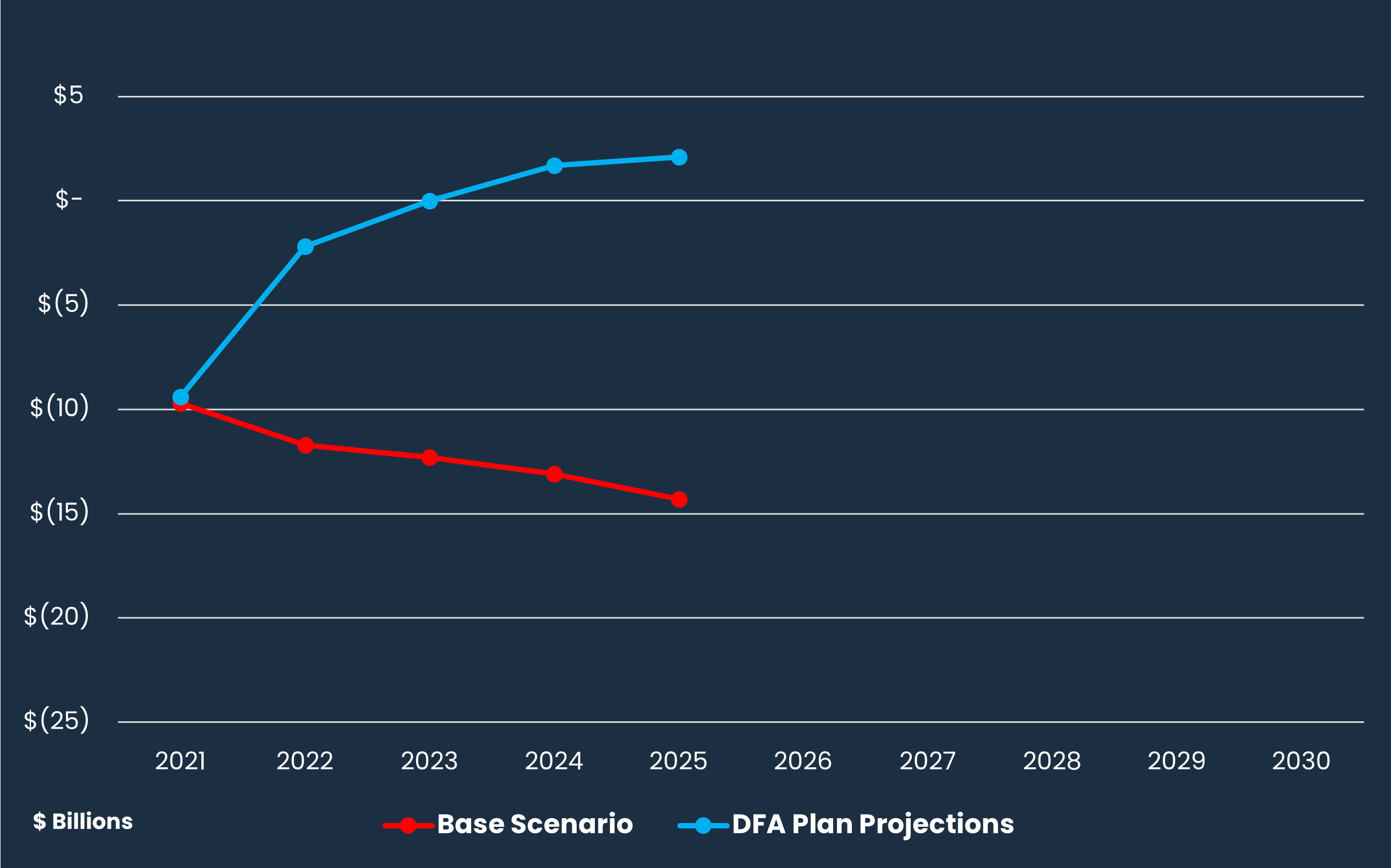

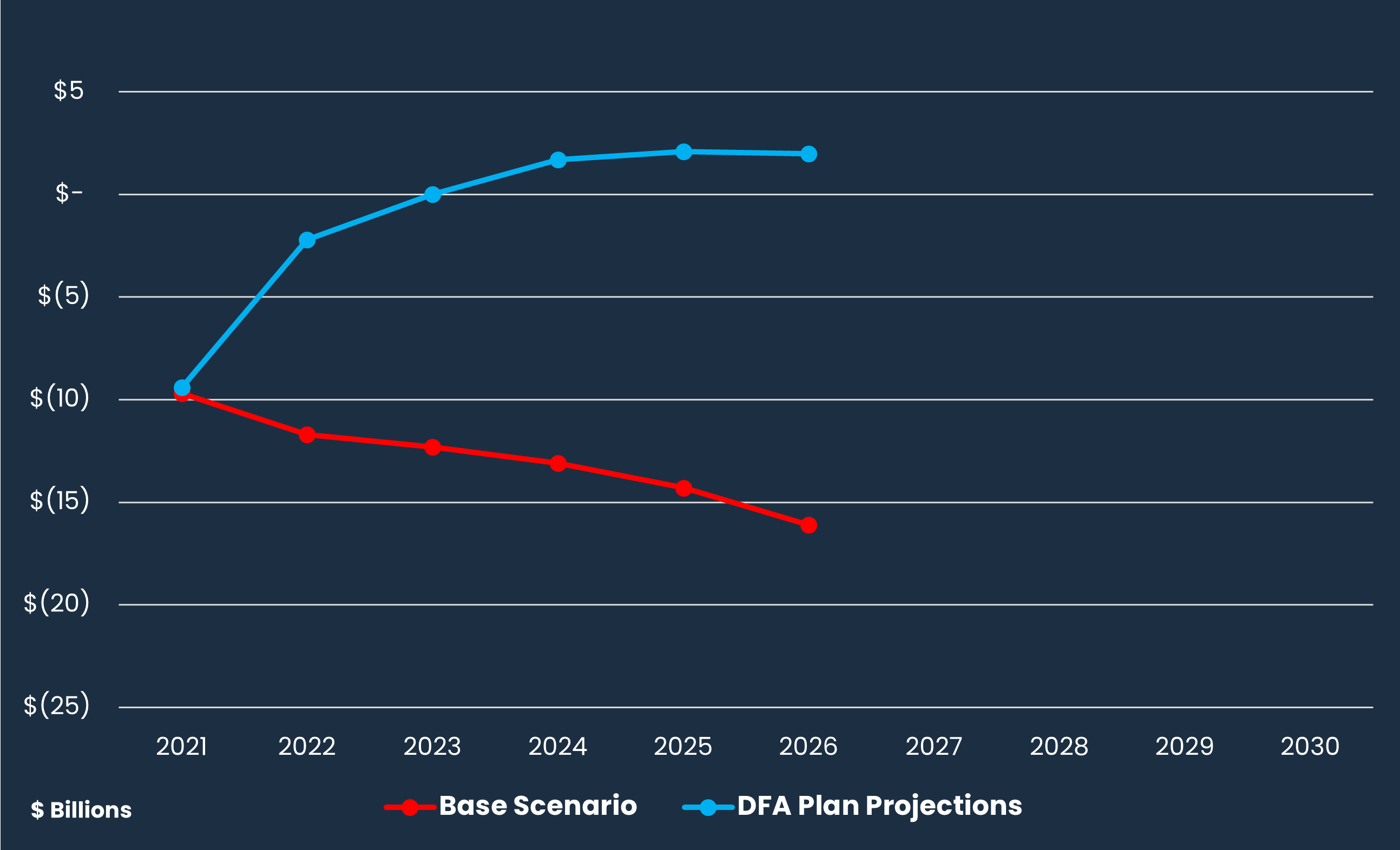

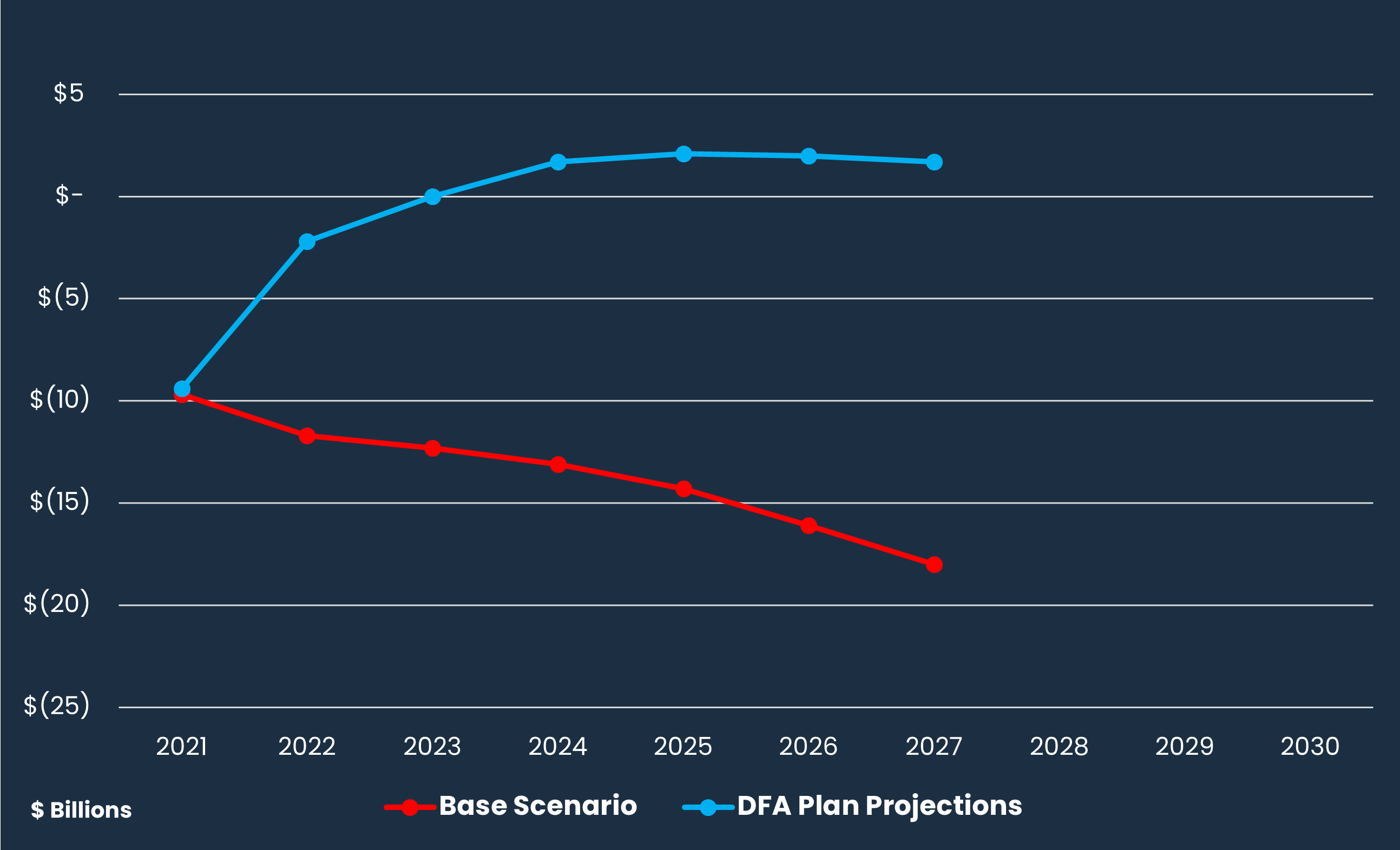

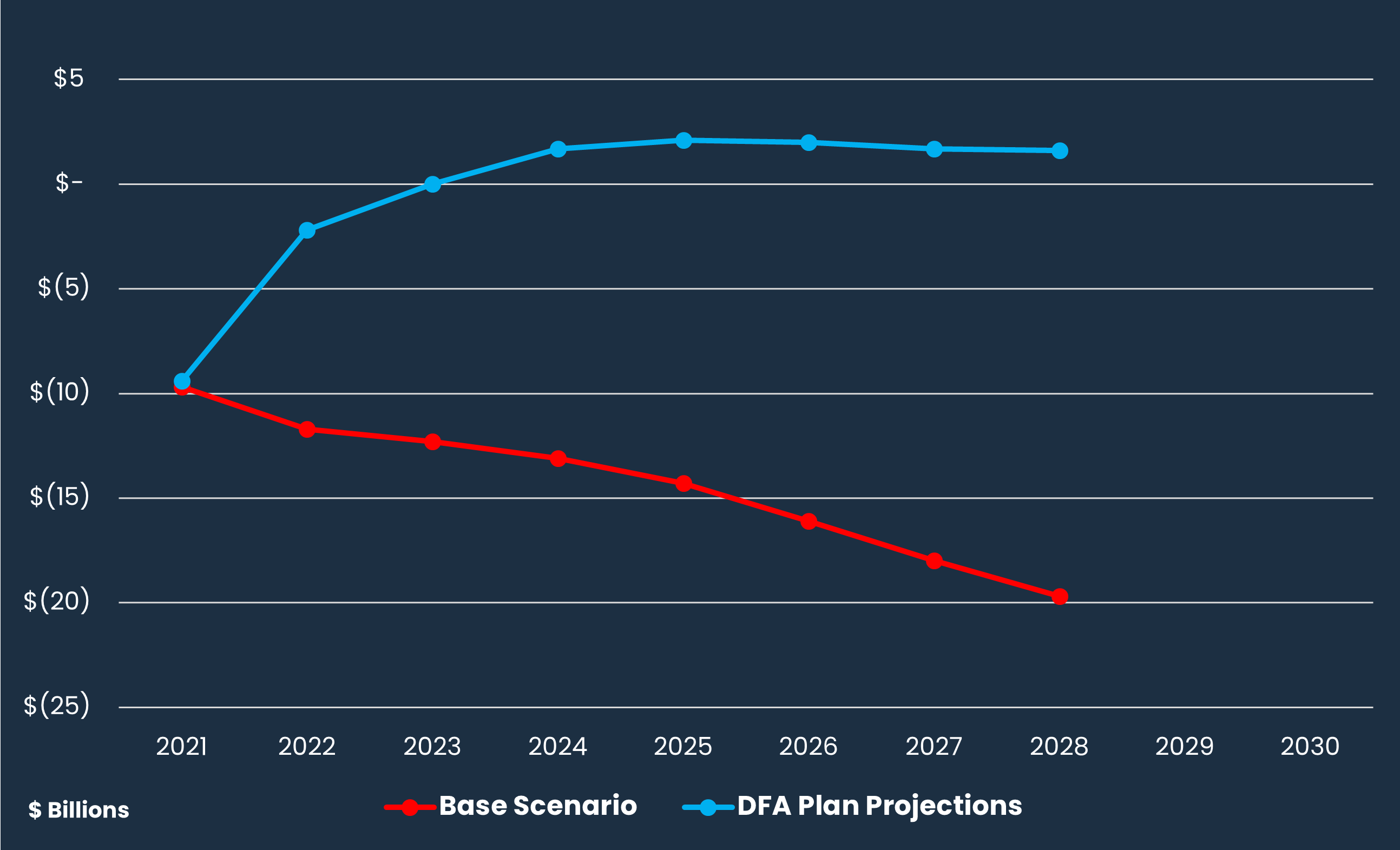

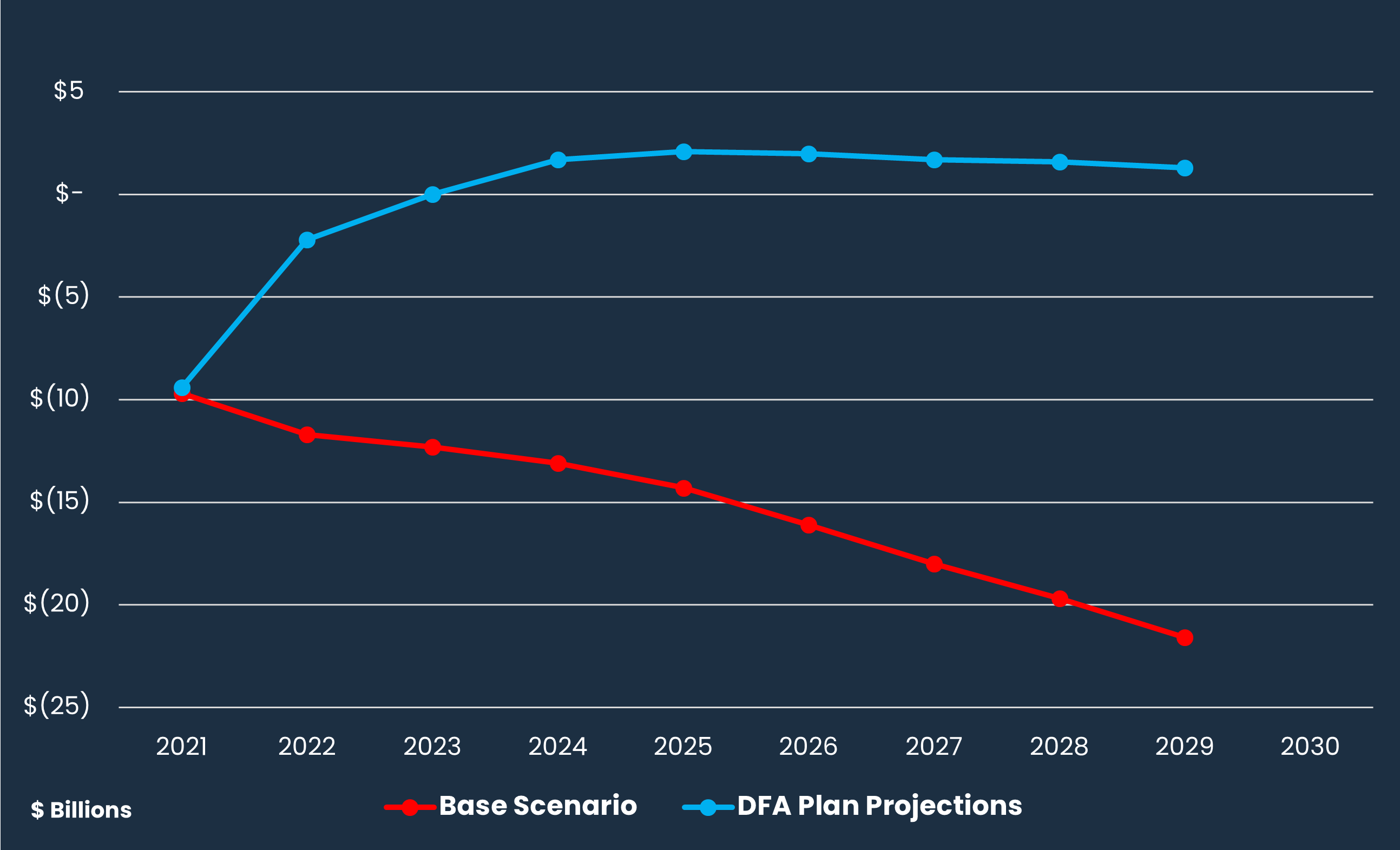

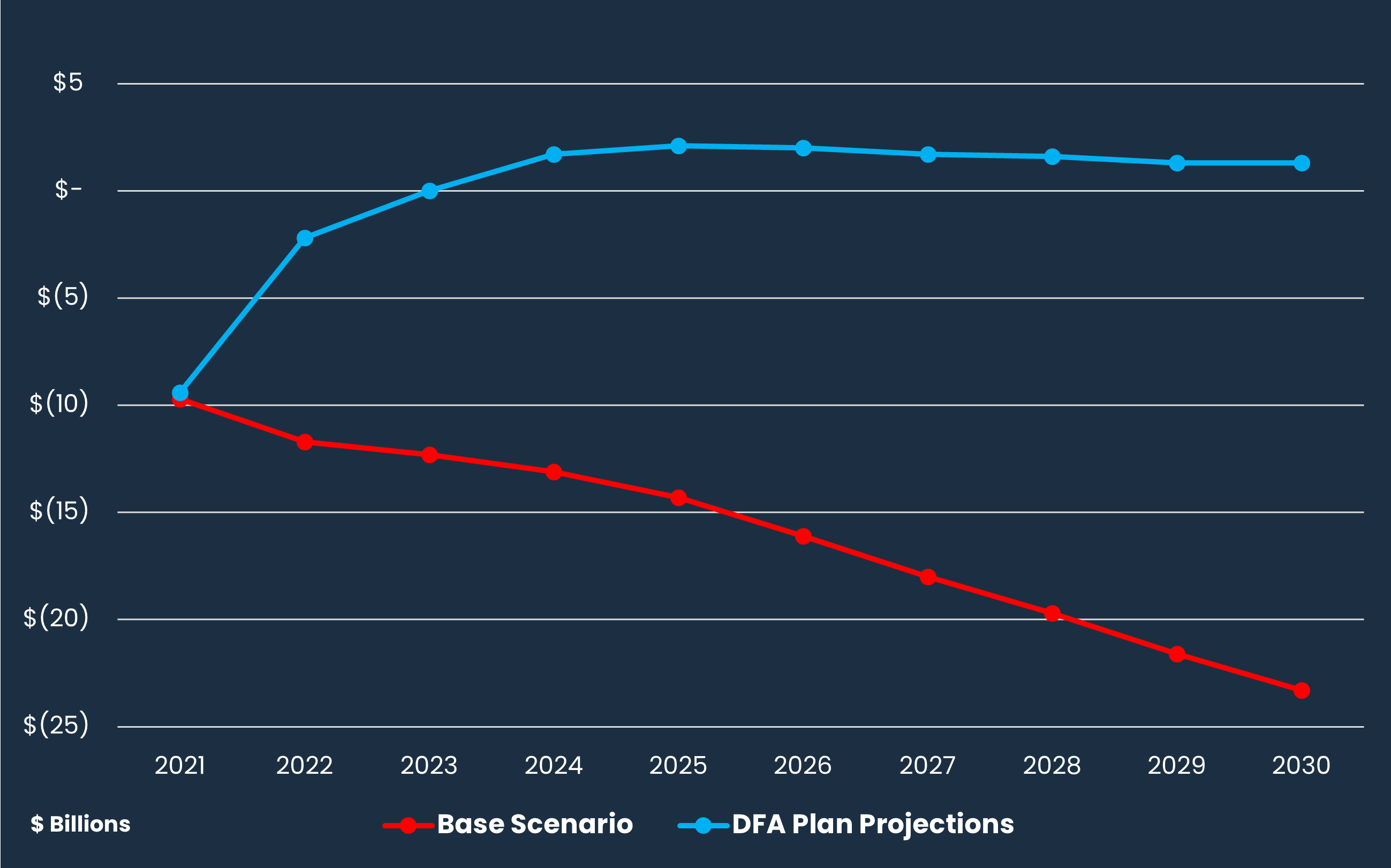

The Postal Service outlined two future scenarios with projected financial results and cash balances.

In the base scenario, USPS does not take certain corrective actions.

In the DFA plan scenario, USPS includes the impact of planned DFA initiatives to reduce losses by $160 billion over 10 years.

DFA initiatives fall into four categories:

• $24 billion in revenue improvements, such as competitive products and pricing changes;

• $34 billion in management cost savings, such as mail processing changes;

• $44 billion in regulatory changes, such as pricing flexibility for market dominant products; and

• $58 billion in legislative and administrative actions, such as the CSRS funding reform.

What We Found

The DFA was developed during the COVID-19 pandemic — a time of considerable uncertainty — and conditions have evolved significantly since March 2021.

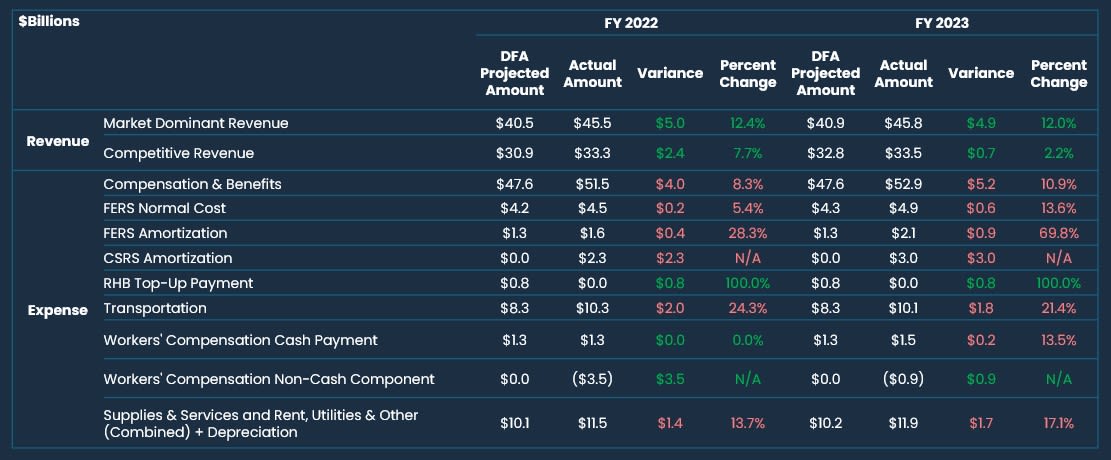

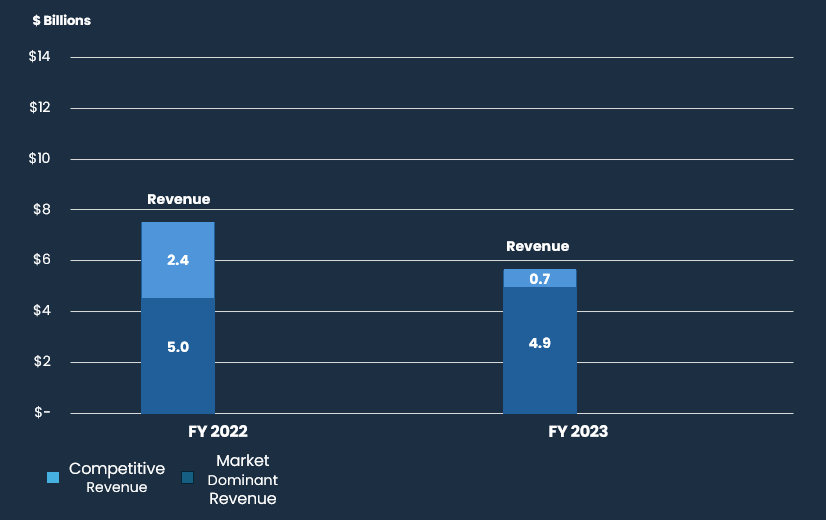

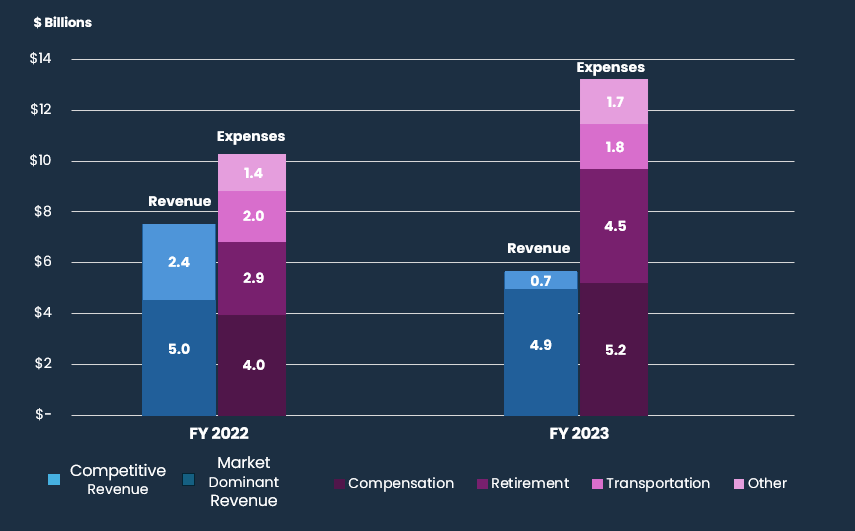

We reviewed actual results compared to projections for FYs 2022 and 2023.

Actual revenue was higher than projections by $7.4 billion and $5.6 billion, but actual expenses also exceeded expense projections by $6 billion and $11.7 billion, respectively.

For each Profit & Loss Line, we found the following variances:

Overall, in both years, actual expenses exceeded actual revenue.

The DFA projections are no longer relevant and the opportunity exists to revise projections.

Causes for the Variances

The Postal Service provided,

- Actual mail volume was higher than projected in the DFA, which led to higher expenses to process that volume.

- Inflation was higher than projected.

- Progress on initiatives was slower than planned.

We generally concurred, however, we also identified,

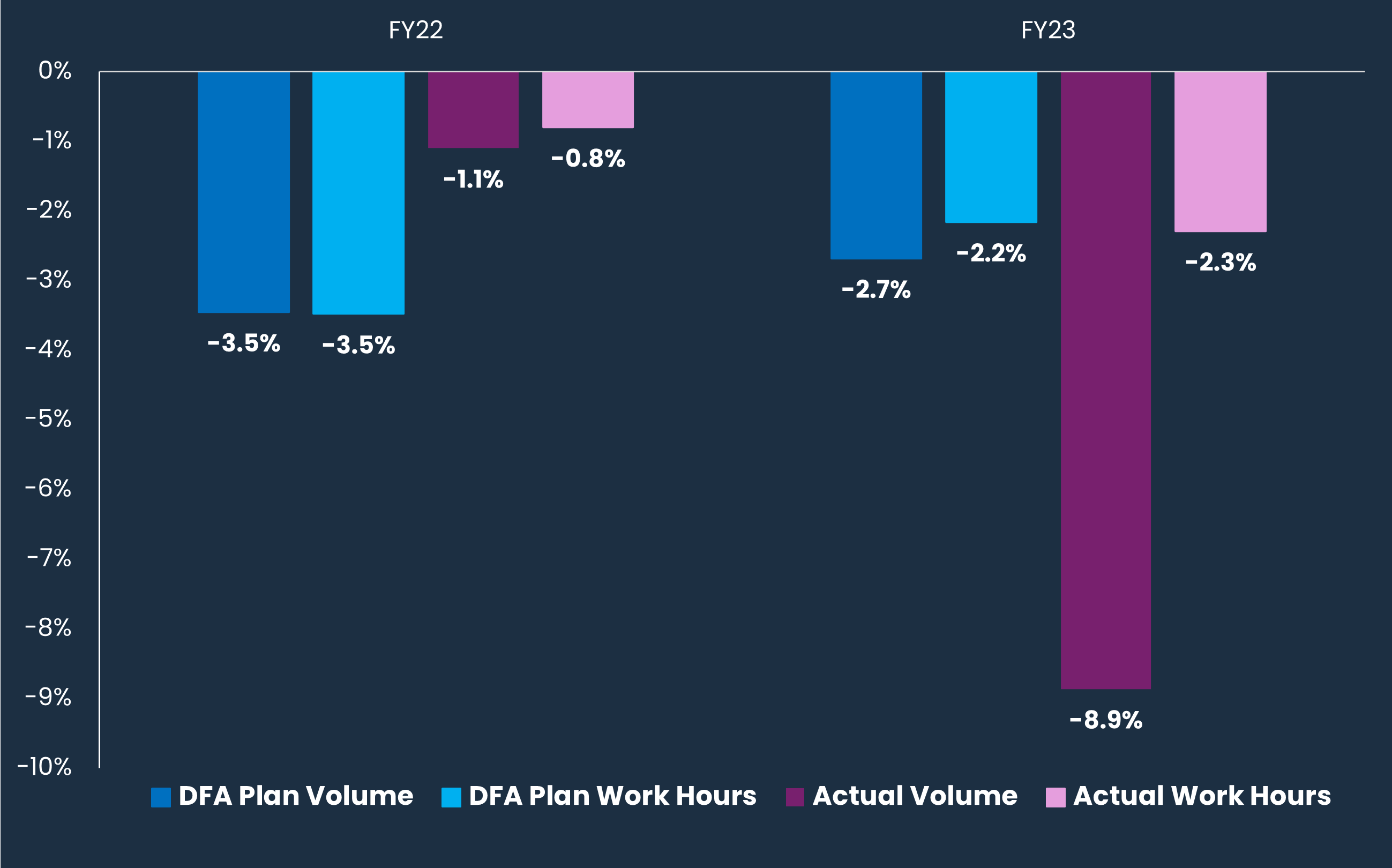

- Work hours reductions did not align with volume declines when comparing the rates of change between the FYs.

- Initiatives’ progress could not be determined because specific initiative progress was not tracked back to the projected savings calculated in the DFA plan projections.

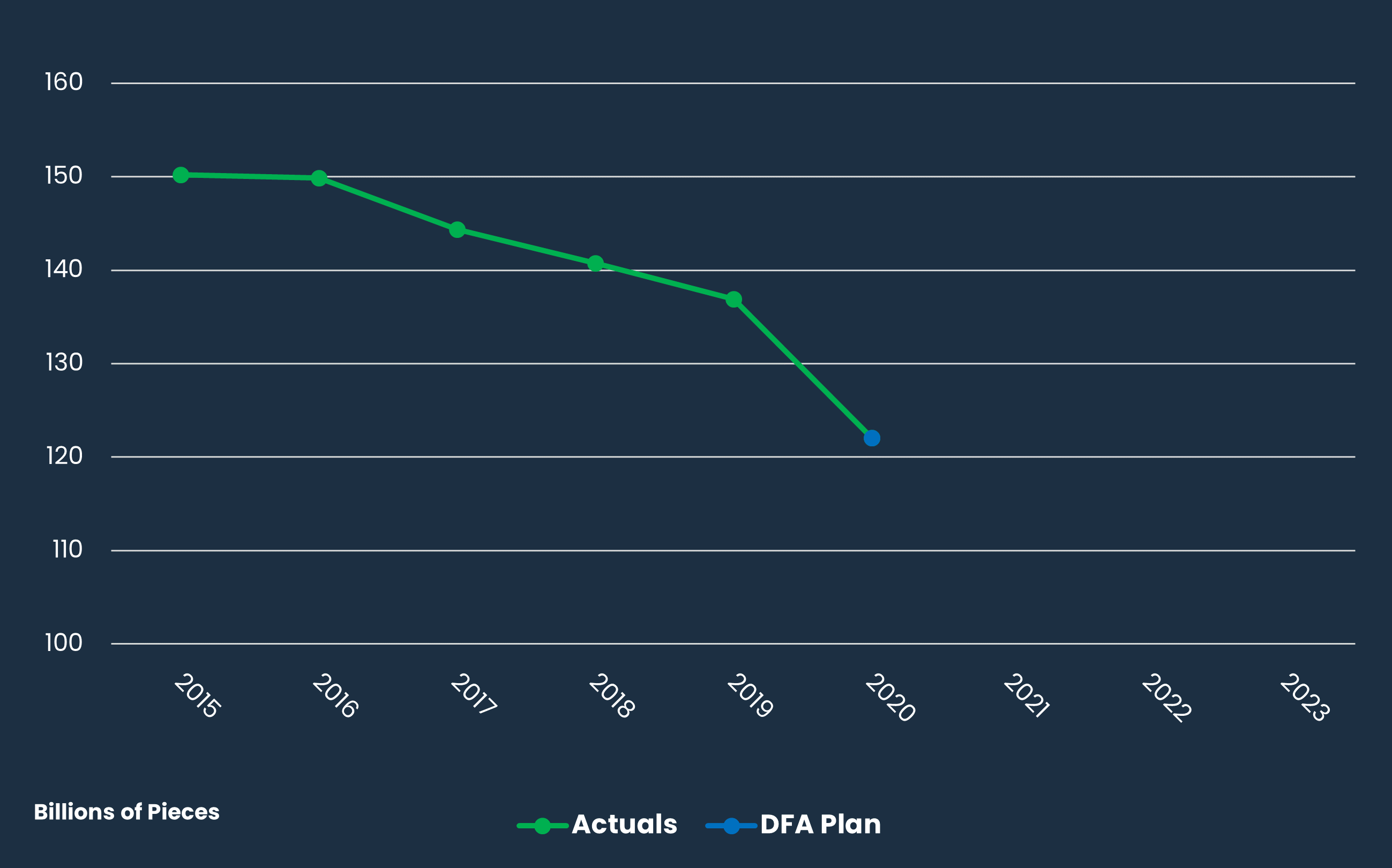

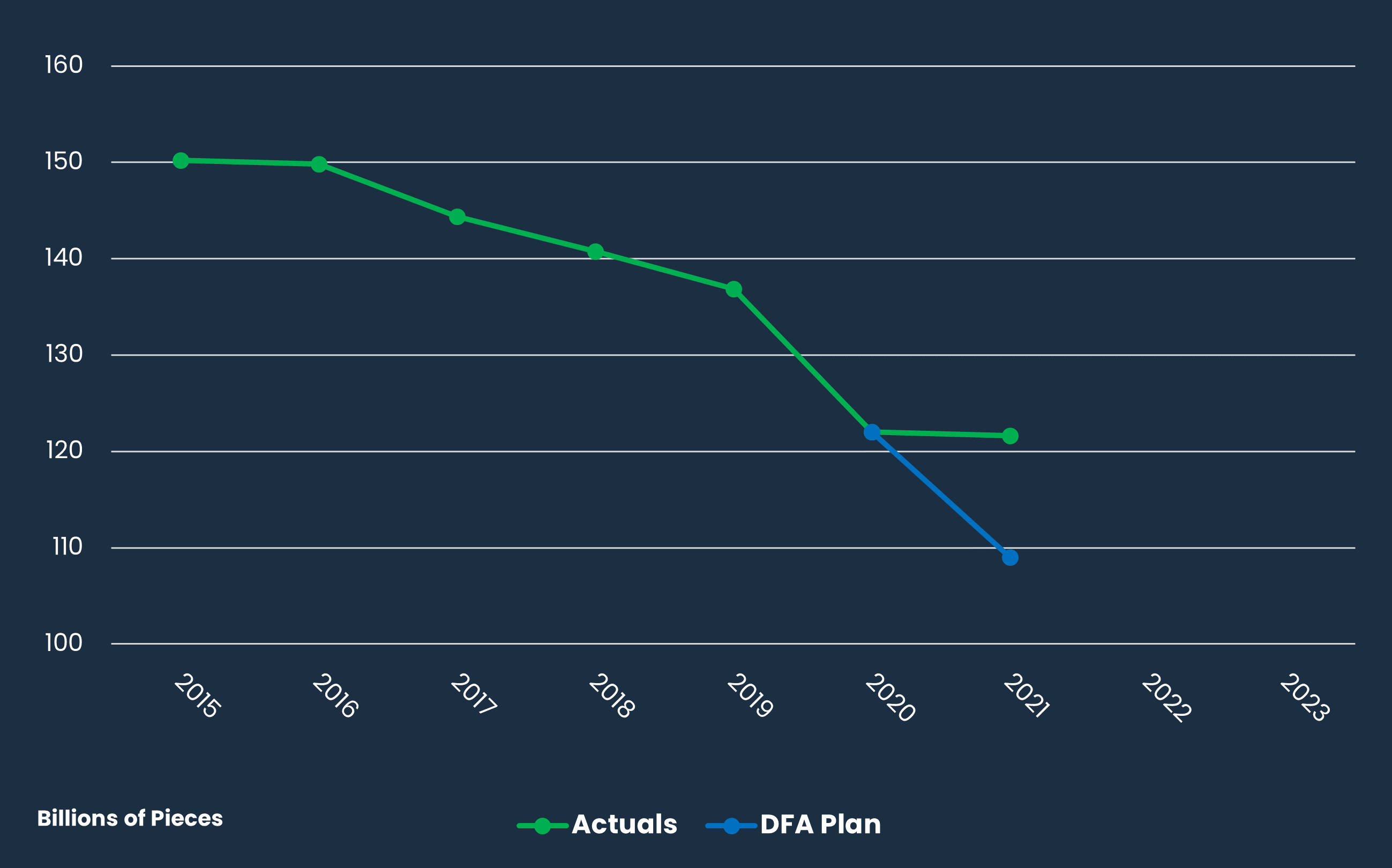

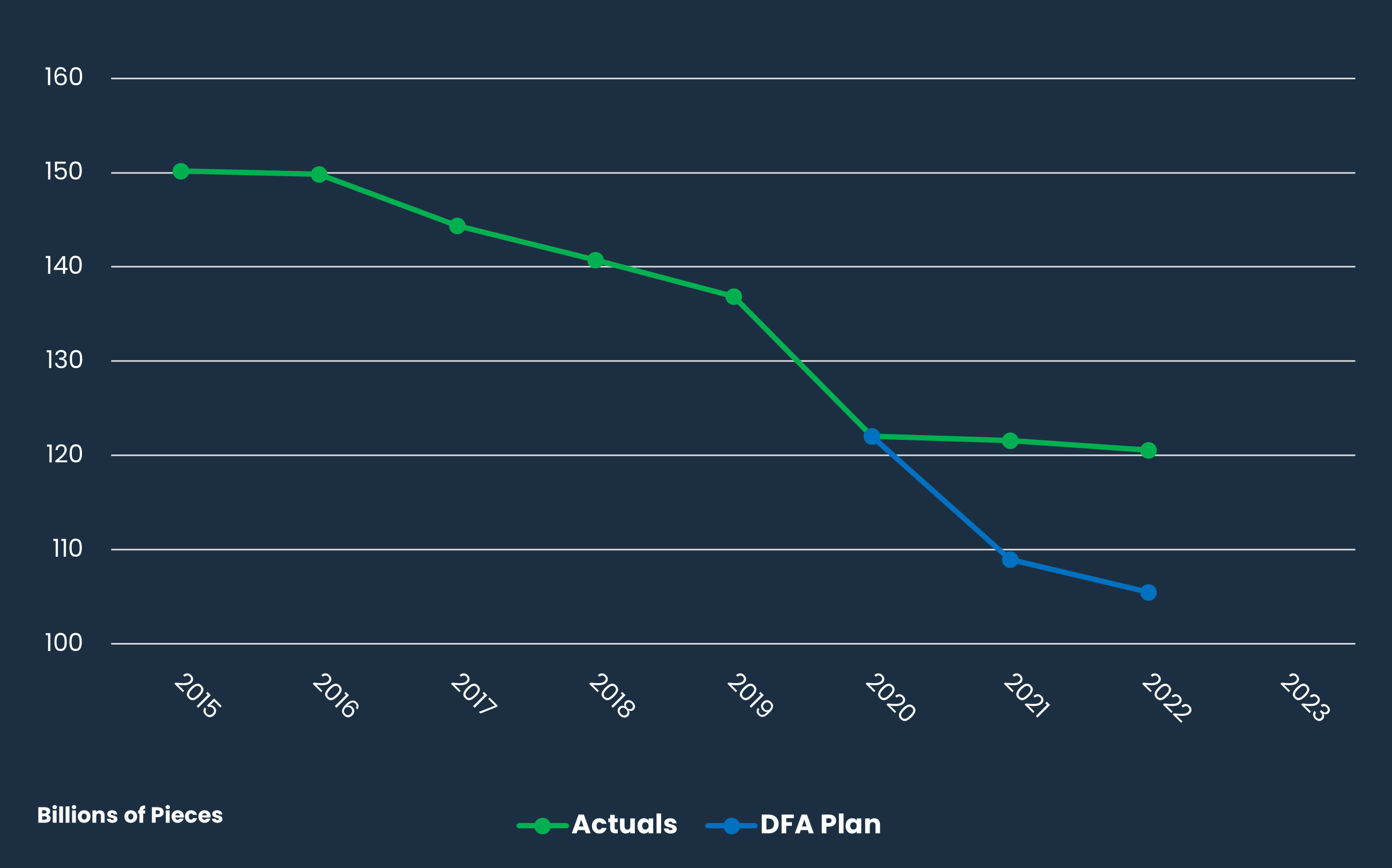

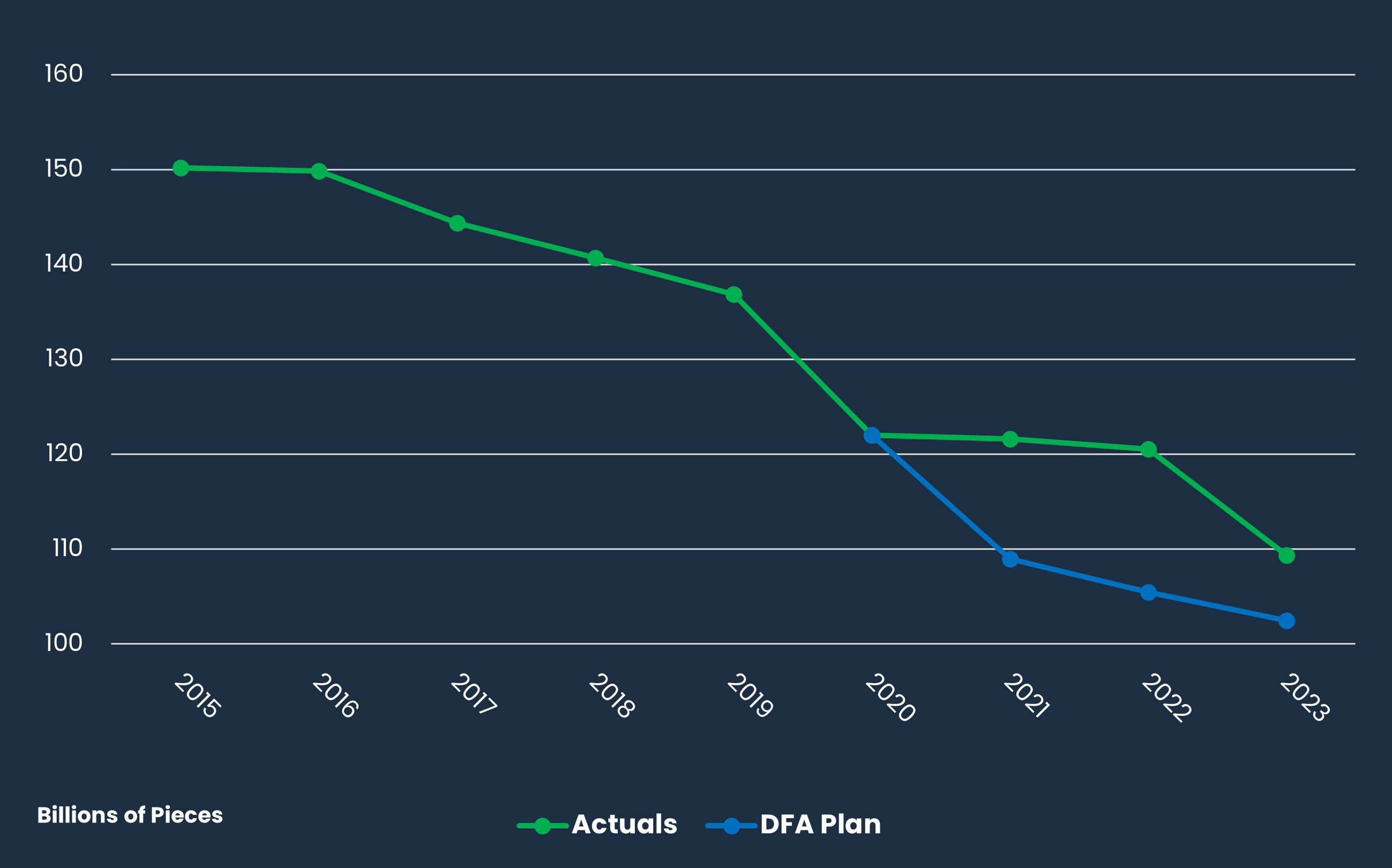

Declining Volume

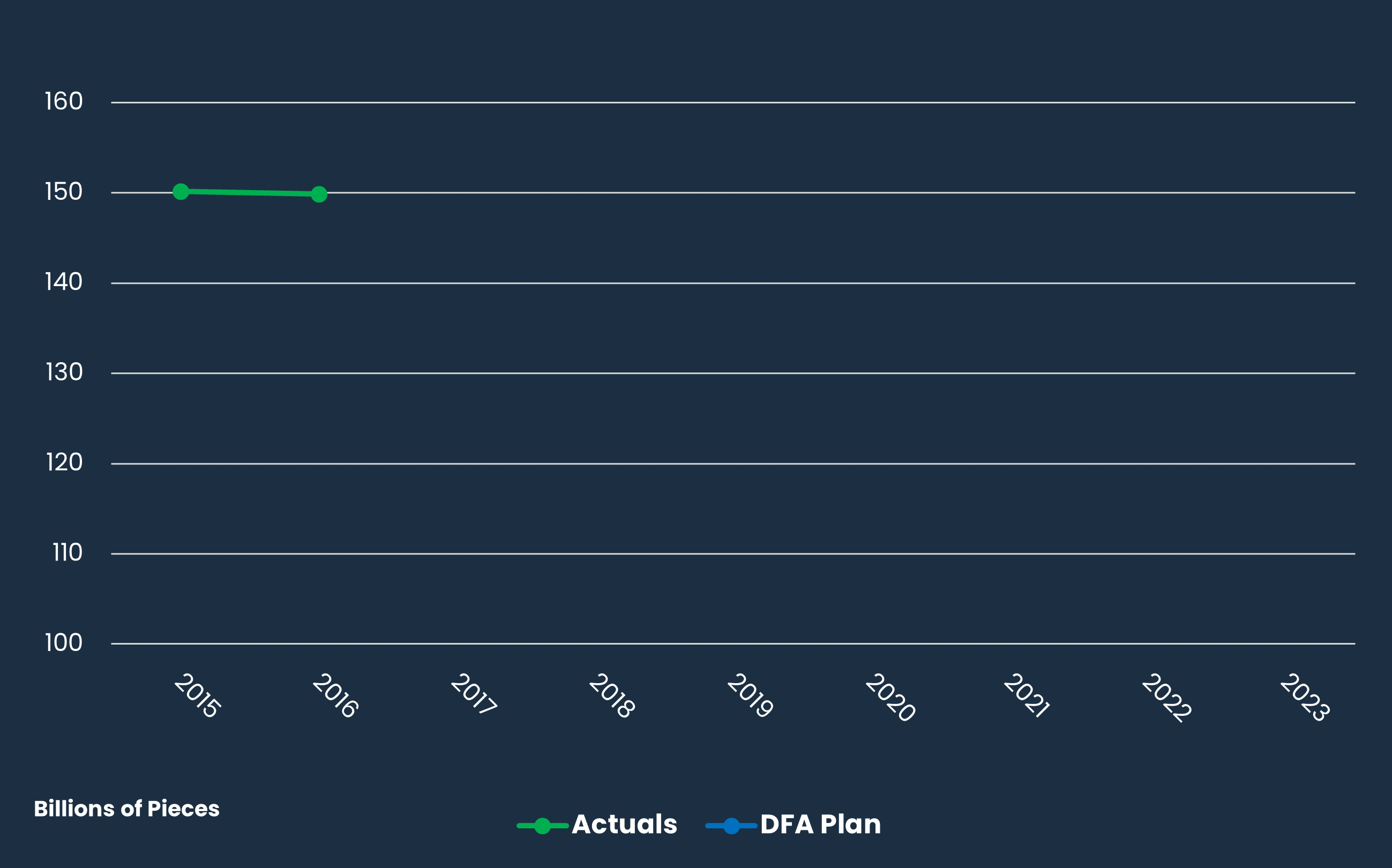

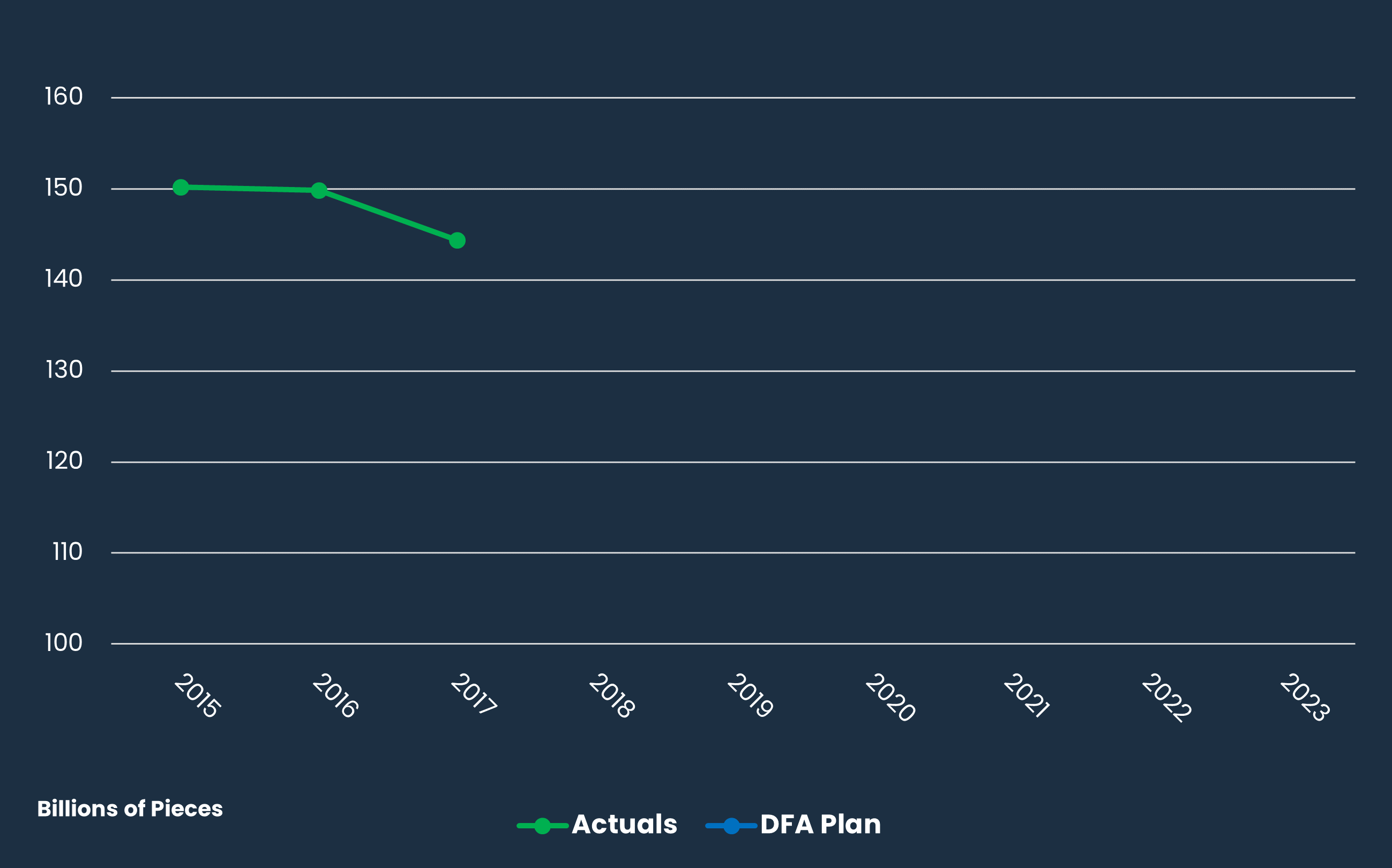

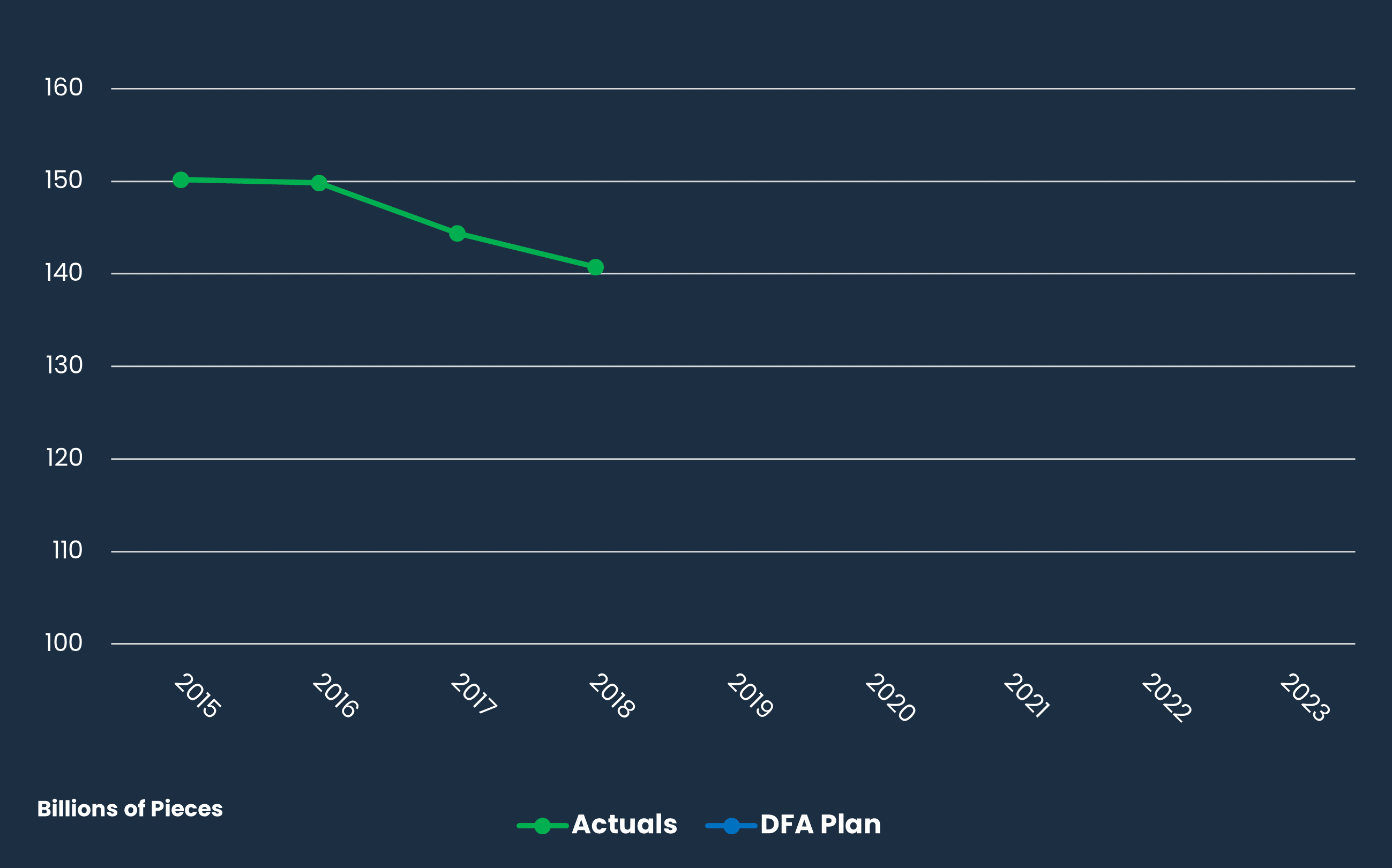

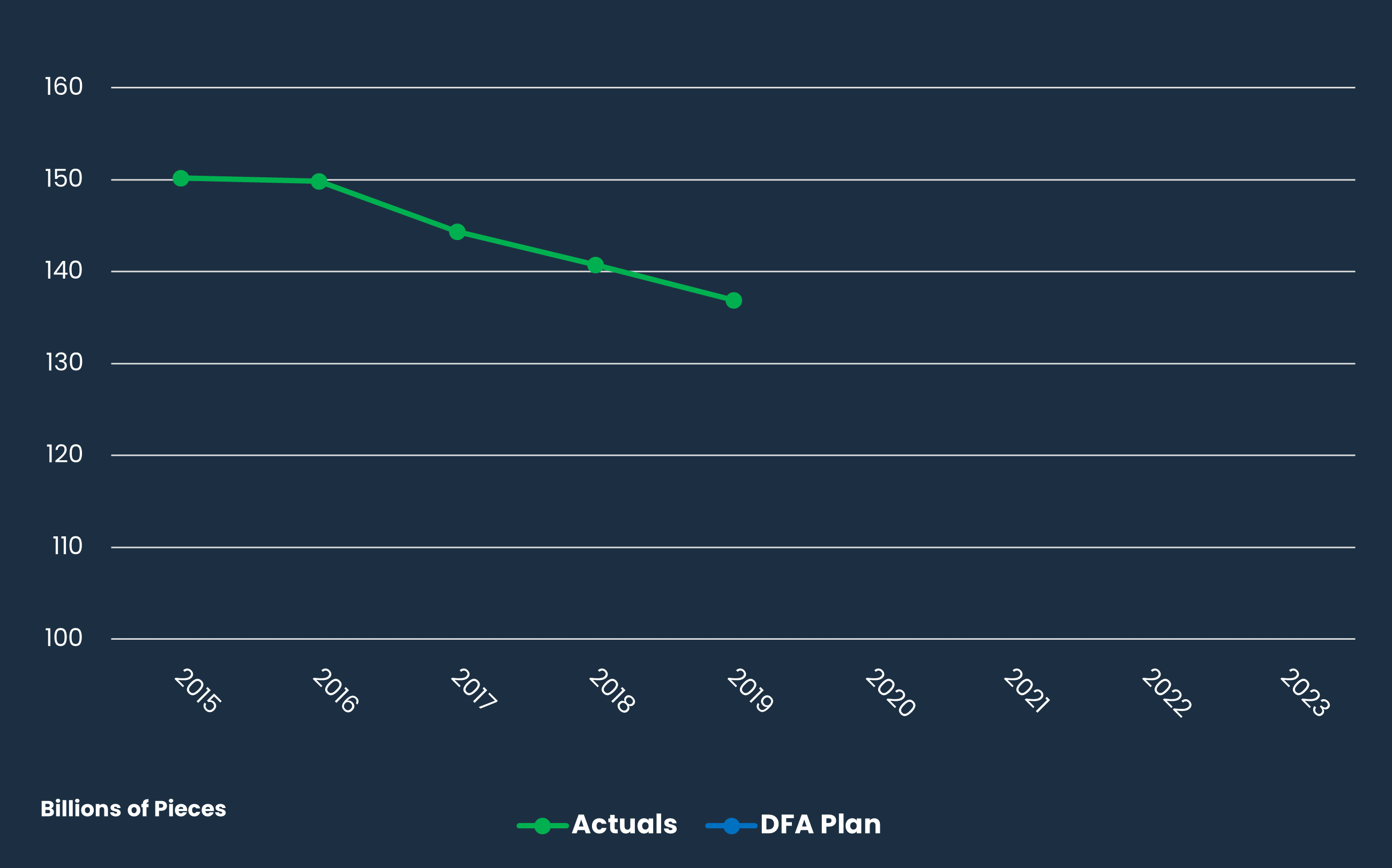

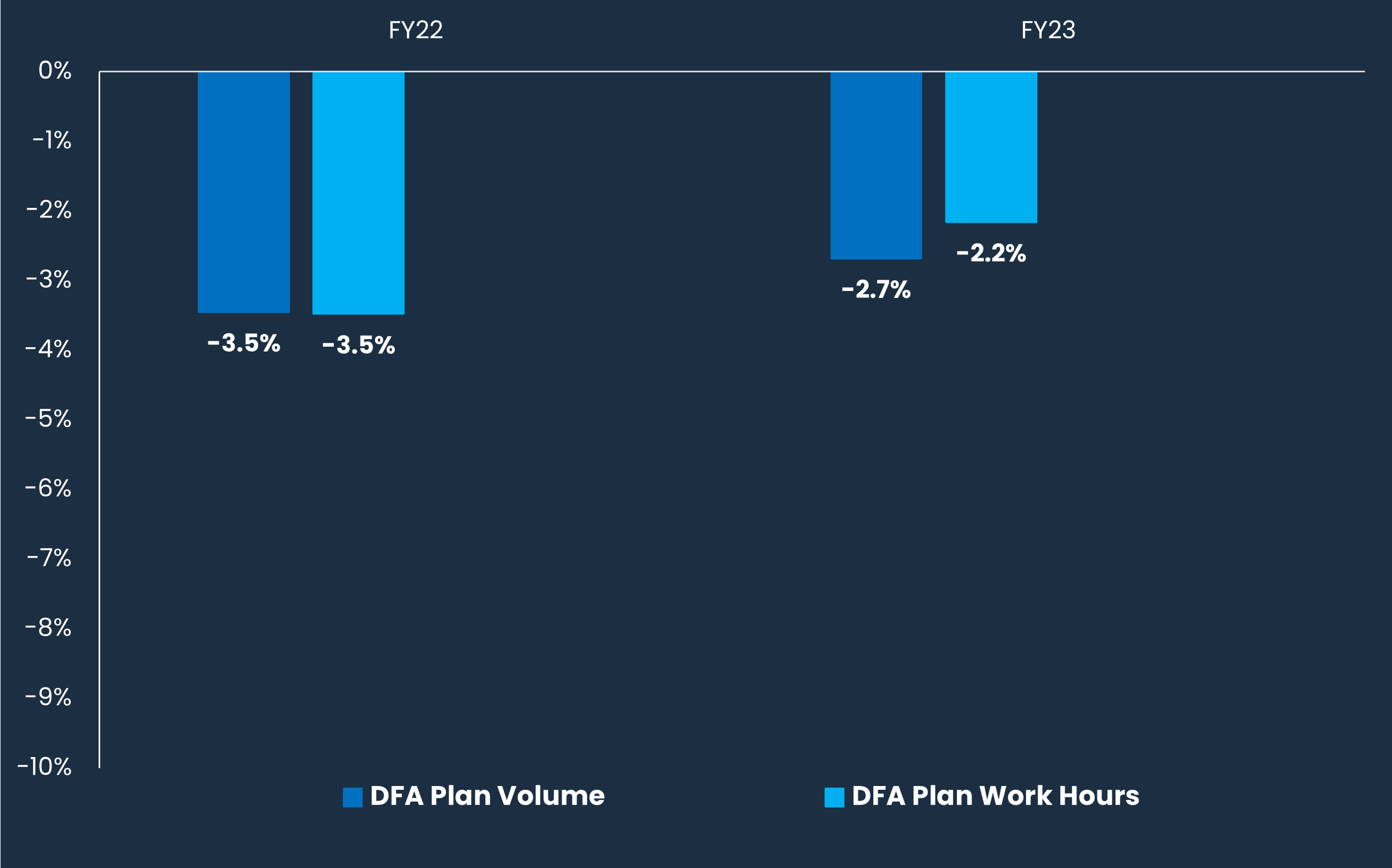

The existing trend in the decline in mail led USPS to project further decreases in volume in its DFA.

USPS planned in the DFA for mail volume to significantly drop in FYs 2021, 2022, and 2023 due to economic uncertainty caused by the COVID-19 pandemic.

However, the economy rebounded from the COVID-19 pandemic and mail did not decrease as significantly as projected in the DFA.

Aligning Work Hours with Volume

Yet, USPS built its projections on the assumption that a decrease in volume would result in a comparable decrease in work hours.

We identified that actual work hours did not decrease at the same rate as volume, signaling a reduction in work hour productivity.

This is consistent with what USPS communicated in its 2023 Report to Congress regarding labor productivity.

Inflation

During FYs 2022 and 2023, the United States experienced one of the highest levels of inflation since the 1980s and much higher than USPS projected in the DFA for revenue and expenses.

Higher Revenue: The higher-than-expected inflation positively affected revenue because market dominant products are subject to a price cap system that is linked to the Consumer Price Index for All Urban Consumers (CPI -U), which is the most widely cited measure of inflation.

See percentage increase projected in the DFA plan compared to actual CPI increase.

|

Fiscal Year |

CPI Percent Increase Projected in the DFA Plan |

Actual CPI Percentage Increase |

|

2022 |

1.0% |

1.2% |

|

5.1% |

||

|

2023 |

2.4% |

4.2% |

|

3.4% |

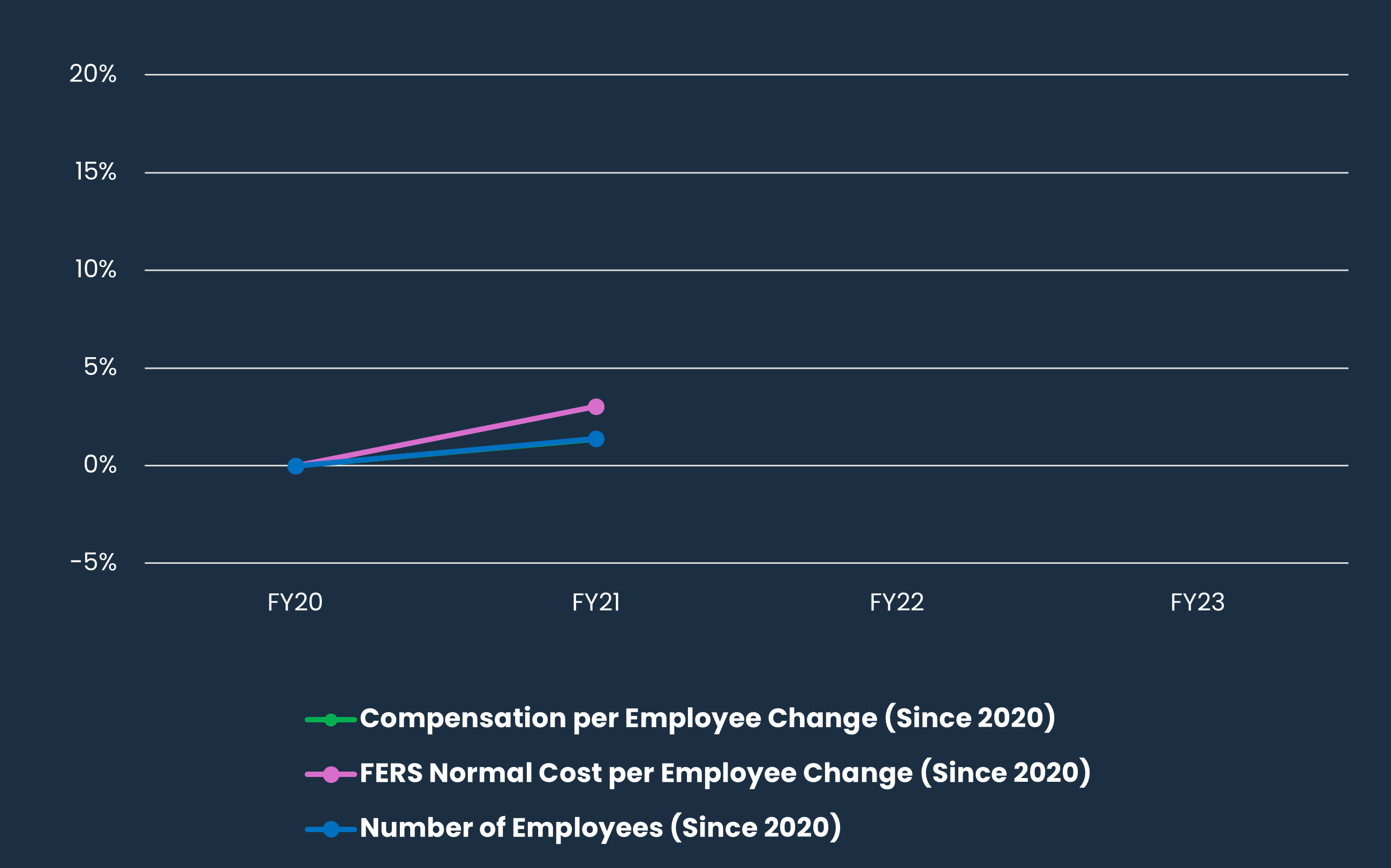

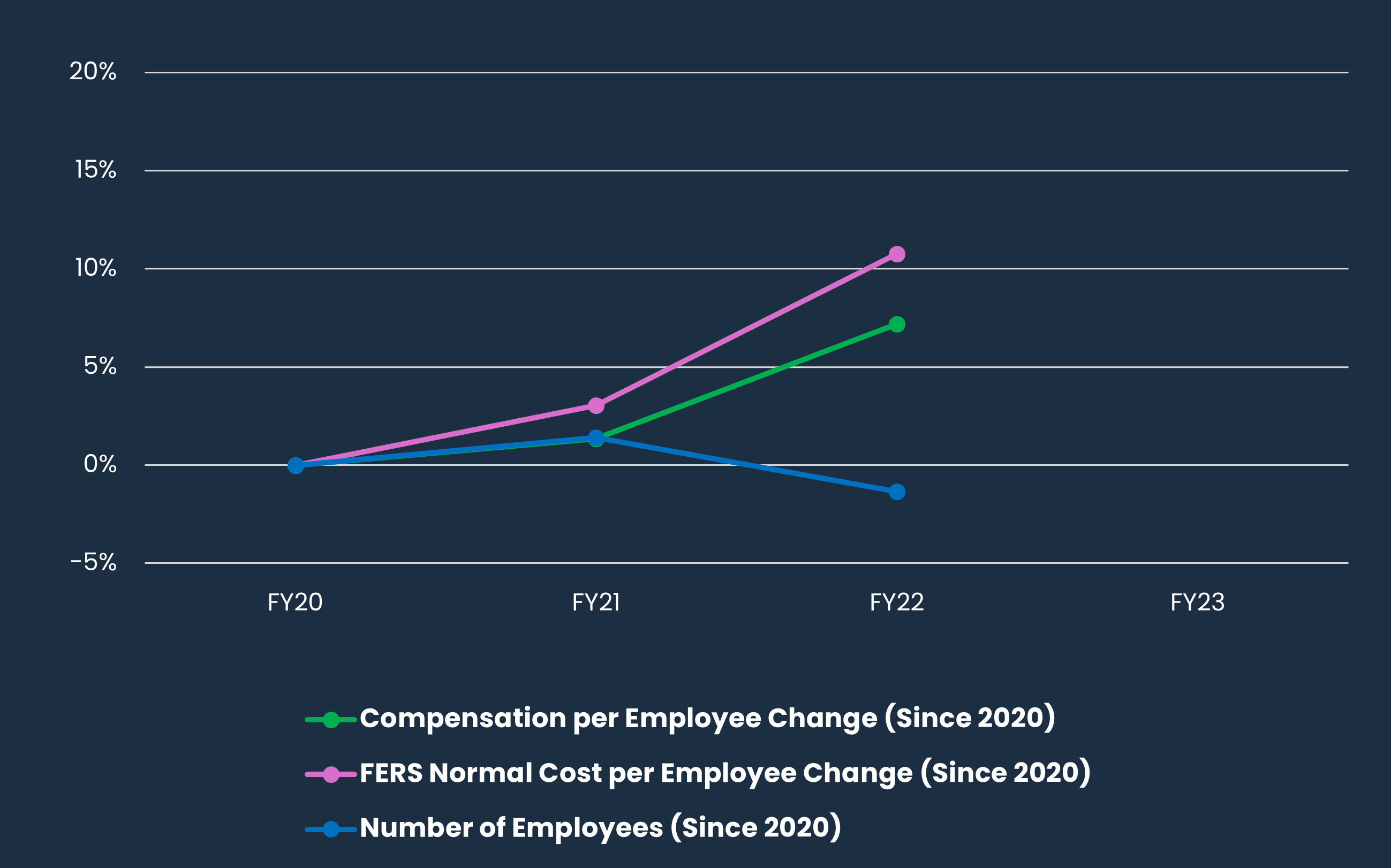

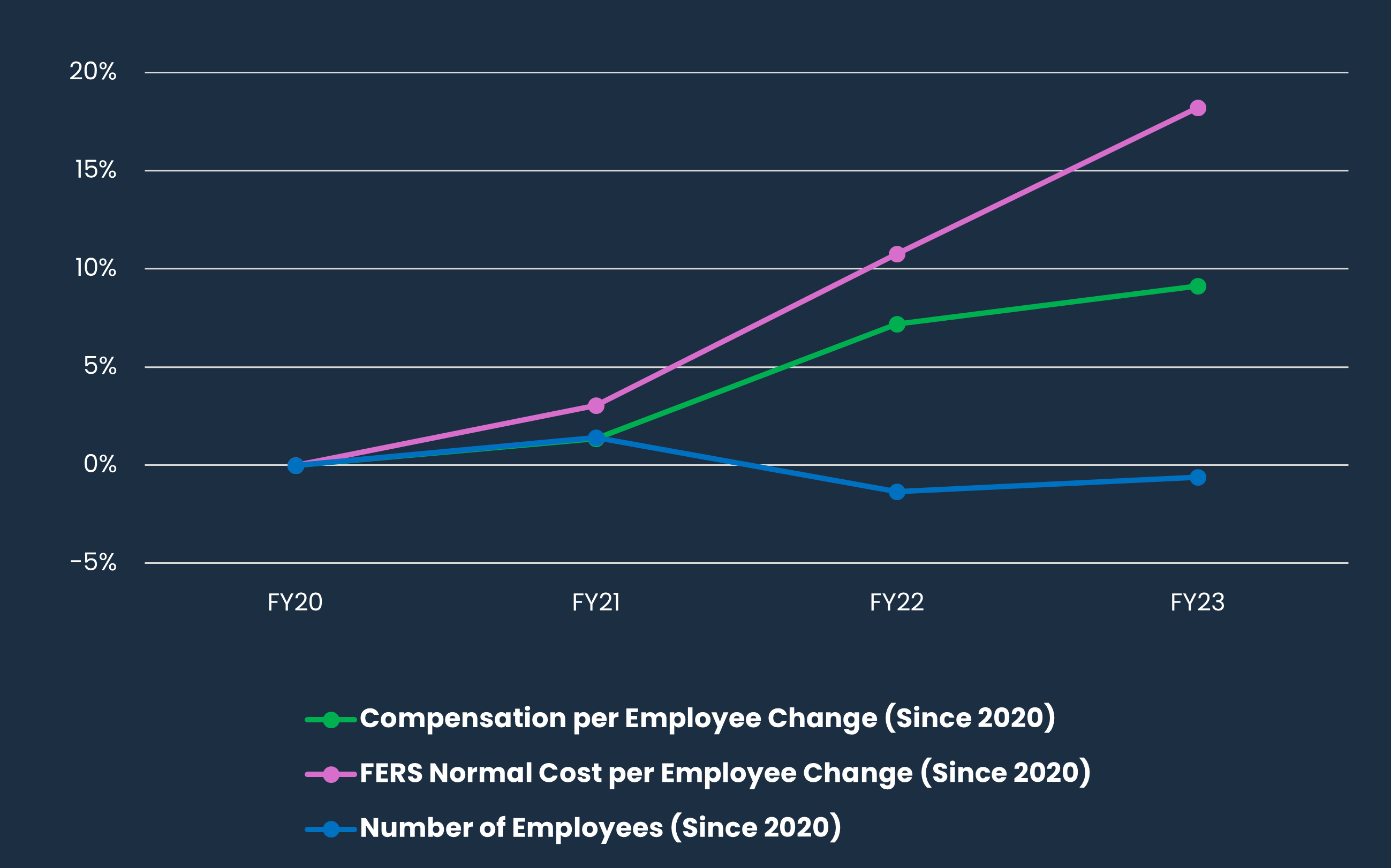

Higher Expenses: Inflation also impacted USPS expenses and was most acute in the compensation and retirement expense categories.

The compensation expense and FERS normal cost expense per employee were dramatically higher, primarily due to the contractual cost-of-living adjustments for approximately 525,000 employees.

• 9.1 percent increase for the compensation expenses.

• 18.2 percent increase for the FERS normal cost expenses.

Initiatives

Postal Service management acknowledged slower than planned progress on the initiatives led to the variances between actuals and projections. We could not determine the outcome of the initiatives because the USPS did not track the progress back to DFA projections.

Instead, the USPS tracks its DFA initiatives to its annual Integrated Financial Plan (IFP), which provides projections and targets for the next fiscal year.

In FY 2023, the IFP was aligned to the strategic objectives of the DFA but not DFA projections.

Communications Regarding Initiative Progress

We reviewed the USPS communications from FYs 2022 and 2023 to determine how the initiatives were measured and tracked. We found that only select initiatives were discussed in the various communications and no financial updates on the active initiatives were reported.

Recommendations

We recommended the Postal Service 1) update and communicate Delivering for America plan financial projections based on current conditions and environment and 2) develop a plan to track, measure, and communicate progress on initiatives that result from the DFA.

Postal Service Response

Management agreed with recommendation 1, generally agreed with recommendation 2, and generally agreed with our finding about the DFA and its projections but believes while current DFA projections are no longer relevant to the current environment, they are still relevant as management reassesses projections.

USPS has a goal to develop and release an updated DFA plan by the end of this fiscal year.

Management will articulate a plan as to how it tracks, measures, and communicates progress on DFA initiatives, as it already has a system to track initiatives tied to each year’s IFP. Management also stated it cannot entirely predict the future financial, legislative, and operational conditions, so therefore, it is important the DFA be a living plan.

Looking Forward

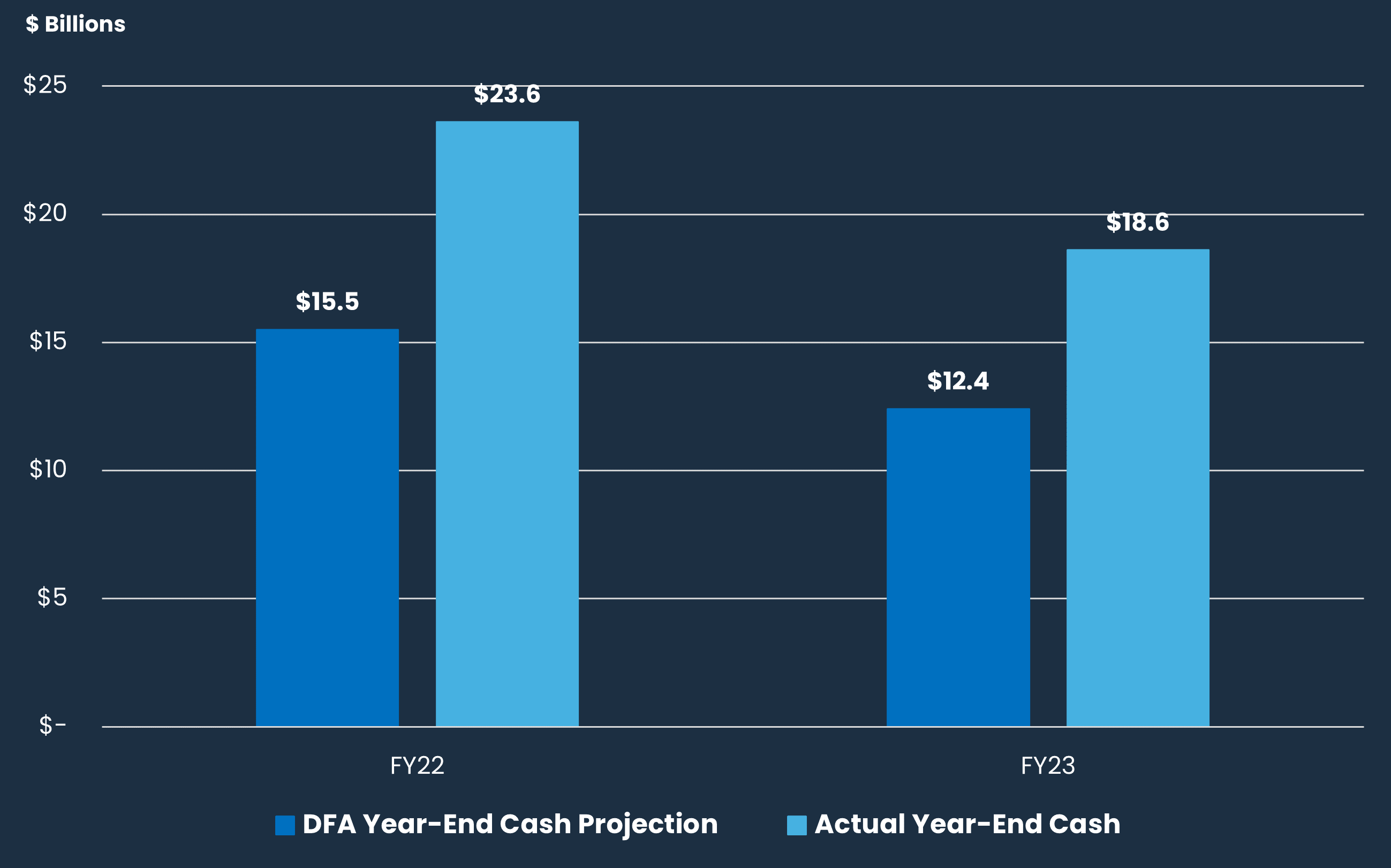

The Postal Service ended both FYs 2022 and 2023 with more cash than projected due to higher cash generated from operating activities.

Capital Investments: As of the end of FY 2023, the USPS has spent $6.7 billion and committed $12.4 billion out of the $40 billion planned to be spent in the DFA.

Retirement Funds: USPS has not paid $13.7 billion in outstanding liabilities to CSRS or $8.8 billion to FERS.

Retiree Health: The Retiree Health Benefit Fund is currently paying retiree premiums. This will continue until the fund is exhausted, which is projected to happen in FY 2031. Then the USPS will return to a pay-as-you-go methodology.

Legal Constraints: USPS cannot diversify its investments into assets that may see higher rates of return than U.S. Treasury bonds, which would help mitigate the impacts of inflation over the long term.

These current and upcoming obligations put further pressure on USPS to achieve financial stability and maintain the liquidity needed to finish its planned $40 billion in DFA capital spending. USPS needs to be transparent with future years’ projections and plan initiatives, so stakeholders can understand goals and progress made.

Contact Us

For media inquiries, please email press@uspsoig.gov.