The Price of a Stamp:

An International Comparison

- Research and Insights Solution Center -

United States Postal Service Office of Inspector General

The U.S. Postal Service spends billions of dollars a year to deliver our nation's mail. These funds cover all aspects of its operations — such as overhead expenses, employee wages, and fleet maintenance costs — to deliver to every address in America. While some international posts receive government subsidies to fund their public service missions, USPS does not. Instead, it relies almost entirely on postage revenue to cover its operations.

Of all postal mail products, First-Class Mail (FCM) raises the most revenue for the agency. As mail volume declines and operational costs rise, USPS increases prices on stamps and other FCM products to generate additional income. However, raising prices increase costs for postal customers — and potentially reduces their demand for mail. Therefore, calibrating optimal prices for FCM products is a critical part of ensuring the agency's financial viability.

To contextualize USPS's recent price increases, the U.S. Postal Service Office of Inspector General (OIG) reviewed stamp prices and rate increases in 31 countries between June 2018 and June 2023.

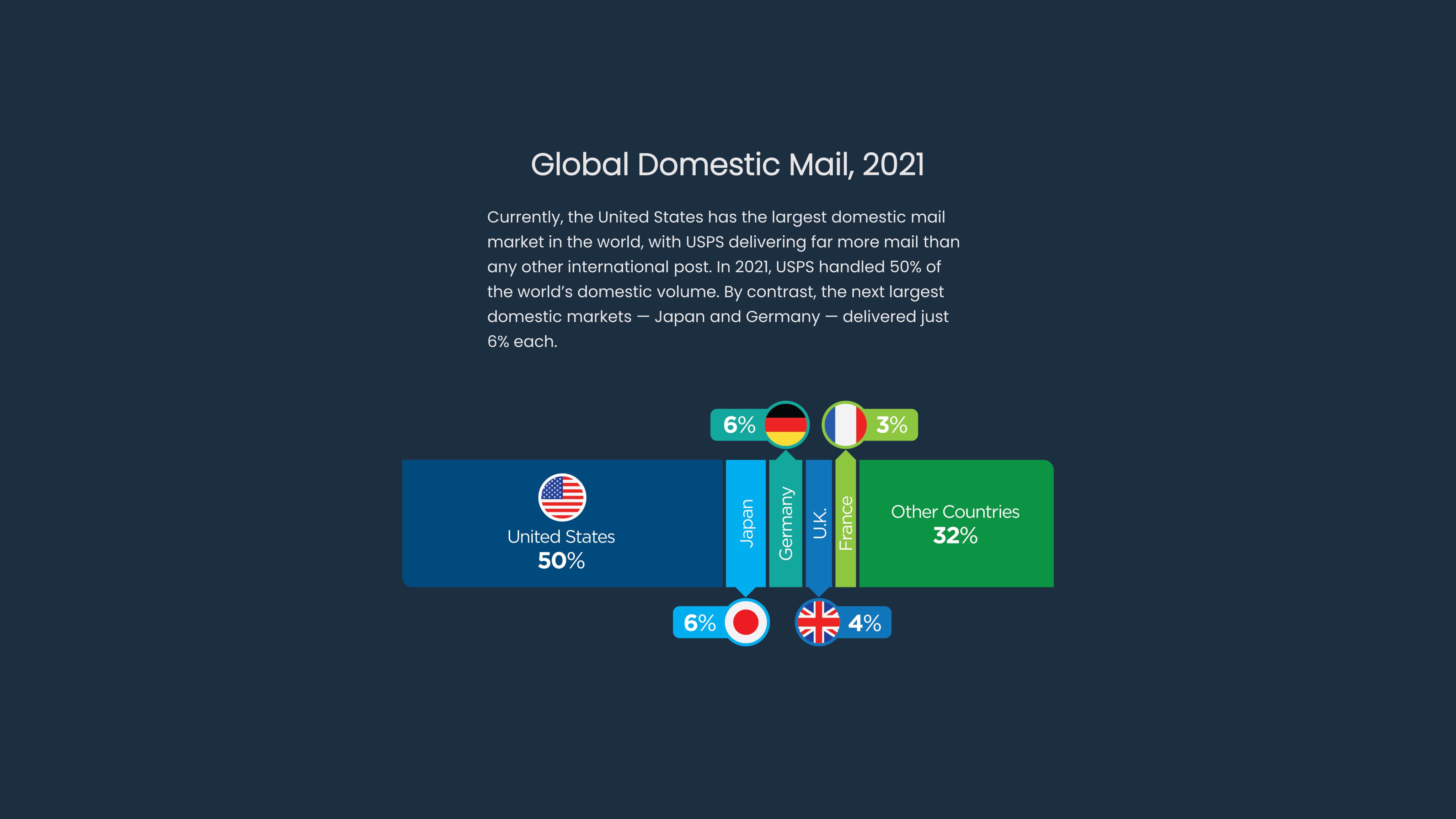

Between 2000 and 2021, domestic mail volume around the world dramatically dropped by more than one-third. Meanwhile, mail volume within the United States also declined — but at a slower rate. As a result, America's mail volume now comprises a greater percentage of the world's domestic volume.

Because the U.S market for commercial FCM and Marketing Mail is larger than that of any other country in our sample, the Postal Service can offer a highly profitable product at a much lower price point compared to other countries. This is due, in part, to economies of scale and scope (that is, costs are distributed among higher volumes and a broader range of mail products in the U.S.).

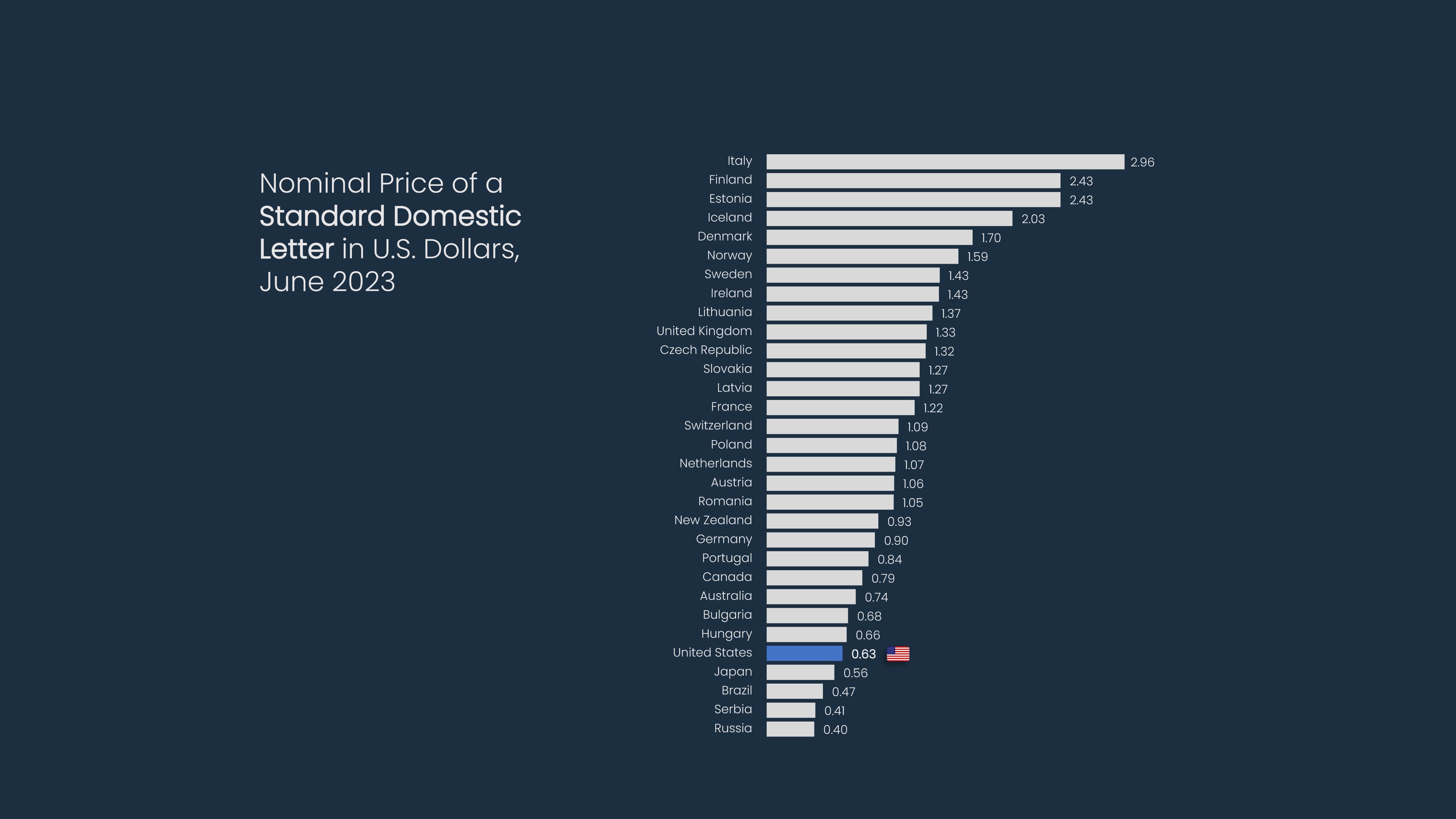

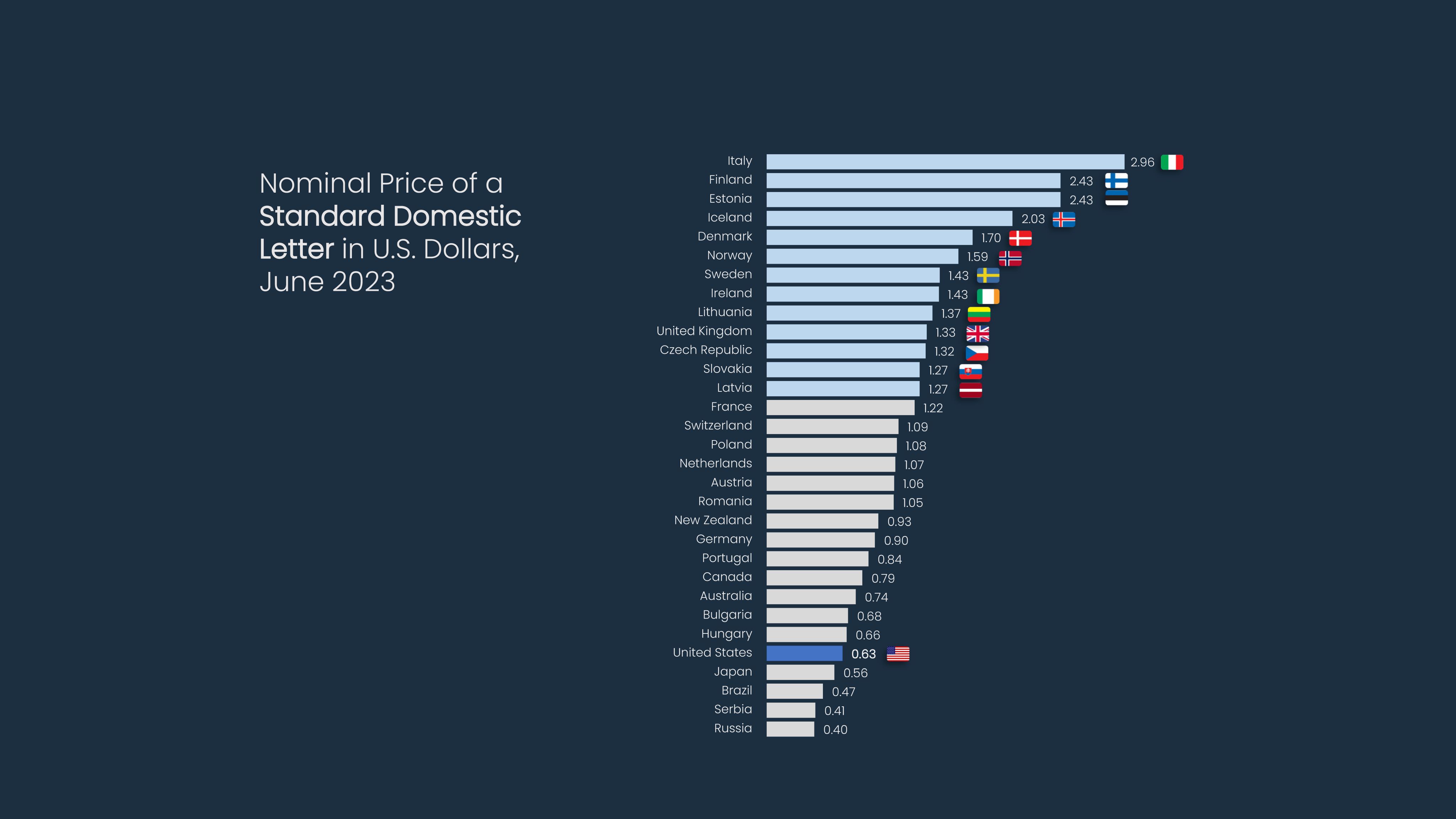

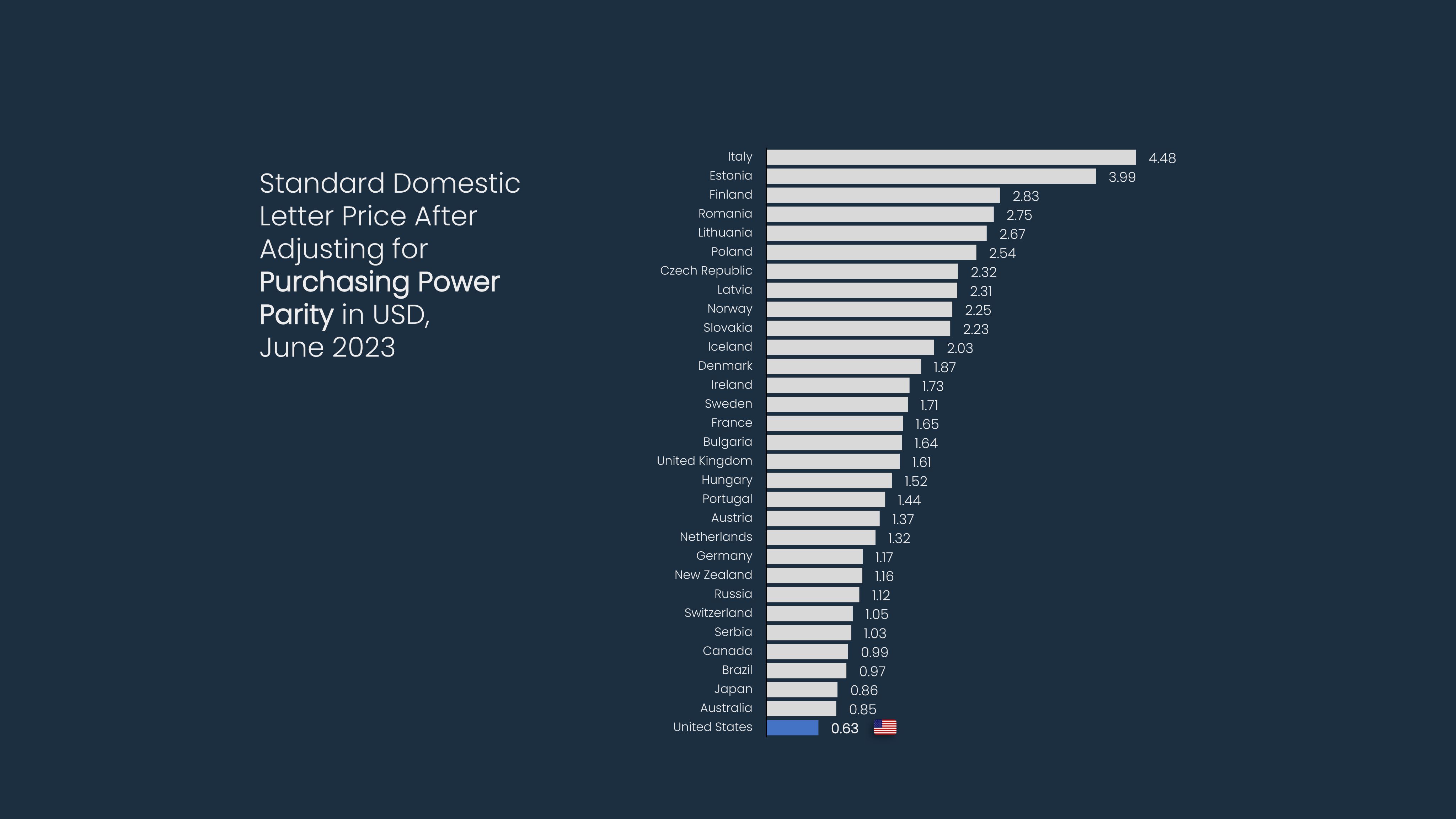

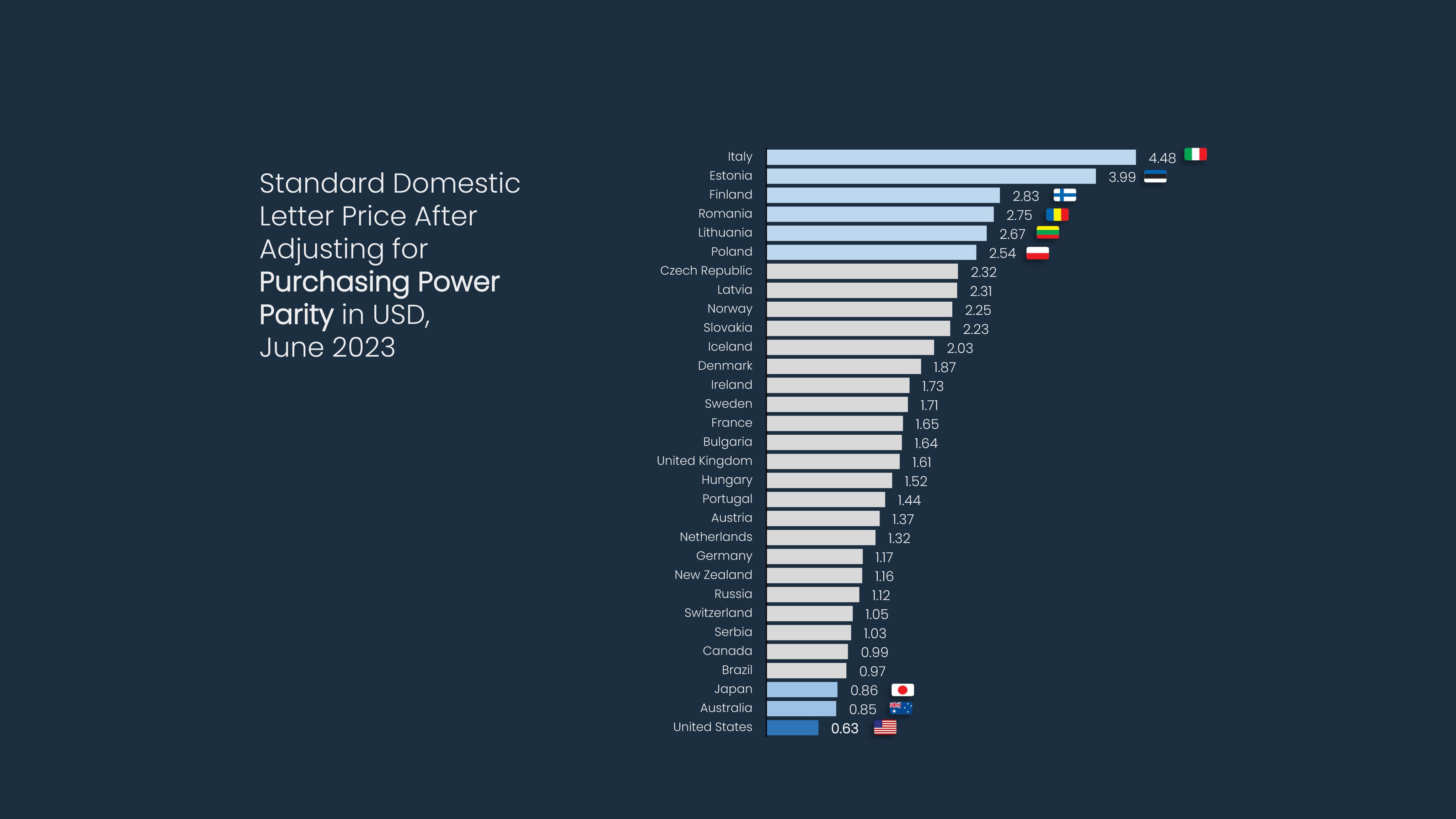

The price of a one-ounce First-Class Mail stamp in the U.S. was one of the lowest prices in our sample. The Postal Service's 63¢ nominal price was almost half the average price of $1.20.

Stamps from 13 countries in our sample cost more than double the price of a U.S. stamp. Italy, Finland, Estonia, and Iceland charged more than triple what the U.S. charged. Only four countries charged less.

Over the years, the price of a U.S. stamp has increased — but at a slower rate than in other countries. Between 1970 and 2020, increases in the postage rate were rare and largely aligned with inflation and a dramatic decline in letter volume. After the Postal Regulatory Commission (PRC) granted additional pricing authorities in 2020, USPS began to increase stamp prices more frequently.

Although the U.S. stamp increased by more than 50% in recent decades, rate increases in the U.S. were less pronounced than in other countries.

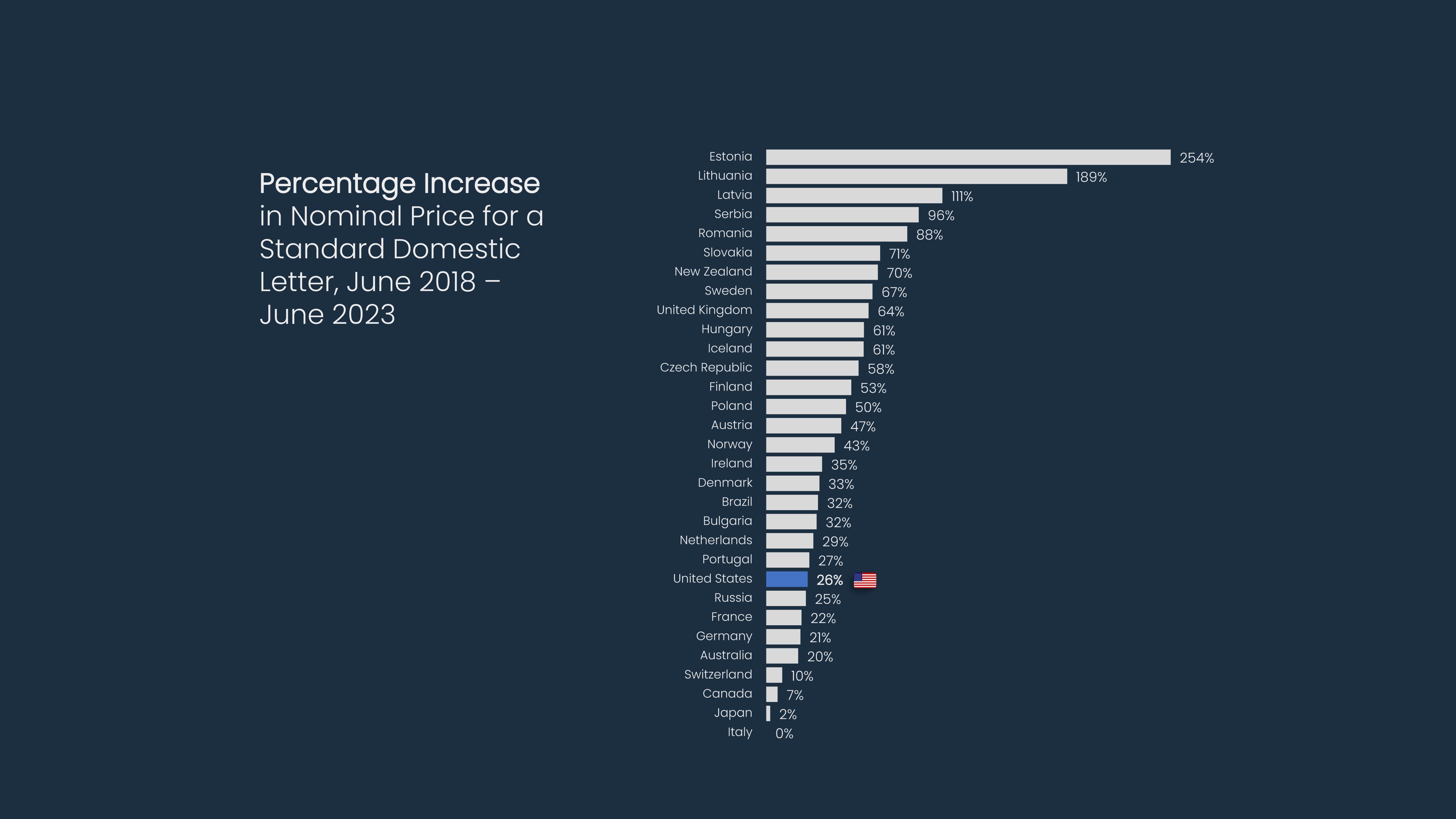

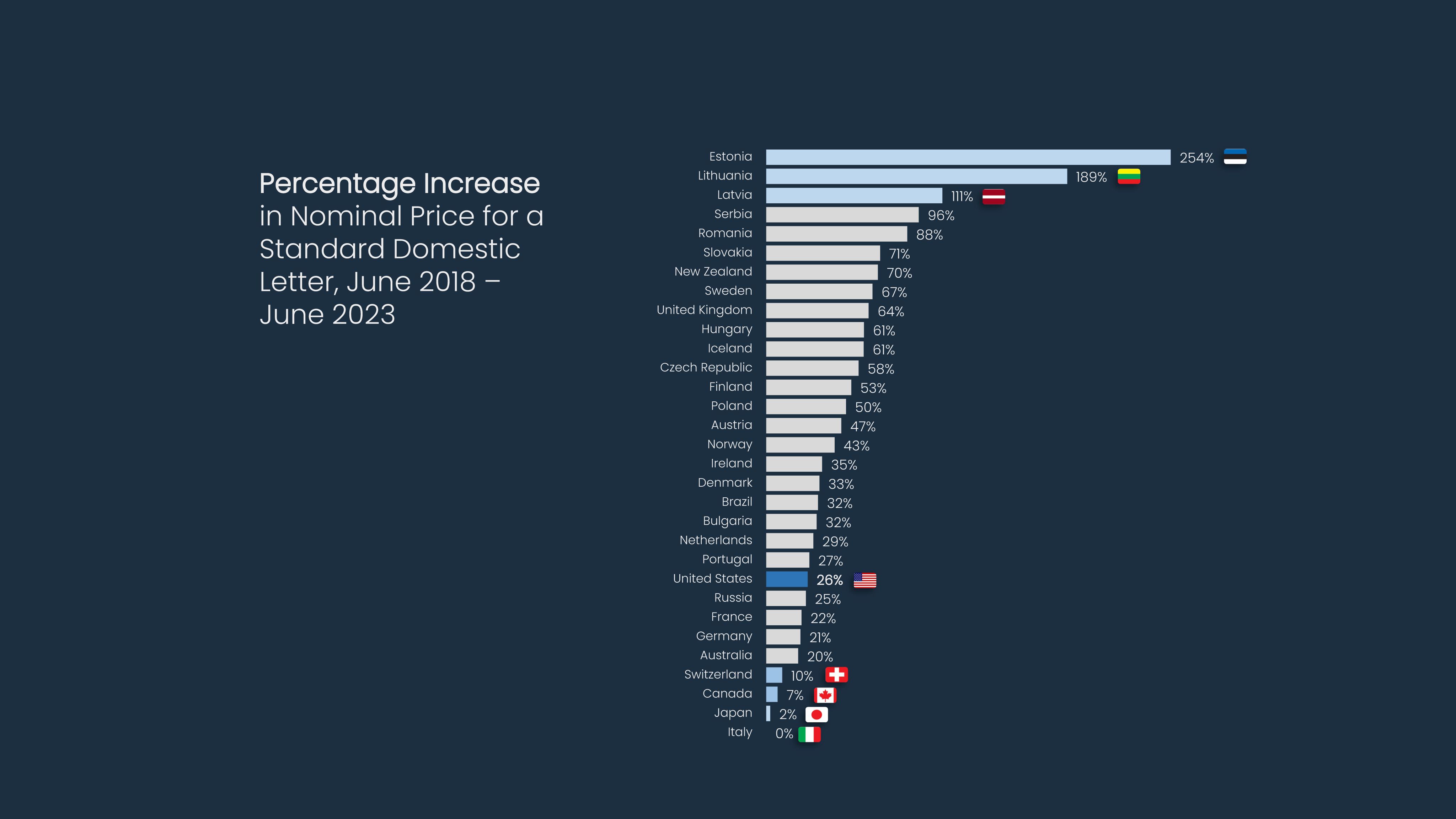

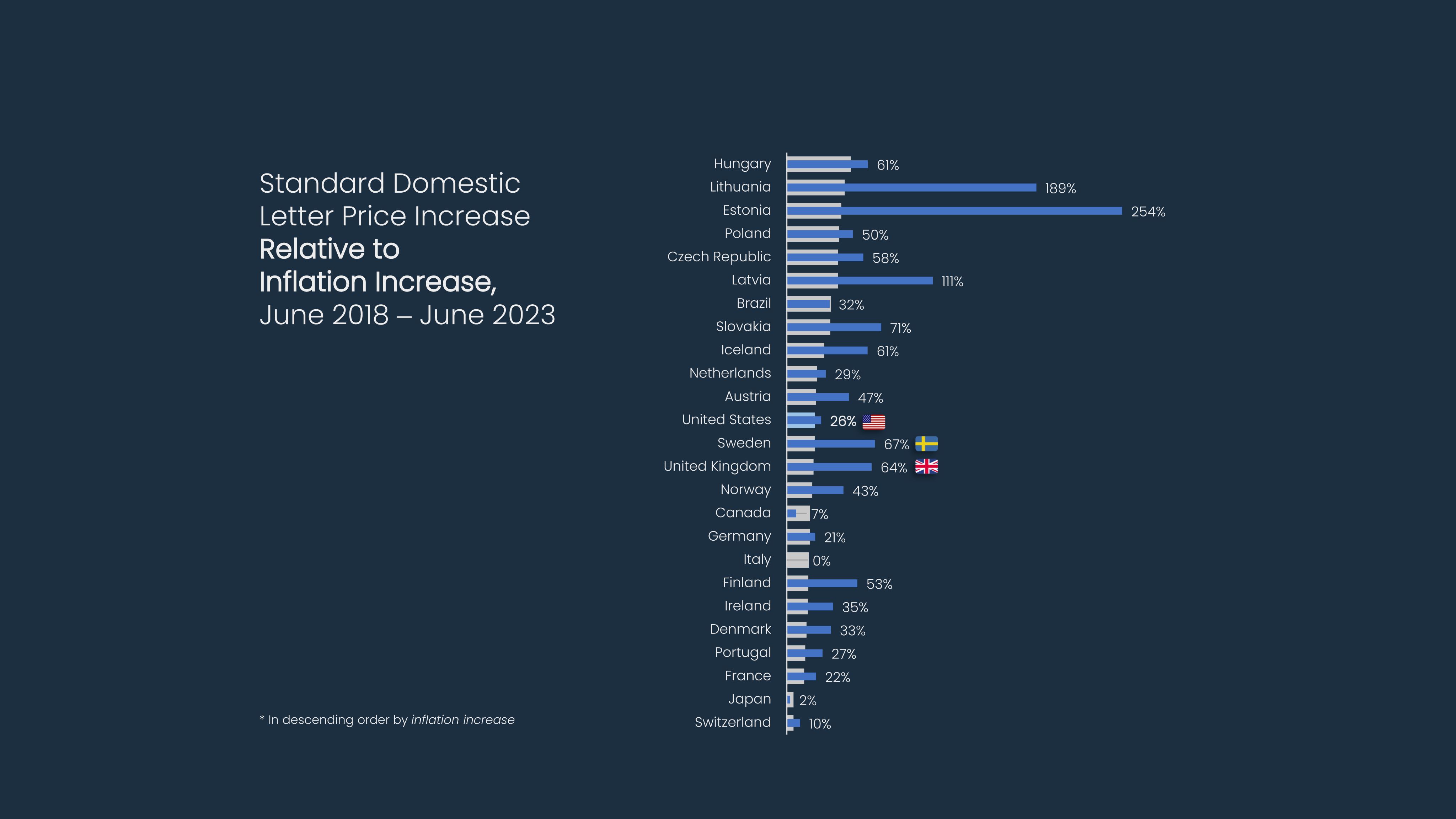

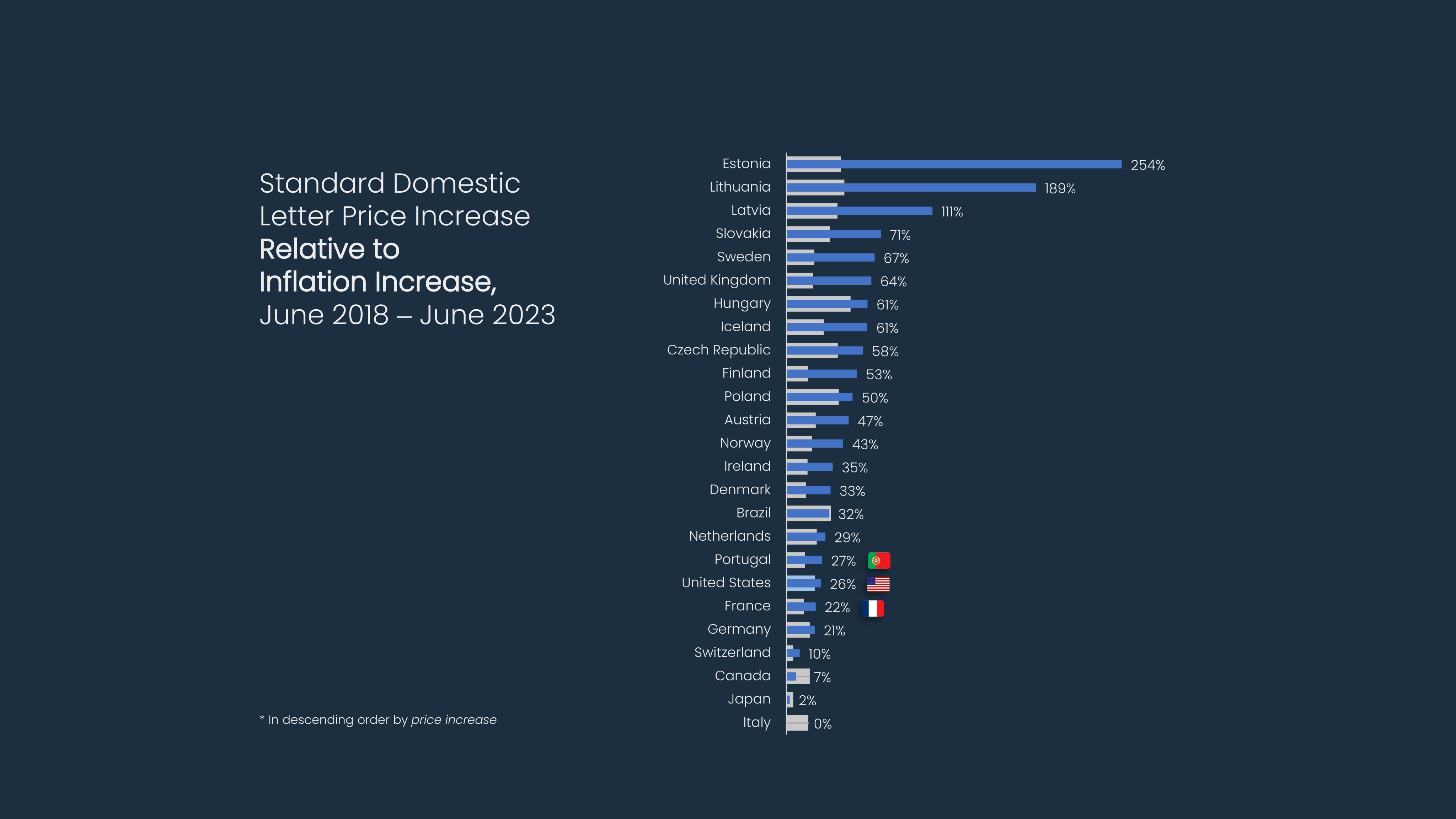

Between June 2018 and June 2023, the price of a U.S. stamp increased from 50¢ to 63¢, representing a rise of 26%. Meanwhile, the average price increase in our sample was more than double the increase in the United States: 55%.

Stamps from the Baltic states of Estonia, Lithuania, and Latvia more than doubled in price over the past five years, illustrating the impact of broader geopolitical trends (such as Russia's invasion of Ukraine) on stamp prices.

At the same time, prices increased 10% or less in Switzerland, Canada, Japan, and Italy. Posts in Japan and Canada opted to increase prices on their international services instead of on stamps, while Italy — which changed the least — consistently held the highest-priced stamp in our sample.

Anumber of factors contribute to the wide variety of stamp prices and rate increases around the world: inflation rates are rising, mail volume is declining, and regulatory requirements are changing. In the midst of these shifting trends, postal operators must strike a careful balance between affordability concerns and the fulfilment of their public service mission.

USO Requirements

Posts are commonly subject to a Universal Service Obligation (USO) — that is, requirements ensuring a basic level of service at a reasonable price. Many postal regulators recently relaxed their USO requirements with an aim towards reducing costs as an alternative to raising prices. For instance, Denmark's government abolished Post Denmark's USO entirely in January 2024. Posts have reduced their service standards accordingly.

Loosened requirements provide new flexibility, but the elimination of affordability considerations inherent in USO requirements may result in higher stamp prices.

Inflation

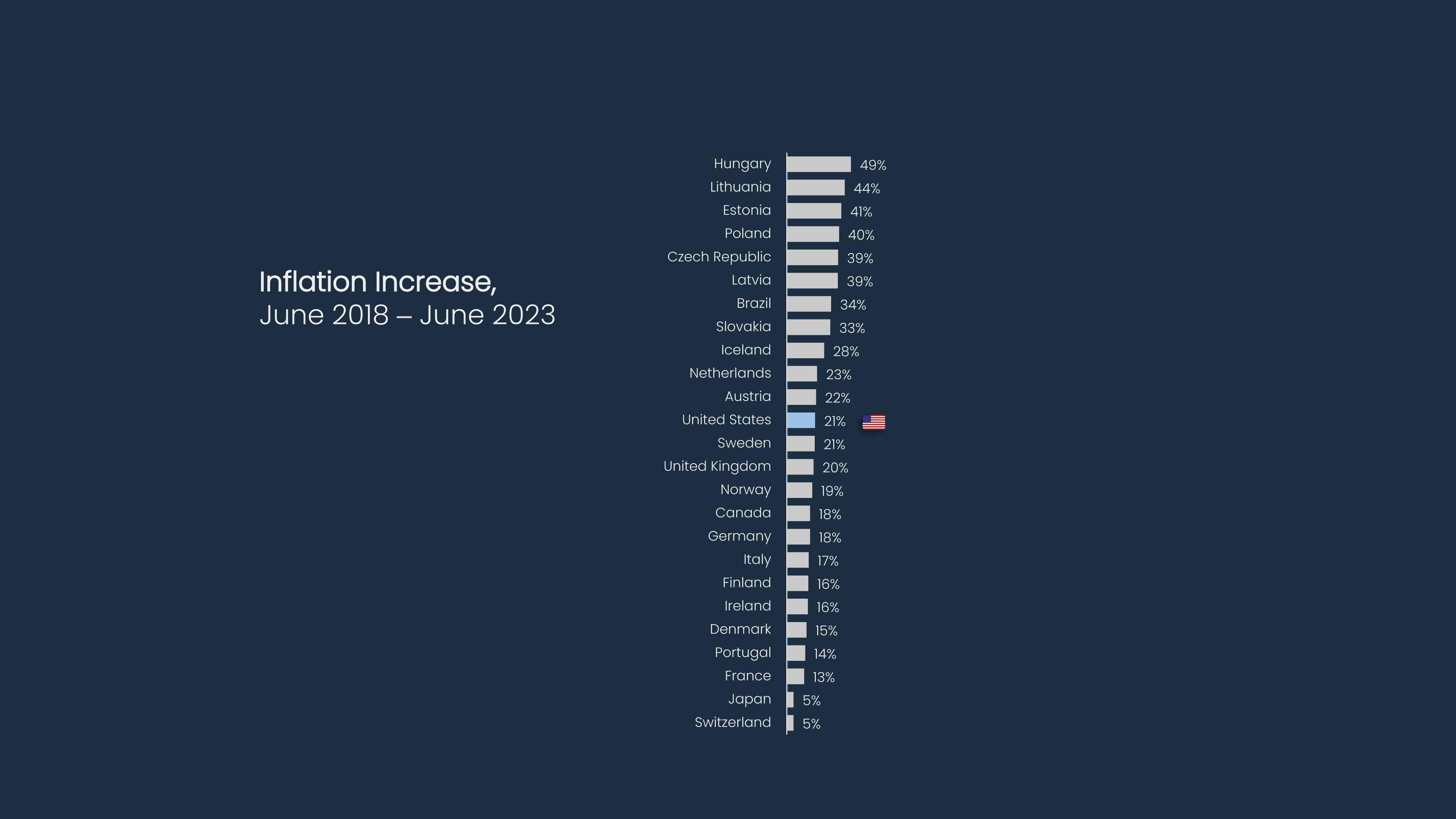

Supply chain disruptions related to the COVID-19 pandemic and Russia's invasion of Ukraine contributed to record levels of inflation. The United States experienced its highest inflation level in decades, with subsequent impacts on USPS’s costs for labor, retirement, and other goods and services.

Price Caps

Inflation can impact posts' prices in another important way.

Regulators prevent posts from raising prices excessively, as that could render mail unaffordable and undermine posts' public service mission. National regulators in the U.S. and elsewhere — such as the Netherlands, Germany, Portugal, France, and Sweden — have imposed price caps on standard letter products. This legally-defined maximum typically follows inflation (in addition to other factors). As a result, inflation informs price caps which, in turn, limit price increases on stamps.

The Postal Service is not immune to the inflationary and regulatory factors impacting stamp prices around the world. According to USPS, recent price increases are, in part, intended to offset "inflationary pressures on operating expenses." Nevertheless, the agency's price increases for standard domestic letters were not as large as those implemented by many other posts between June 2018 and June 2023.

In the five years between June 2018 and June 2023, the U.S. inflation rate rose by 21% and represented the median inflation increase in our sample.

During that time, the U.S. raised its stamp price by 26% — five percentage points above its inflation increase of 21%. By comparison, Sweden (which also saw its inflation increase by 21%) raised its price by 67%, and the U.K. (which had a slightly lower inflation increase of 20%) raised its price by 64%.

When countries are ranked according to price increase rather than inflation increase, the United States drops lower on the list. Its price increase of 26% places it between Portugal and France, whose inflation rose by 14% and 13%, respectively. In other words, the U.S.'s price increase of 26% aligns with countries that had lower increases in inflation. Countries with inflation increases similar to the U.S. tended to increase their stamp price by a larger amount.

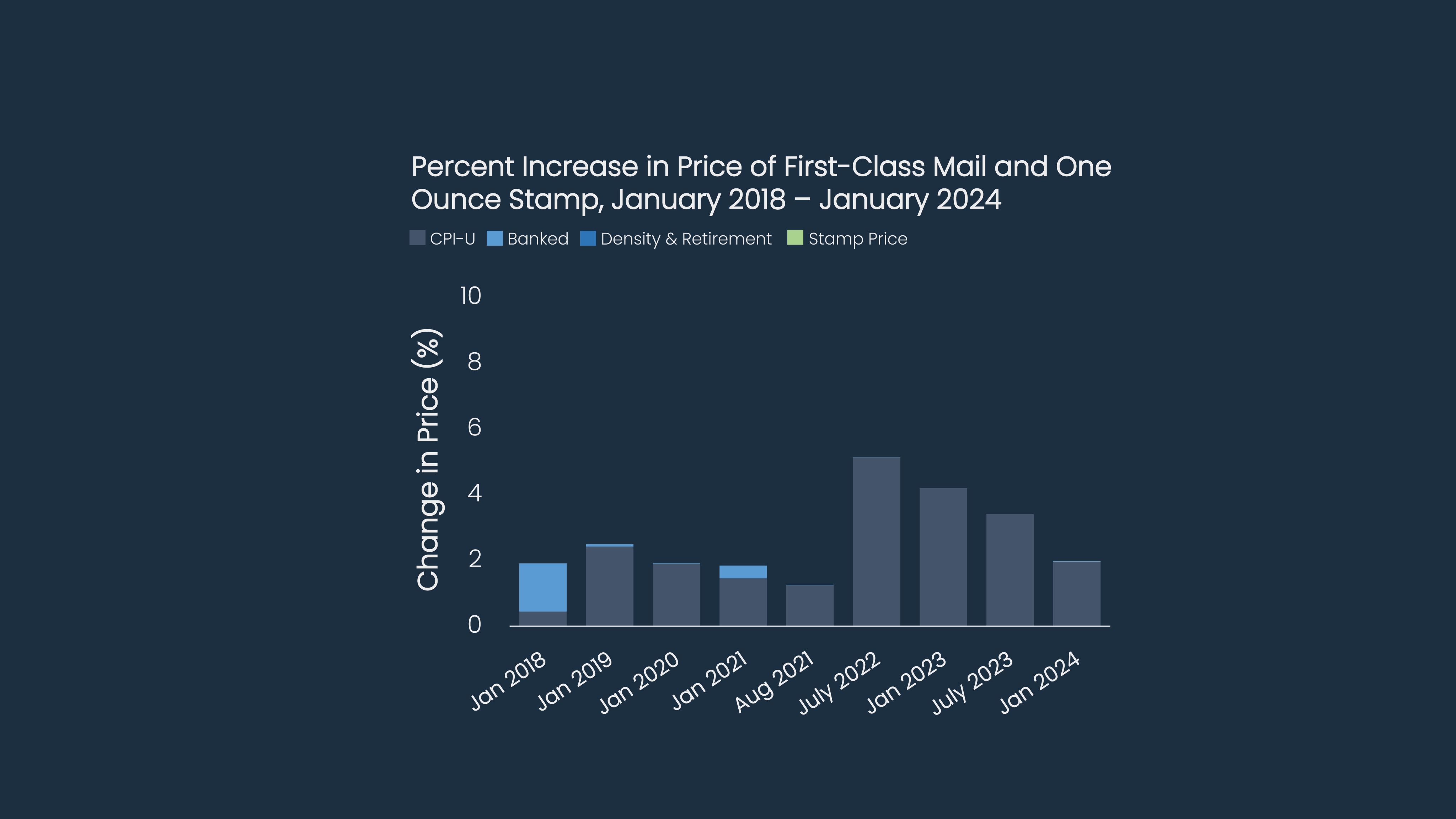

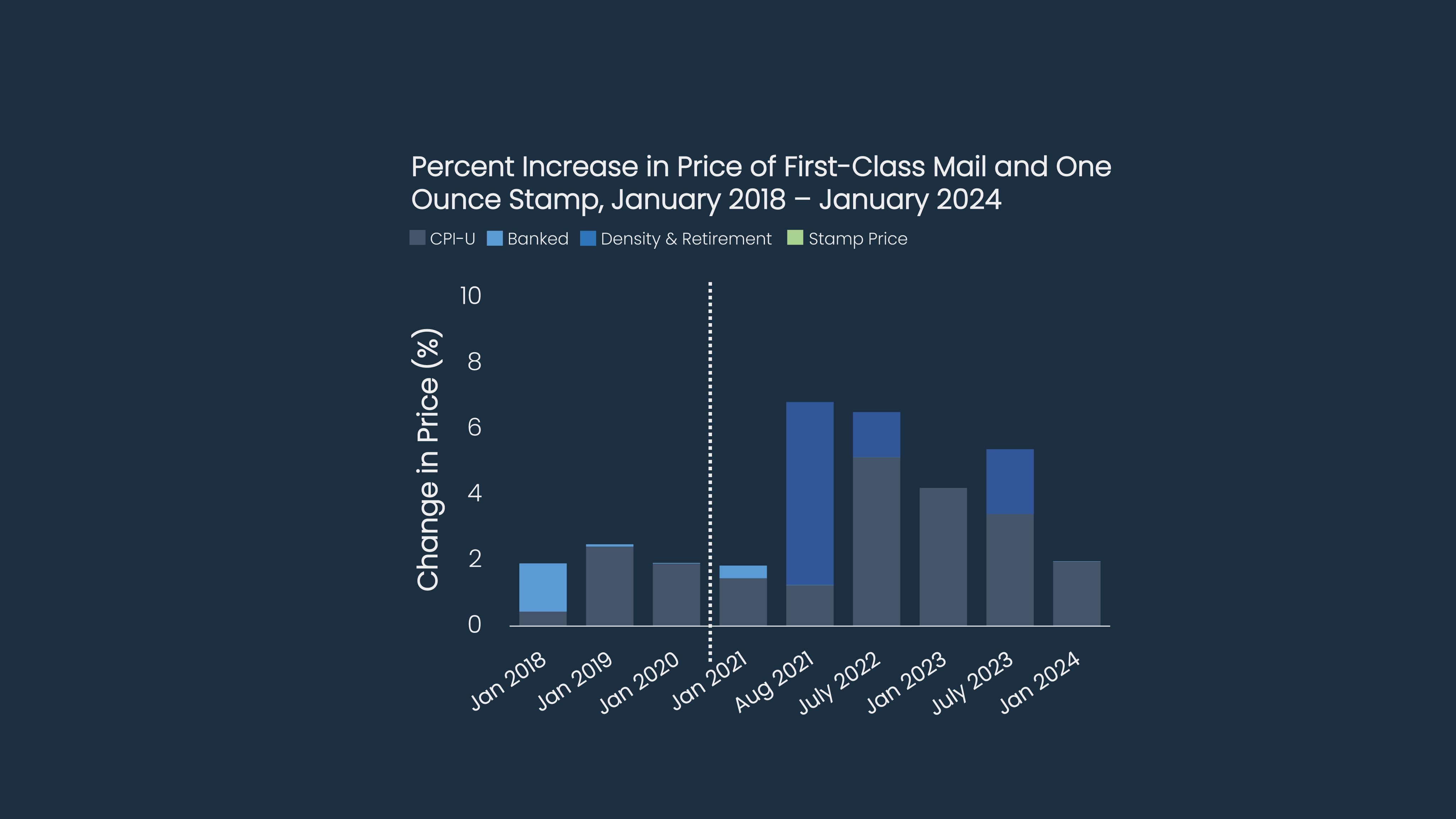

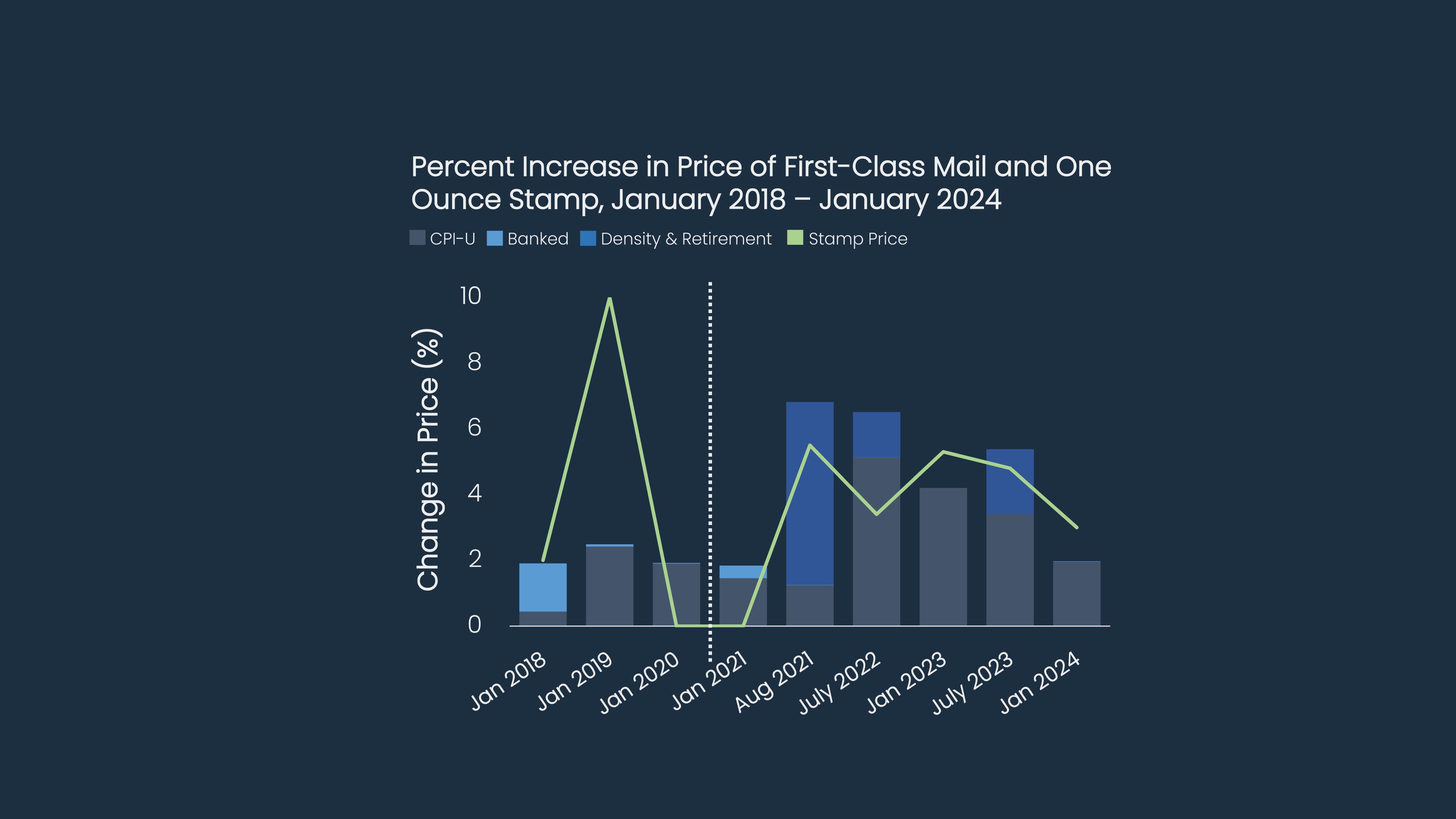

Recent regulatory changes also impacted the Postal Service's ability to raise its stamp price. The PRC modified its price cap calculation in November 2020 and allowed USPS to raise its rate above inflation. Since then, USPS's price increases have been higher and more frequent.

Before November 2020, USPS’s pricing authority was limited to the rate of inflation.

The agency could also choose to "bank" (or save) unused authority for future use. It notably used some of its previously-banked authority in January 2018 and January 2021.

In November 2020, the PRC implemented a modified system allowing additional pricing authority based on mail density, retirement obligation payments, and non-compensatory classes. USPS used its new pricing authorities for the first time in August 2021 when it increased the price of a standard domestic letter by 6.8%. This represented a 5.6 percentage point increase over the 1.2% authority it had under the old system (when increases were limited to the rate of inflation). With these new authorities, the price of a stamp has generally increased twice per year since 2021.

Price increases for stamps do not always follow overall FCM increases. For example, in January 2019, USPS deliberately set stamp prices at a round number divisible by 5. The price for a 1-oz. stamp rose by 10% — a much higher percentage than FCM's 2.5% increase.

When compared against 30 other countries, the U.S. is the most affordable place to send a standard domestic letter despite recent inflationary pressures and regulatory changes. The U.S. stamp is the least expensive stamp in our study after adjusting for purchasing power parity (PPP) — a metric incorporating a country's productivity, economic growth, and cost of living. Adjusting for PPP standardizes stamp prices against the U.S. dollar and allows comparison across a variety of economies.

USPS has the most affordable domestic letter price of the 31 countries we studied. In June 2023, a U.S. stamp was nearly one-third of the average price of a stamp in our sample.

The next affordable posts, Australia and Japan, are nearly 25% less affordable than USPS.

Meanwhile, prices in six countries are more than quadruple the United State's stamp price after adjusting for PPP. The three most expensive countries — Italy, Estonia, and Finland — changed their delivery standards. In addition, Italy and Estonia pivoted their overall mail pricing strategy to privilege slower-but-much-more-affordable non-priority products instead. These offerings are increasingly becoming their main mail products.

The U.S. has the world's largest domestic mail market, and its volume and breadth contribute to the Postal Service's ability to offer stamps and other FCM products at a lower price than other international posts. While inflationary pressures impacted stamp prices around the world, USPS raised its stamp price to a lesser degree than other countries during our scope period. In fact, when stamp prices are adjusted for PPP metrics, the U.S. stamp is the most affordable stamp in our study.

Nevertheless, new price authorities granted by the PRC allow USPS to raise prices above inflation, and the Postal Service increased prices more frequently since then. The agency indicated it needed to use its new authorities to become financially self-sufficient and maximize mail revenue. However, many mailers remain concerned about the impact of larger, more frequent price increases on the industry and on mail volume.

USPS may handle a majority of the world's mail, but other nations present instructive insights into its future. In other countries, Universal Service Obligations narrowed, volume declines started far earlier, and mail became less prominent than other postal and non-postal offerings. As USPS's volumes decline and costs increase, the agency should carefully consider these and other factors — including those raised in previous OIG work. Optimal calibration of its pricing strategy will allow the Postal Service to remain viable and affordable while continuing to deliver for the nation.

Additional Resources from the USPS OIG

Contact Us

For media inquiries, please email press@uspsoig.gov.