USPS Office of Inspector General

The Greatest Theft

Investigative Case Highlights | August 14, 2024

We all saw it. We all felt it. The dry cleaners at the corner closed. That great coffee place down the street shut down. The same message plastered on window upon window: Closed due to COVID-19.

Almost as quickly as the pandemic set in, the federal government stepped up to help people in need. The Small Business Administration (SBA) moved at lightning speed to launch pandemic relief programs under the CARES Act to help small businesses. Over $1 trillion was given to help more than 10 million small businesses.

But fraudsters seized the opportunity to mount what would be known as the greatest theft of taxpayer money in U.S. history.

As many government agencies worked to identify individuals who defrauded SBA loans, our Office of Professional Responsibility teamed up with our research arm and the Pandemic Response Accountability Committee (PRAC) to find possible fraudsters employed by the Postal Service. Using in-house analytics, we identified suspected fraudulent activity and started multiple investigations. The first case to be prosecuted by a U.S. attorney’s office, however, would prove most unsettling.

It wasn’t the amount of money wrongfully taken. Compared to those who grossly defrauded the government of pandemic relief funds, this case somewhat paled in comparison. What made it egregious was who was stealing hard-earned taxpayer dollars: a woman working in the Postal Service’s law enforcement agency, the Postal Inspection Service.

Just How Big Was the Greatest Theft?

To date, the total amount of pandemic relief fraud is unknown. But in May 2023, the U.S. Government Accountability Office reported it had flagged 3.7 million recipients of SBA funds as having warning signs consistent with potential fraud. And in April last year, the PRAC indicated that states have reported estimates that total $60.4 billion in unemployment insurance fraud. To learn more, check out this Associated Press article.

As an Inspection Service employee, she swore to protect the Postal Service. She held a high security clearance since she started the job in 2020 and was responsible for running background checks for the agency.

More importantly, she held a position of trust not just as a public servant, but as a law enforcement official for an agency involved in — get this — pandemic relief fraud investigations. Yet, like other fraudsters, she chose to exploit an unprecedented situation for personal gain.

Our special agents found the employee lied three times when applying for SBA loans: First, she applied for an Economic Injury Disaster Loan (EIDL) loan intended to keep small businesses afloat when they couldn’t operate fully or at all. Asking for almost $60,000, she made up a business out of thin air and claimed it had grossed over $145,600 in revenue the year before she applied.

She then filed two Paycheck Protection Program (PPP) loans — these were smaller loans designed to cover employee paychecks during the pandemic. For each loan of almost $21,000, she used a legitimate rental business she owned, but overinflated its revenue by over 80 percent. She also submitted falsified tax and payroll documents to support her applications.

The SBA paid out the EIDL and first PPP loan, but it didn’t approve the second PPP loan after it flagged the application for potential fraud. The employee used all the money she received for personal expenses and then filed a request to have her first PPP loan forgiven. The SBA forgave the loan.

By the time our special agents interviewed her last September, there was no denying the falsified payroll and tax documents in her applications. When our special agents presented the case to the U.S. attorney’s office, it accepted the case because of the employee’s role and because she defrauded the very program her agency and others were tasked to protect.

This February, she pleaded guilty to wire fraud and was sentenced to time served, five years’ supervised release, and ordered to pay more than $80,000 in restitution.

Pandemic relief fraud steals from every taxpayer in America. If you suspect or know of pandemic relief fraud, please report it to the Pandemic Response Accountability Committee’s Hotline. And if you suspect or know of Postal Service employees or contractors committing this or other financial fraud, please report it to our Hotline.

Learn more about our investigative work

Learn about our eight program areas and specialized units

More stories on how we guard the Postal Service against fraud, waste, and abuse

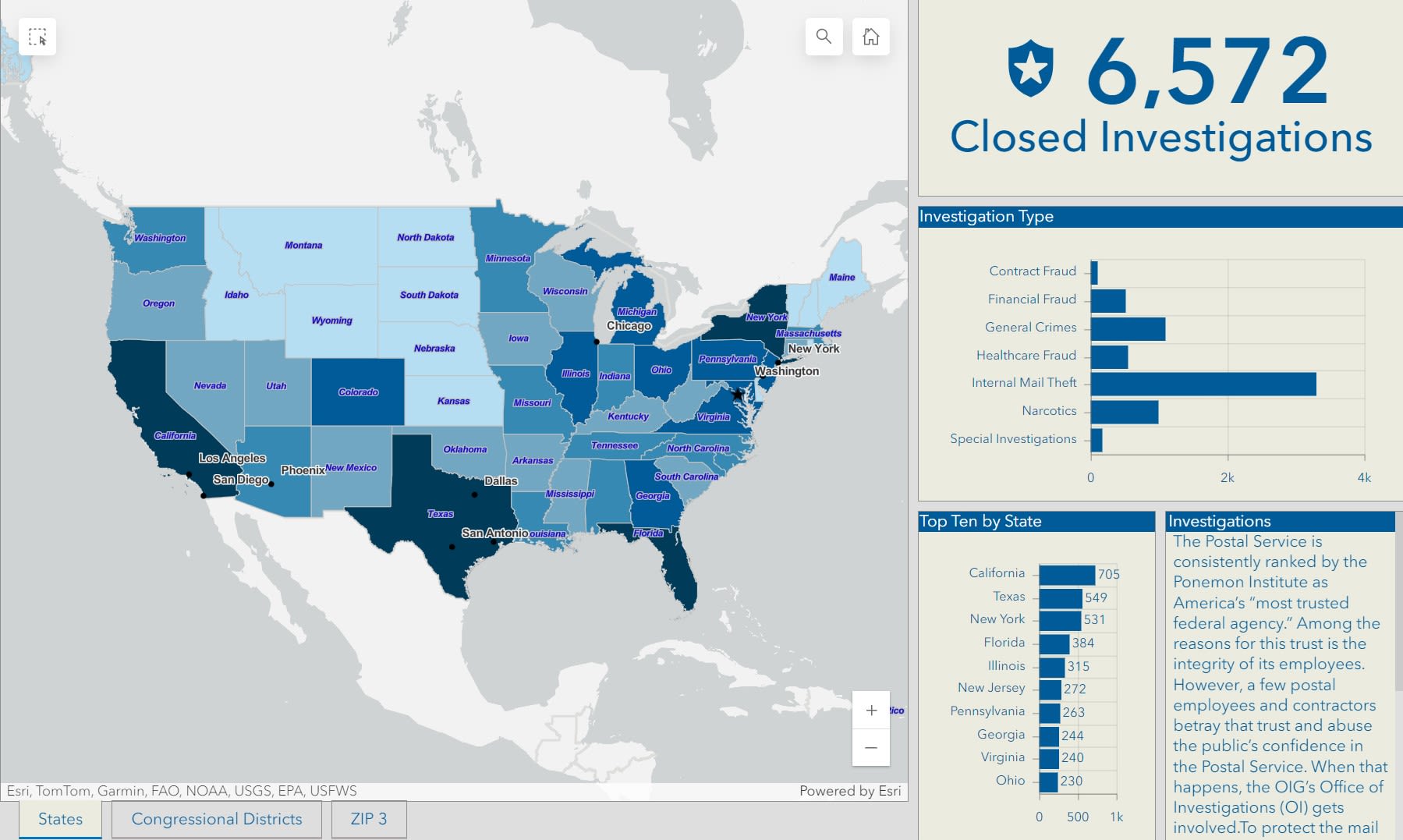

An interactive map provides an overview of OIG closed investigations