The Financial History of the U.S. Postal Service

Congress established the Postal Service as an independent federal agency to give it the management flexibility of a private enterprise while operating as a public sector entity and maintaining the civil service status of its employees. Different from other federal entities, the Postal Service is structured to be self-funded and relies almost entirely on the cash generated from the sale of products and services, interest income, and borrowing from the Federal Financing Bank to continue operations and fund employee retirement obligations.

We examined the historical events, legislative enactments, and operational performance that have shaped the Postal Service’s financial results over the last two and a half decades, separated into the following timeframes.

Evolving Economic Landscape and Digital Disruption

FYs 2000-2006

The Postal Accountability and Enhancement Act, the Great Recession, and Mail Volume Declines

FYs 2007-2010

Unmet Retirement Obligations and Accumulating Losses

FYs 2011-2019

The Impact of COVID-19 and the Delivering for America Plan

FYs 2020-2024

2000-2006

Evolving Economic Landscape and Digital Disruption

Evolving Economic Landscape

Throughout the 1990s, the Postal Service’s profitability fluctuated. In the early 2000s, the Postal Service experienced the Dot-com economic crisis, the September 11 terrorist attacks, and the anthrax by mail contamination.

During this time, the Government Accountability Office placed the Postal Service on its list of High-Risk Programs. The Postal Service was $11B in debt, paying retiree healthcare costs under a "pay-as-you-go” method, and the accounting used by the Office of Personnel Management to compute its Civil Service Retirement System (CSRS) retirement obligations was inaccurate, which put the obligation at risk of being overfunded.

In 2003, the Postal Civil Retirement System Funding Reform Act was passed, which reduced the Postal Service's CSRS contributions to prevent potential overfunding.

Digital Disruption

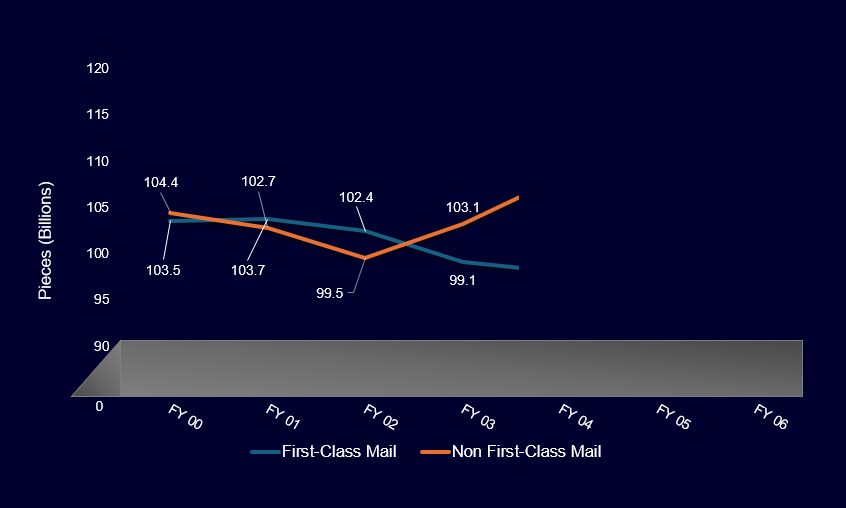

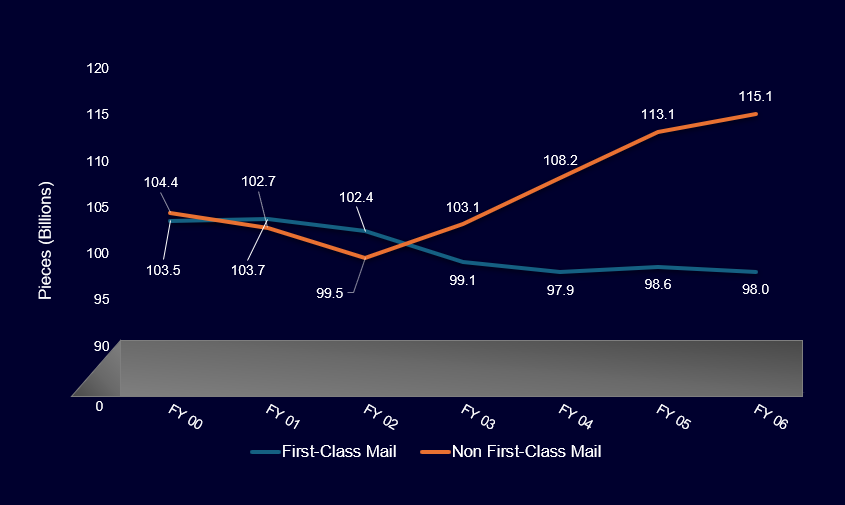

As total mail volume continued to grow for several years, First-Class Mail exhibited an opposite trend largely driven by the emergence and accessibility of email and online bill payment options. The diversion of physical mail to electronic alternatives gradually led to a decline in First-Class Mail, a key product that the Postal Service depended on to finance its network.

The First-Class Mail decline provides an early indication of the financial constraints the Postal Service is still dealing with today.

Revenue grew between FYs 2000 and 2006.

But, the Postal Service reported fluctuating profitability due to rising expenses.

In the later part of this period, net income began to decline due to First-Class Mail volume decline, coupled with expenses, such as employee pension costs, retiree health benefits, and fuel costs rising more rapidly than revenues.

Cash and debt exhibited improvements mainly due to the 2003 legislation redirecting CSRS savings to pay outstanding debt and build up an escrow cash account.

These results and the broader economic conditions, coupled with an inflexible postal rate-setting process led to legislative reform gaining steam after it had been under consideration since the 1990s.

2007-2010

The Postal Accountability and Enhancement Act, the Great Recession, and Mail Volume Declines

The Postal Accountability and Enhancement Act

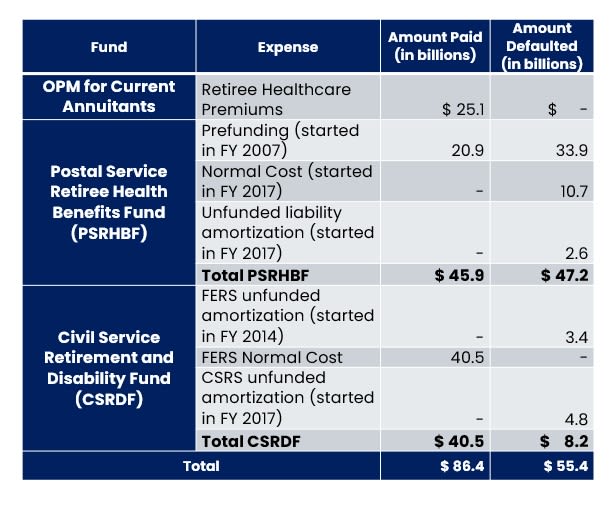

The Postal Accountability and Enhancement (PAEA) Act fundamentally reshaped the financial and operational landscape of the Postal Service. Among the most significant changes, the Act established the Postal Service Retiree Health Benefits Fund (PSRHBF), requiring the Postal Service to make 10 annual payments of roughly $5 billion to prefund the PSRHBF. A total of $20.9 billion was paid between FYs 2007 and 2010.

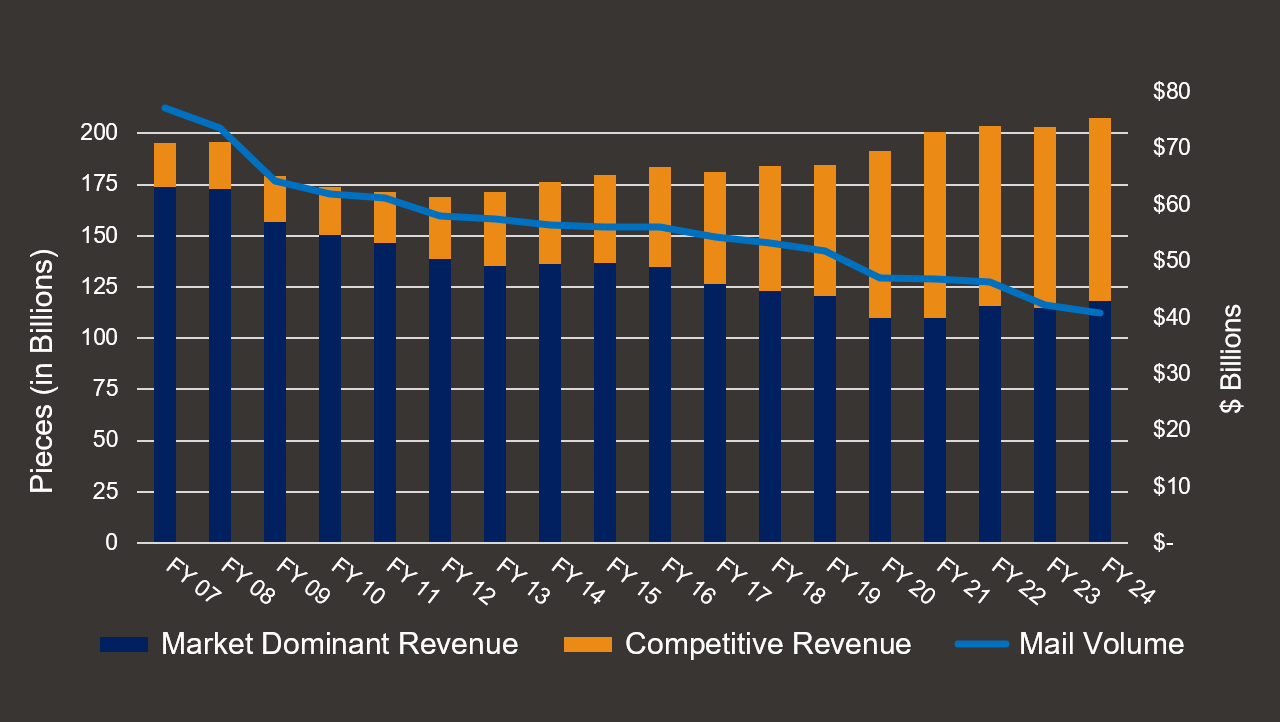

The second major change brought by PAEA was dividing Postal Service products into market dominant and competitive classes and then limiting the Postal Service's ability to raise prices on market dominant products by no more than increases in the Consumer Price Index for All Urban Consumers (CPI-U) for 10 years.

The Great Recession and Mail Volume Decline

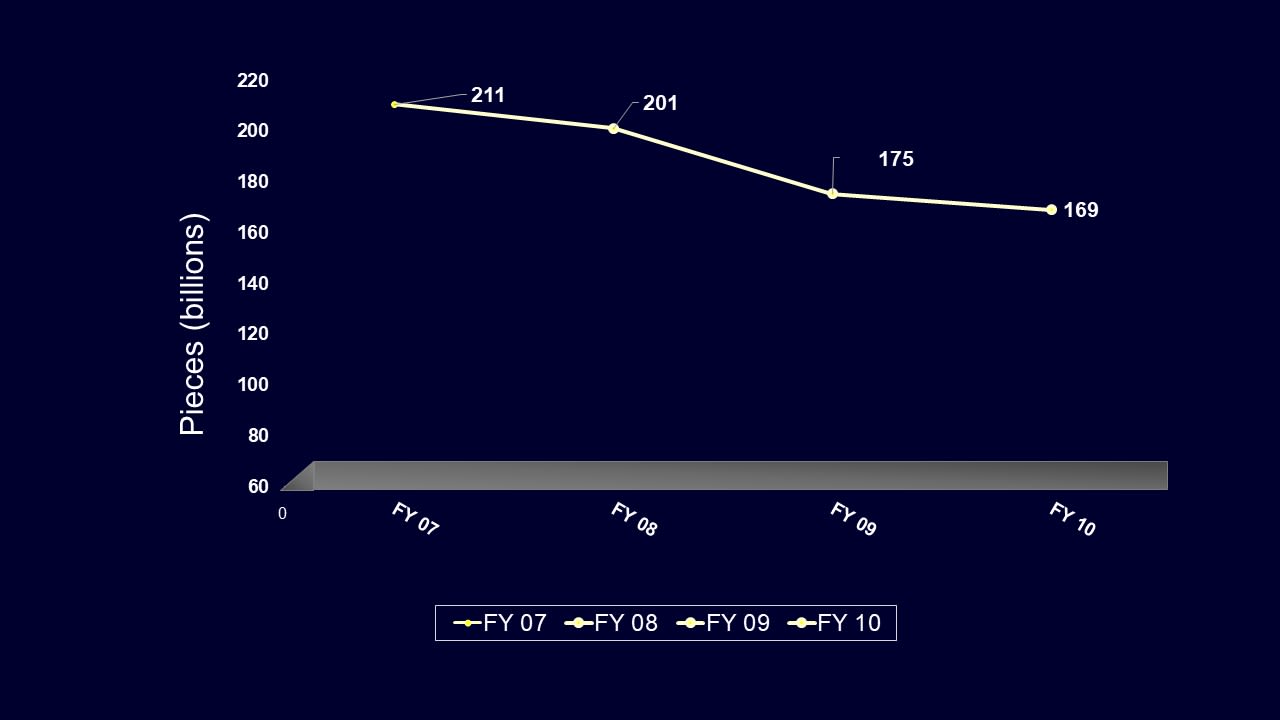

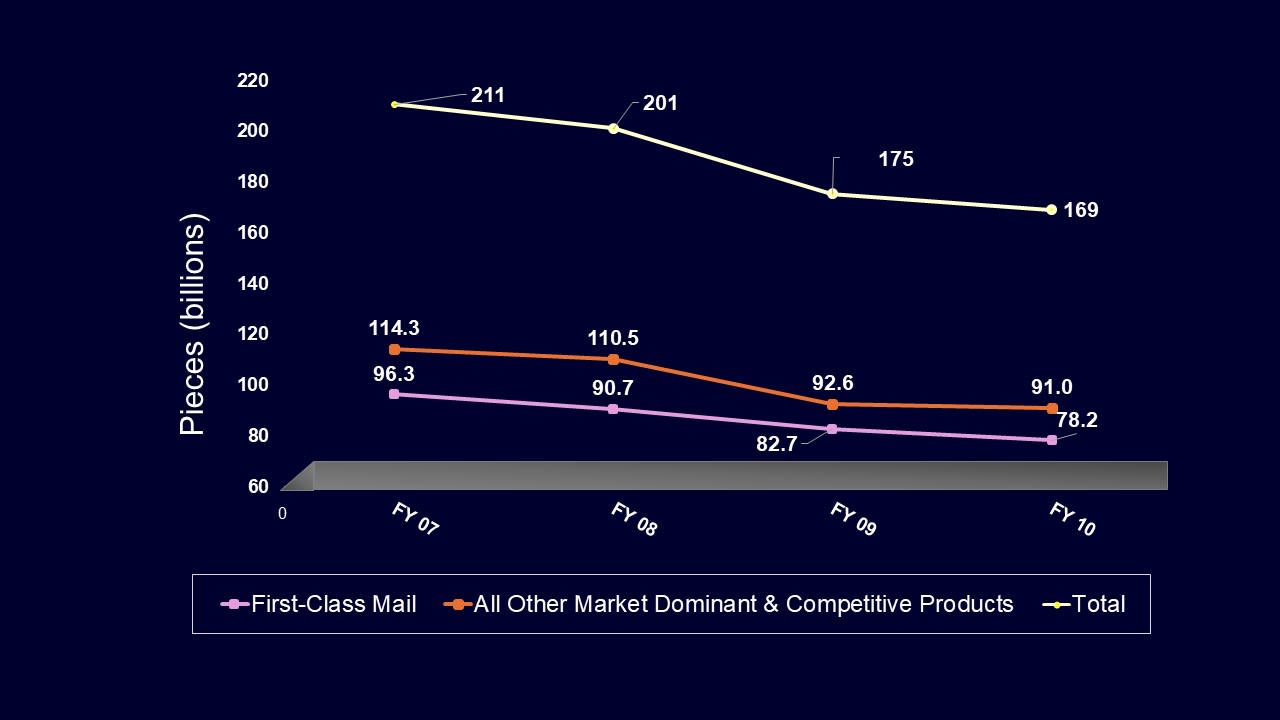

During the Great Recession, the Postal Service experienced a significant drop in mail, from 211 to 169 billion pieces.

First-Class Mail volume also dramatically fell, as cost-conscious businesses shifted their advertising to less expensive means, such as Marketing Mail and electronic platforms, including online bill payments.

In FY 2010, the Postal Service stated in its annual financial report that, “even when employment, consumer spending, and capital investment recover [following the Great Recession], the growing use of the internet and other electronic means of communication will continue to suppress First-Class Mail growth”; suggesting the shift online would have long-term effects.

To mitigate this decline and respond to the shift by U.S. consumers to increased online shopping, the Postal Service actively pursued attaining additional package volume.

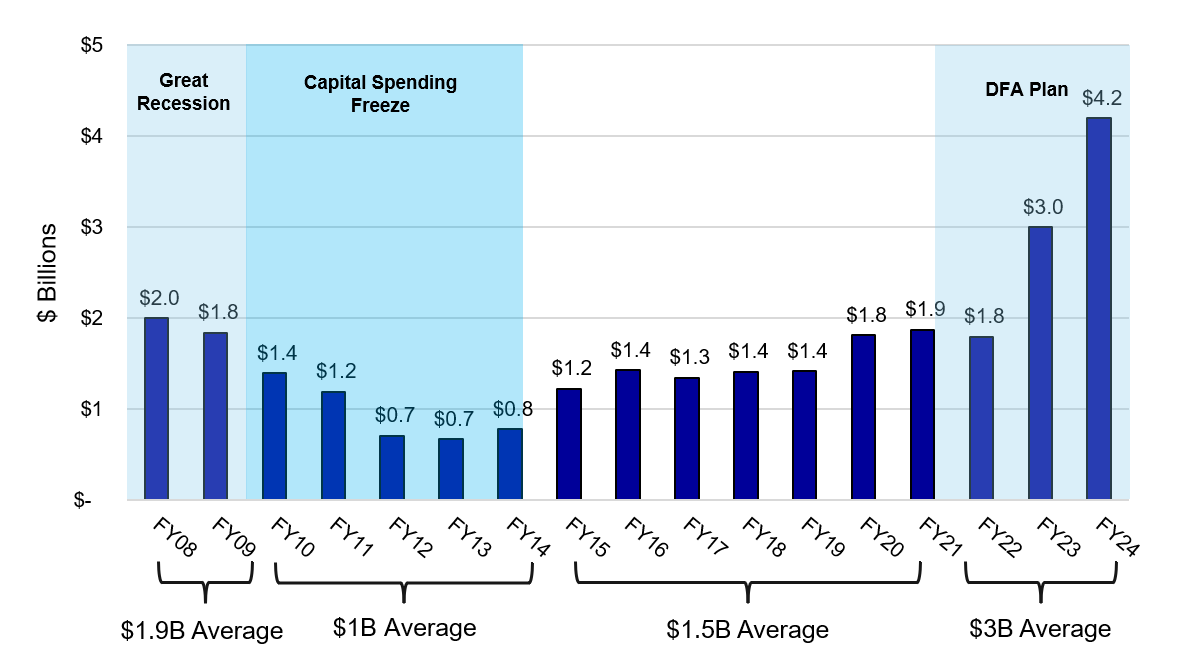

During this period, operating expenses dropped due to lower employee compensation and benefits and transportation costs. However, retiree health care premium costs, which the Postal Service was paying, increased, and the PAEA-required PSRHBF prefunding payments began. To manage its liquidity, the Postal Service took on debt.

This period’s declining mail volume negatively impacted revenue.

Cash remained around $1 billion; except for FY 2009 when the Postal Service received a $4 billion prefunding payment reduction from Congress to avert a potential cash shortfall.

Debt was used to backfill the cash outflow as the Postal Service was making annual prefunding payments; rising to $12 billion in FY 2010.

2011-2019

Unmet Retirement Obligations and Accumulating Losses

Unmet Retirement Obligations Allowed USPS to Preserve Cash

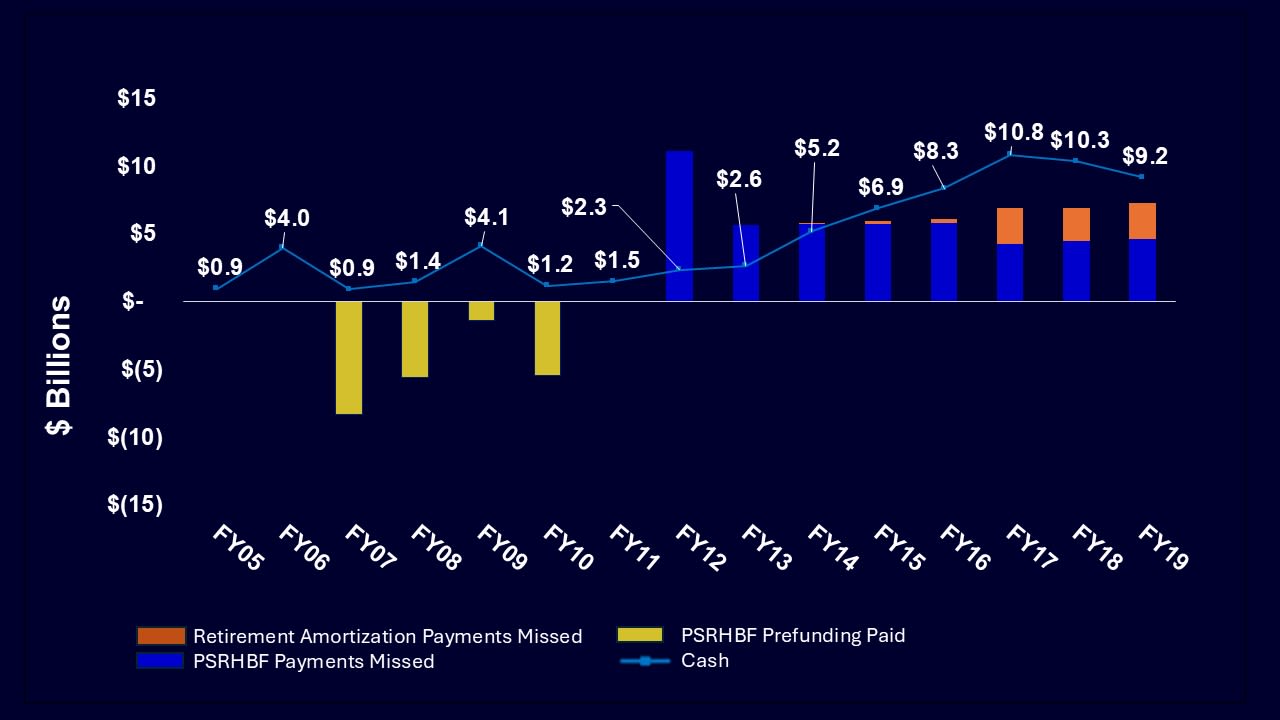

In FY 2012, the Postal Service stated that it needed to prioritize payments to employees and suppliers. To preserve cash to run its operations, the Postal Service defaulted on required retirement payments to the Office of Personnel Management (OPM).

The Postal Service also defaulted on its PSRHBF obligations in 2012. In FY 2014, OPM adjusted the assumptions used to calculate the Federal Employee Retirement System (FERS) obligations, which changed a surplus to a deficit - and established an amortization schedule to pay down that obligation's unfunded liability. In FY 2017, amortization schedules were required for the CSRS obligation.

From FYs 2007 through 2019, the Postal Service defaulted on payments in the amount of $55.4 billion.

Accumulating Losses

During this period, mail volume continued its downward trend that began in FY 2007, falling from 168.3 to 142.6 billion pieces.

To further conserve cash, the Postal Service decreased funding for research and development, postponed infrastructure maintenance, and instituted a capital spending freeze.

It was largely the Postal Service’s decision to default on its retiree healthcare and retirement amortization expenses that led to its improved cash position.

Revenue exhibited modest increases because of an exigent surcharge — a temporary price increase on market dominant products — which added $4.6 billion between January 2014 and April 2016. Yet, expenses climbed at a more accelerated rate.

Large expenses for retirement and retiree healthcare due to OPM, totaling $55.4 billion between FYs 2011 and 2019, led to net losses.

However, not making these retiree payments enabled the Postal Service to grow its cash steadily from FY 2011 through FY 2017 and reduce its outstanding debt in FYs 2018 and 2019.

2020-2024

The Impact of COVID-19 and the Delivering for America plan

COVID-19 and the CARES Act

In response to the COVID-19 pandemic, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which authorized up to $10 billion in additional borrowing from the Treasury, should the Postal Service determine that it would be unable to fund operating expenses due to the pandemic. In FY 2021, Congress amended the CARES Act, which allowed the Postal Service to receive a separate, one-time $10 billion appropriation.

The COVID-19 pandemic led to a surge in e-commerce. Package volume went from 6.2 billion pieces before COVID-19 in FY 2019, to 7.6 billion pieces in FY 2021, a 22.6 percent increase.

Delivering For America

In March 2021 as the pandemic began to subside, the Postal Service published its Delivering for America plan. The plan led to some cost-cutting successes, including the reduction in transportation costs. But the post-pandemic rise in inflation increased the Postal Service's compensation and benefits expenses.

The plan also sought legislative reform to eliminate the prefunding of retiree health benefits requirement. In April 2022, Congress passed the Postal Service Reform Act, canceling $57 billion in missed payments to the PSRHBF that the Postal Service recorded between FYs 2011 and 2021.

Eliminating the prefunding requirement temporarily alleviated the Postal Service’s financial burden, but it did not change the fact that once the PSRHBF runs out of funds, the Postal Service is responsible for funding its share of the healthcare premium costs for its retirees as the costs are incurred. These payments, called "top up payments" will begin in FY 2026.

Capital Investments

The Postal Service also began expending funds to complete the $40 billion in capital investments outlined in the DFA plan. By the end of FY 2024, $10.9 billion was allocated to capital projects. These investments represented a significant increase from prior years.

In November 2020, the PRC provided some additional pricing flexibility for the Postal Service’s price cap. Specifically, in August 2021, the PRC passed rules that allowed the Postal Service to raise rates for market dominant products over CPI-U increases. Over this period, competitive products and rate increases kept growing revenue.

However, expenses grew as well, and the Postal Service ended FY 2024 with a $9.5 billion net loss, its largest since FY 2012.

The net losses incurred during these years led to a rising net deficiency and the Postal Service has borrowed its maximum allowable amount of debt.

The Postal Service prioritized retaining its cash and short-term investments, which totaled $19.5 billion in FY 2024. This is more cash than it ever had, except for the three years following the CARES Act appropriation.

Conclusion

Before PAEA, the Postal Service began facing financial challenges due to a decline in First-Class Mail volume and expenses rising faster than revenue. PAEA's passage fundamentally altered the Postal Service’s financial results by limiting revenue growth and adjusting retiree healthcare costs. Following 2006, the Postal Service recorded net losses each year.

To remain in business, the Postal Service took measures to conserve cash by not making certain required retirement payments, taking on debt, reducing capital spending and receiving some congressional relief.

The Postal Service ended FY 2024 with $19.5 billion in cash, but ultimately, future retirement obligations will need to be funded. Despite significant changes and challenges, the Postal Service needs to achieve financial sustainability to continue its mission of providing critical service to the American public.

Additional Resources

State of the U.S. Postal Service's Financial Condition

Published in 2024, this OIG report evaluates the financial performance of the Postal Service in relation to its DFA plan financial projections.

The Postal Service in the 21st Century: A Recent History

This OIG white paper provides a high-level overview of the Postal Service’s operational environment since 2000. The paper identifies major postal trends over the past 22 years and contextualizes those trends against the broader social, economic, and legislative environment.

Contact Us

For media inquiries, please email press@uspsoig.gov.